Adobe stock stumbles toward worst day in 20 months as DocuSign fears spark ‘knee-jerk reaction’

Shares of Adobe Inc. are sinking Friday, and on track for their worst performance in more than 20 months, after DocuSign Inc. delivered what some saw as a the latest sign of a demand cooldown for work-from-home software.

DocuSign DOCU,

Some of that investor fear seems to be transferring over to Adobe ADBE,

The decline in Adobe shares struck Wedbush analyst Daniel Ives as a “DOCU-related selloff” as DocuSign’s report served as a “a barometer that the WFH tailwinds are now abating and could be a headwind for Adobe,” he told MarketWatch. “The DOCU print was a shocker and this is a knee-jerk reaction.”

Subscribe: Want intel on all the news moving markets? Sign up for our daily Need to Know newsletter.

Adobe is due to post its own quarterly results Dec. 16. The company highlighted its e-signature technology in its prior earnings report, as Chief Financial Officer John Murphy noted that “third-quarter Document Cloud growth drivers included adoption of Sign in Acrobat driven by the increased need to collaborate in a hybrid work environment.”

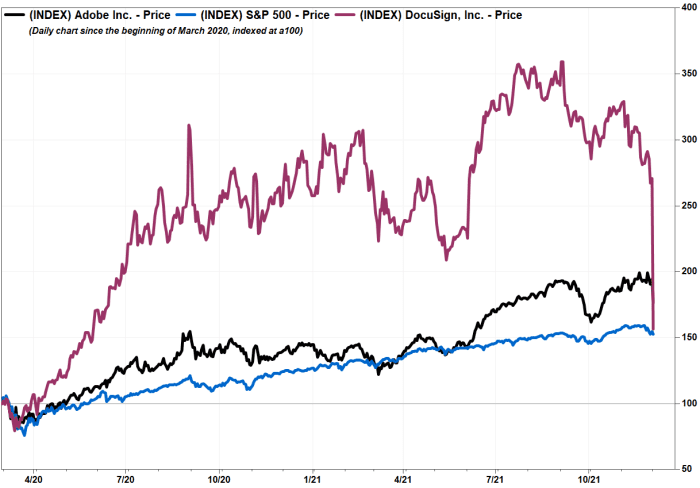

While other at-home stocks took a hit on disappointing outlooks earlier in the course of the pandemic, DocuSign initially appeared more resilient. Its stock hit an all-time high in September and was up 165% since March 2020 as of Thursday’s close. Now the company will need to “show that it can generate, not just fulfill, demand on a regular basis,” according to an Evercore analyst.

Adobe has a more diversified business than DocuSign. While the company sells contract-related software, it has a variety of other offerings including subscriptions to creative programs like Photoshop. Adobe’s Document Cloud accounted for about 13% of the company’s overall revenue in its last-reported quarter.

Shares of Adobe were up 86% since March 2020 as of Thursday’s close.