This chart shows copper price could dive 28% going into 2022

While almost all agree copper’s longer-term future is bright, there is much less consensus on how much the price of the metal will shine during the next few years.

A new report by Capital Economics argues there is weakness ahead. The London-Headquatered independent researcher expects copper prices to fall heading into 2022 as demand from China wanes and primary supply ramps up, notably from Kamoa-Kakula in Congo, one of the biggest mines to enter production in decades:

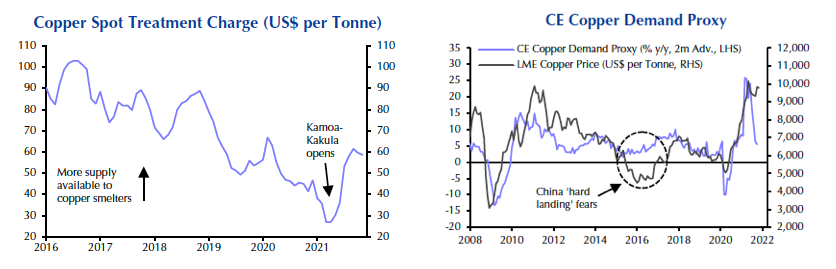

“First, high copper prices have accelerated ramp-ups of mine supply, which had been slowed by strikes, poor weather and covid-19 restrictions. Mined copper now appears to be coming back at pace, as shown by the increase in the spot treatment charge.

“Second, we expect copper demand to ease back. Our in-house demand proxy suggests that demand has already fallen. This is driven by the slowing of the Chinese construction sector, the largest copper end-user.

“Furthermore, we expect demand for goods containing copper to also cool as global spending patterns shift away from goods to services as lockdowns end and international travel opens.”

Click here for an interactive chart of copper prices

Treatment and refining charges (TC/RCs) paid by miners to smelters to process concentrate into refined metal rise when supply is ample and fall when smelters are forced to compete for scarce material. While TC/RCs have risen to around $60 a tonne from historically low levels of just over $20 a tonne in April, today’s charges still compare to spikes as high as $130 in the 2010s.

Capital Economics now expects the global copper market to enter a surplus of some 200,000 tonnes next year after four years of deficits, including a shortfall of more than 800,000 tonnes in 2020.