Rio Tinto to buy Argentina lithium project for $825m

The world’s second-largest miner said the deal demonstrates its commitment to build its battery materials business and strengthens its portfolio for the global energy transition.

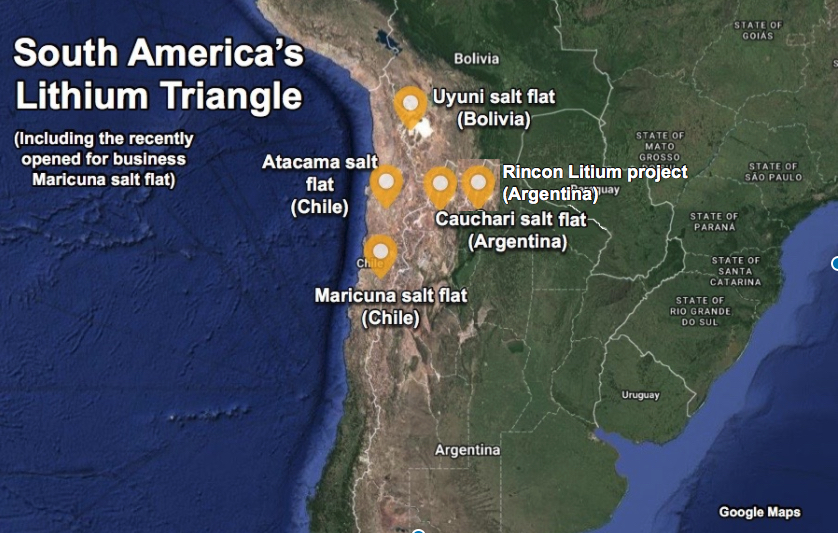

Rincon is a large undeveloped lithium brine project that will use a direct, low-cost extraction technology that has the “potential to significantly increase lithium recoveries” compared to solar evaporation ponds, Rio said, adding that a pilot plant was currently running at the site.

According to Rincon Mining, which has developed the project and technology since 2009, the novel extraction method allows obtaining the battery metal from raw brine in under 24 hours.

The project, Rio said, has the potential to have one of the lowest carbon footprints in the industry that can help deliver on Rio’s commitment to decarbonise its portfolio.

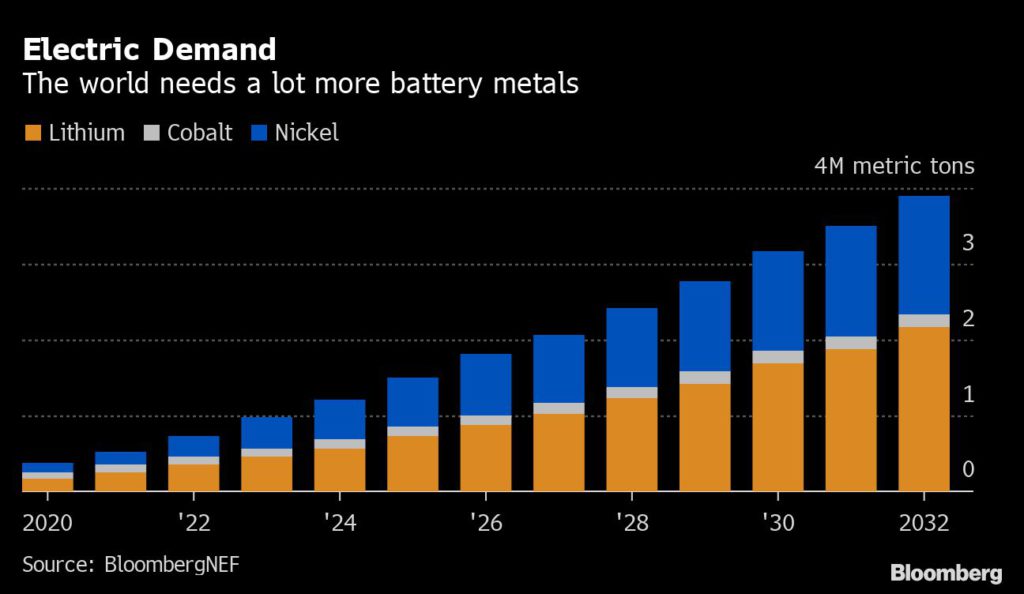

The company said that market fundamentals for battery grade lithium carbonate are strong, with lithium demand forecast to grow 25-35% a year over the next decade. And EV sales are on track to hit up to 55% of the world’s total light vehicles sales as early as 2030, reaching about 65 million units.

This means, Rio has said, that manufacturers would need about three million tonnes of lithium, compared with the roughly 350,000 tonnes they consume today. Existing operations and projects combined, however, are slated to contribute one million tonnes of lithium, the miner has noted.

Filling the gap

Rio Tinto estimates that committed supply and capacity expansions will contribute only about 15% to demand growth over the 2020-2050 period. The remaining 85% would need to come from new projects.

“Filling the supply gap will require over 60 Jadar projects,” the company’s head of economics Vivek Tulpule said in October.

“This acquisition is strongly aligned with our strategy to prioritise growth capital in commodities that support decarbonization,” chief executive Jakob Stausholm said in the statement. “The Rincon project holds the potential to deliver a significant new supply of battery-grade lithium carbonate, to capture the opportunity offered by the rising demand driven by the global energy transition.”

Rio committed $2.4 billion in July to its Jadar lithium project in Serbia, which has ignited protests by environmentalists over alleged water and land pollution the mine would generate.

The mining giant allegedly attempted to buy in 2020 a $5bn stake in Chile’s Chemical and Mining Society (SQM), the world’s second largest lithium producer.

The investment would have provided the Rio Tinto foothold in the booming battery metals sector, though it already holds key copper assets and the red metal is also used in EVs.