Using ETFs To Solve For Fixed Income

Fixed income investors are faced with a murky market outlook, with inflation, monetary policy and the pandemic all having differing effects across the yield curve. ETF.com surveyed several advisors to learn more on how they were positioning client portfolios in the face of such uncertainty.

Though no solution is one size fits all, as different clients have differing goals and objectives, the advisors surveyed by ETF.com agreed in some areas but showed stark differences in others.

Threat Of Rising Rates

Rising rates were mentioned by several advisors not only as a recent concern, but as one that has permeated the positioning of clients’ fixed income portfolios for the last several years.

Todd Jones, CIO of Gratus Capital, has been adjusting clients’ fixed income exposure for the past four years, since the yield on 10-year bonds fell below 3%. In that time frame, half of clients’ fixed income allocation has been shifted from core bond strategies to “alternative income strategies.”

Strategies within this category have a low allocation to the SPDR S&P 500 ETF Trust (SPY) as well as the iShares Core U.S. Aggregate Bond ETF (AGG), which both have a yield above 2%, and are diversified from other alternative income strategies.

Some ETFs being used within this sleeve include the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL), the Alerian MLP ETF (AMLP) and the Vanguard Short-Term Inflation Protected Securities ETF (VTIP).

Jones also notes that duration for client portfolios is down slightly compared with a year ago. Previously, durations were closely aligned with that of AGG, currently around 6 1/2 years.

Durations have since fallen and are now closer to five years. However, the uncertain market environment means duration is not likely to shift much lower. “We don’t want to get too short of a duration in the portfolio, as rates could move lower from here,” Jones noted.

Rob Kantor, CIO and co-founder of XML Financial Group, has also had clients positioned in short- and medium-duration fixed income for some time in anticipation of rising rates.

Along with keeping durations on the lower end, Kantor’s firm has increased allocations to ETFs that would benefit from inflation or rising rates. He specifically notes increasing the allocation to the iShares TIPS Bond ETF (TIP).

This ETF tracks a market-value-weighted index of U.S. Treasury inflation-protected securities with at least one year remaining in security. The ETF has vastly outperformed the broad fixed income benchmark over the past year.

Jeffrey Kalapos, director of investment services at Coastal Bridge Advisors, offers yet another approach to the uncertain environment. His firm focuses on strategic asset allocation and investing for the long term.

Clients continue to be invested across the curve, and in many cases, employ a “barbell” strategy with concentrations in both short- and long-duration strategies.

Split On Credit Quality

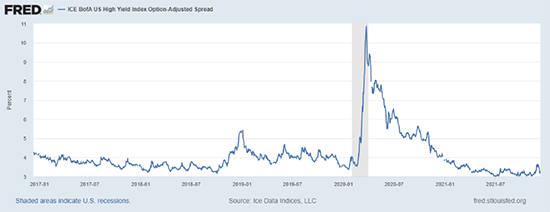

The advisors surveyed by ETF.com are split on how to manage the credit quality of client portfolios in light of historically low spreads on high yield bonds.

(For a larger view, click on the image above)

“Credit has been slowly dropping over the years since high quality doesn’t pay,” noted Kantor about his clients.

But Jones’ firm takes another view. Among his clients’ portfolios, credit quality has remained fairly consistent in spite of tightening spreads. Jones notes that he has been “actively avoiding lower credit quality categories like preferred stock, high yield bonds and bank loans.”

Should spreads on lower quality bonds widen, it would have a similar impact on bond prices as rising rates: negatively impacting the price of already-issued bonds.

Active Management Preference

Jones also expressed a preference for active management within the fixed income space.

Outside of ultrashort bond ETFs, Gratus Capital clients are solely invested in active fixed income ETFs. Strategies used include the First Trust TCW Opportunistic Fixed Income ETF (FIXD) and the PIMCO Active Bond ETF (BOND).

These actively managed ETFs have been successful in delivering better-than-benchmark performance over the past several years. Over the trailing three years, both have outperformed AGG.

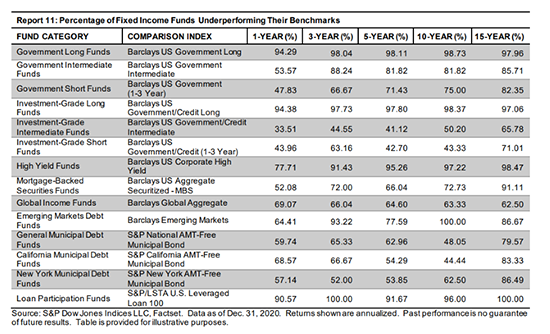

Data from SPIVA supports the view that, at least in some fixed income categories, active managers are capable of outperforming broad-based benchmarks.

(For a larger view, click on the image above)

As of the end of 2020, nearly 60% of active investment-grade intermediate funds outperformed the index over the trailing five-year period. Though success rates vastly differ depending on time frame and category, fixed income managers seem to be more successful than equity managers when it comes to active manager outperformance.

Multiple Solutions

As these varied responses show, similar concerns around the market environment can be solved for in several different ways. But regardless of the exact solution being used, ETFs can be an instrumental tool in positioning portfolios for what lies ahead.

Contact Jessica Ferringer at [email protected] or follow her on Twitter

Recommended Stories