Why OEMs are upping battery recycling capacity – report

In some cases, there is particular interest in helping build a domestic battery metal supply, while in others, there is the desire to reduce reliance on unsustainable mining practices and hedge risks of fluctuating metal prices.

In parallel, OEMs are subject to Extended Producer Responsibility regulations, which means that they are responsible for EV batteries when they reach their end-of-life.

“Therefore, it is in the OEMs’ best interests to develop efficient, economic routes for waste end-of-life batteries, and the environmental credentials associated with recycling are also beneficial,” the report reads. “IDTechEx has identified nearly 90 battery recyclers globally and observed that most of the current recycling capacity is in China.”

Despite such concentration, the market researcher mentions that there are initiatives moving forward outside of China.

One of such projects is Volkswagen’s pilot plant for recycling Li-ion batteries in Salzgitter, which was commissioned in 2021, and which is part of the company’s vertically integrated recycling and second-life business

Another example highlighted in the report is that of Renault, which operates a battery hire scheme on three of its models, as well as full ownership options. In fact, the company optimizes the end-of-life management of its EV batteries using second-life applications and recycling with partners, such as Veolia.

Tesla, on the other hand, is said to be developing a battery recycling system at its Gigafactory in Nevada, having relied on third-party recyclers in the past, while BMW has formed strategic partnerships with recyclers, seeking to design cells with recycling in mind.

“The involvement of these major OEMs looking to boost the sustainability of their EVs reflects the anticipation of the part Li-ion battery recycling will play in the future value chain,” the dossier states. “Not only are the OEMs likely to carry a legal responsibility for end-of-life Li-ion batteries, but the trends they influence will impact the profitability of recycling. In addition to creating partnerships with recyclers from other sectors, OEMs themselves are acting and investing in their own processes and supply circularity.”

Costs expected to go down

In the view of IDTechEx’s experts, process costs for battery recycling are set to decrease as recyclers scale.

The thing to keep in mind is, thus, the chemical composition of EV batteries.

For the market analyst, the value of metals recyclers can extract from end-of-life EV batteries will be impacted by growing interest in lower-value LFP cathodes, which is driven by the desire to drive battery costs down.

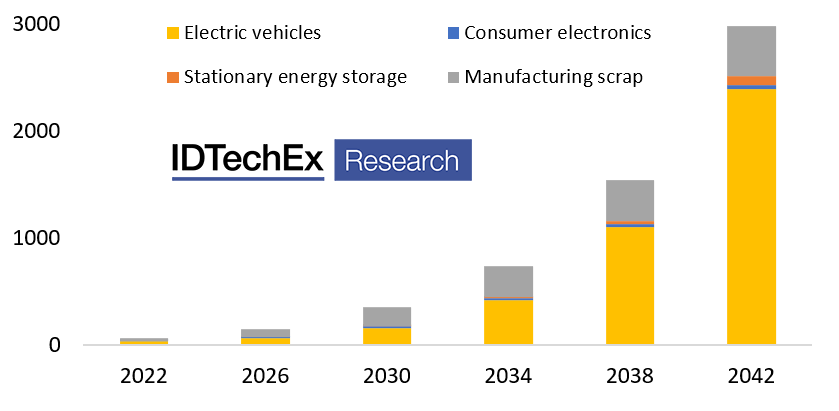

On the other hand, even though, the most value can be extracted from LCO cathodes due to their high cobalt content, these are typically used in consumer electronics which – according to the report – are challenging to develop collection networks for and will account only for a small percentage of Li-ion batteries recycled.