Dollar Steady as Omicron Shadows Asia Market Open: Markets Wrap

(Bloomberg) — The dollar was steady against major peers early Monday as traders weighed spiking coronavirus cases and China’s central bank pledge of economic support over the weekend.

Most Read from Bloomberg

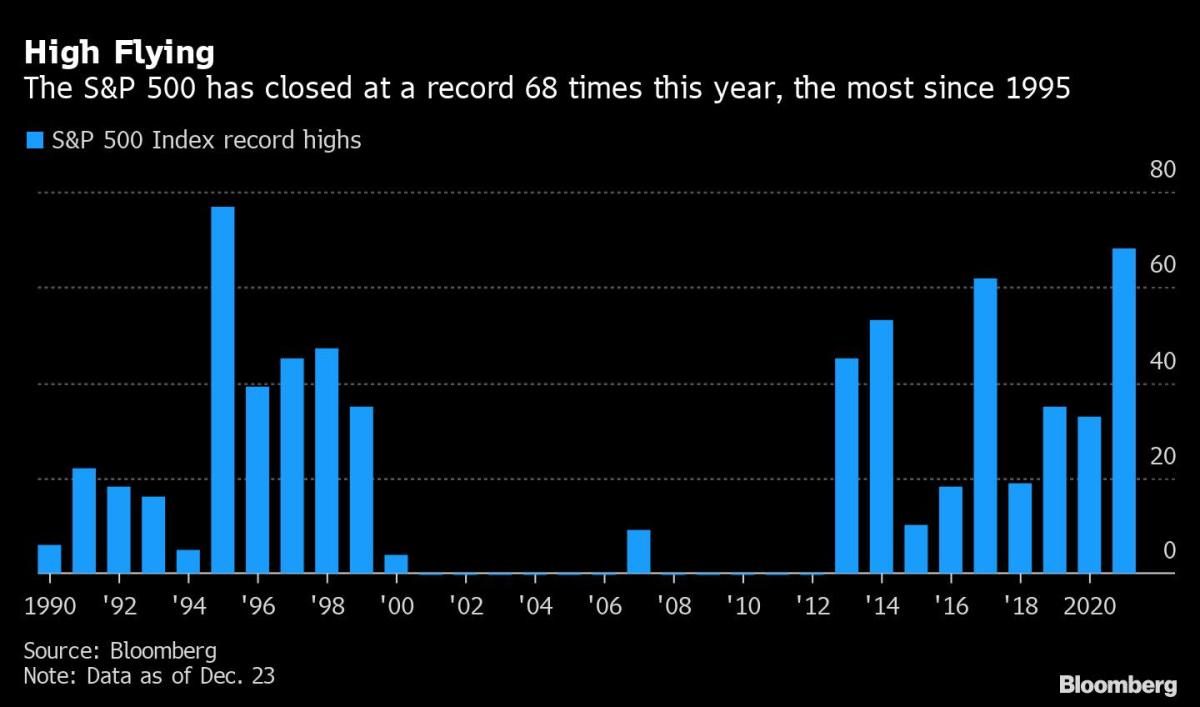

Equity futures for Japan earlier pointed to a muted start, after Asian shares ended Friday mixed despite an all-time high for the S&P 500. Some stock markets are closed or have truncated hours and volumes may be thinner than usual.

Reports indicated new daily U.S. infections with the omicron virus variant have surpassed those in the delta wave, while China posted the highest number of local cases since January. The pathogen is causing disruption, including the cancellation of almost 2,400 flights over the holiday weekend in the U.S.

In China, the central bank pledged greater support for the real economy on Saturday and said it will make monetary policy more forward-looking and targeted, amid expectations of easing as a property-sector slowdown saps economic growth.

Chinese regulators also plan tighter scrutiny of overseas share sales by domestic firms and intend to ban those that could pose a national security threat, Beijing’s latest step to crack down on listings abroad.

China’s possible policy loosening contrasts with steps by the Federal Reserve and other central banks to fight high inflation by scaling back stimulus. The outlook for monetary policy, the virus and company earnings are shaping thinking about whether global stocks can keep rising after nearly doubling from pandemic lows.

On the virus front, Anthony Fauci, President Joe Biden’s top medical adviser, said Americans should stay vigilant against the omicron variant despite evidence its symptoms may be less severe because the volume of cases can still overwhelm hospitals.

Elsewhere, Vice President Kamala Harris said the Biden administration is seeking a path forward for its “Build Back Better” economic stimulus. In Turkey, President Recep Tayyip Erdogan said the nation has abandoned interest-rate hikes as a tool to control price pressures.

Meanwhile, Bitcoin had a steady holiday weekend and was trading at about $50,000 early in Asia on Monday.

What to watch this week:

-

Hong Kong, Australian, Canadian and U.K. markets closed, Monday

-

China industrial profits, Monday

-

U.S. initial jobless claims, Thursday

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

-

The S&P 500 index rose 0.6% on Thursday

-

The Nasdaq 100 index climbed 0.8% on Thursday

-

Nikkei 225 futures fell 0.3% earlier

Currencies

-

The Bloomberg Dollar Spot Index fell 0.1% on Thursday

-

The euro was at $1.1318

-

The Japanese yen was at 114.38 per dollar

-

The offshore yuan was at 6.3746 per dollar

Bonds

Commodities

-

West Texas Intermediate crude rose 1.4% to $73.79 a barrel on Thursday

-

Gold was at $1,817.32 an ounce

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.