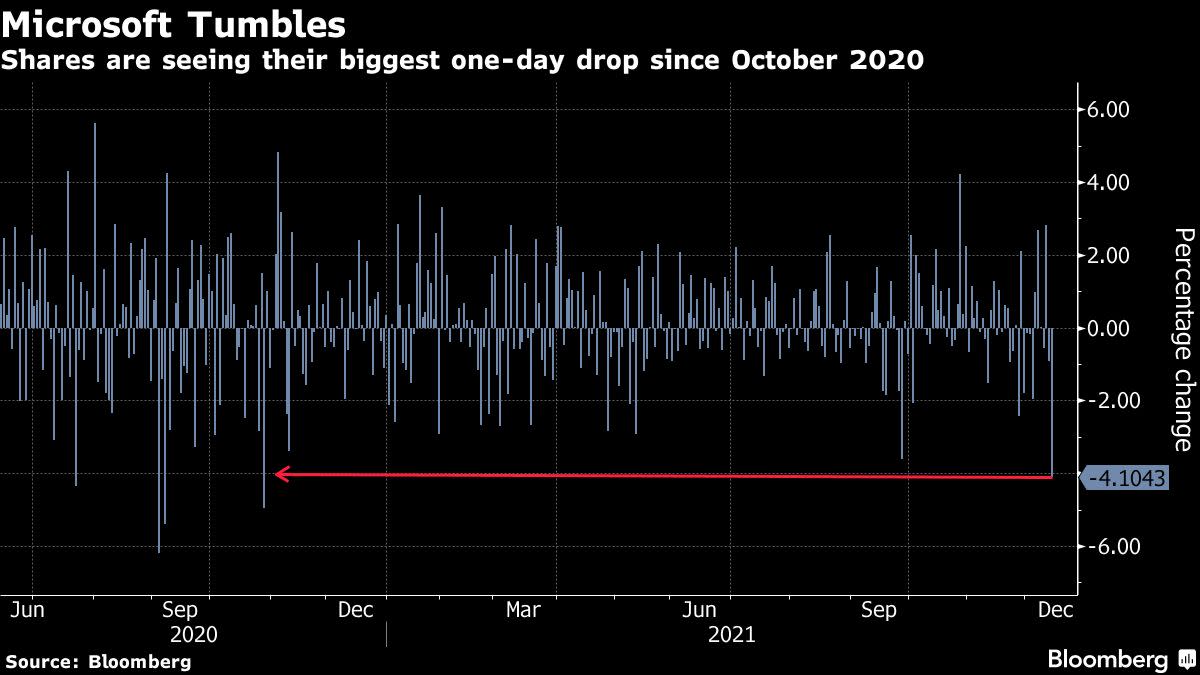

Microsoft Has Biggest Drop Since Sept. After Inflation Data

MarketWatch

4 year-end moves to make with your retirement portfolio

If you’re still working, consider maximizing how much you’re contributing to your employer-sponsored retirement plan, said Patrick Kuster, a wealth adviser with Buckingham Strategic Wealth. For those with earned income above 2021 Roth contribution limits, Kuster said this may be the last year for “backdoor” Roth conversions due to proposals within the Build Back Better Act (BBB). A backdoor Roth IRA conversion is simply making a (typically nondeductible) IRA contribution, followed by a subsequent Roth conversion, according to Kitces.com. IRA account owners — especially those in low-income tax years — might consider traditional partial or full Roth IRA conversions, Ashley Folkes, a senior financial adviser with Bridgeworth Wealth Management.