These nonretail stocks are set for a Black Friday boost, trader says

Two stocks outside the retail trade could get a boost from Black Friday shopping, ERShares’ Eva Ados says.

The National Retail Federation expects 2 million more Thanksgiving weekend shoppers than last year, still below 2019’s levels but a sign that one of the year’s biggest retail holidays remains intact.

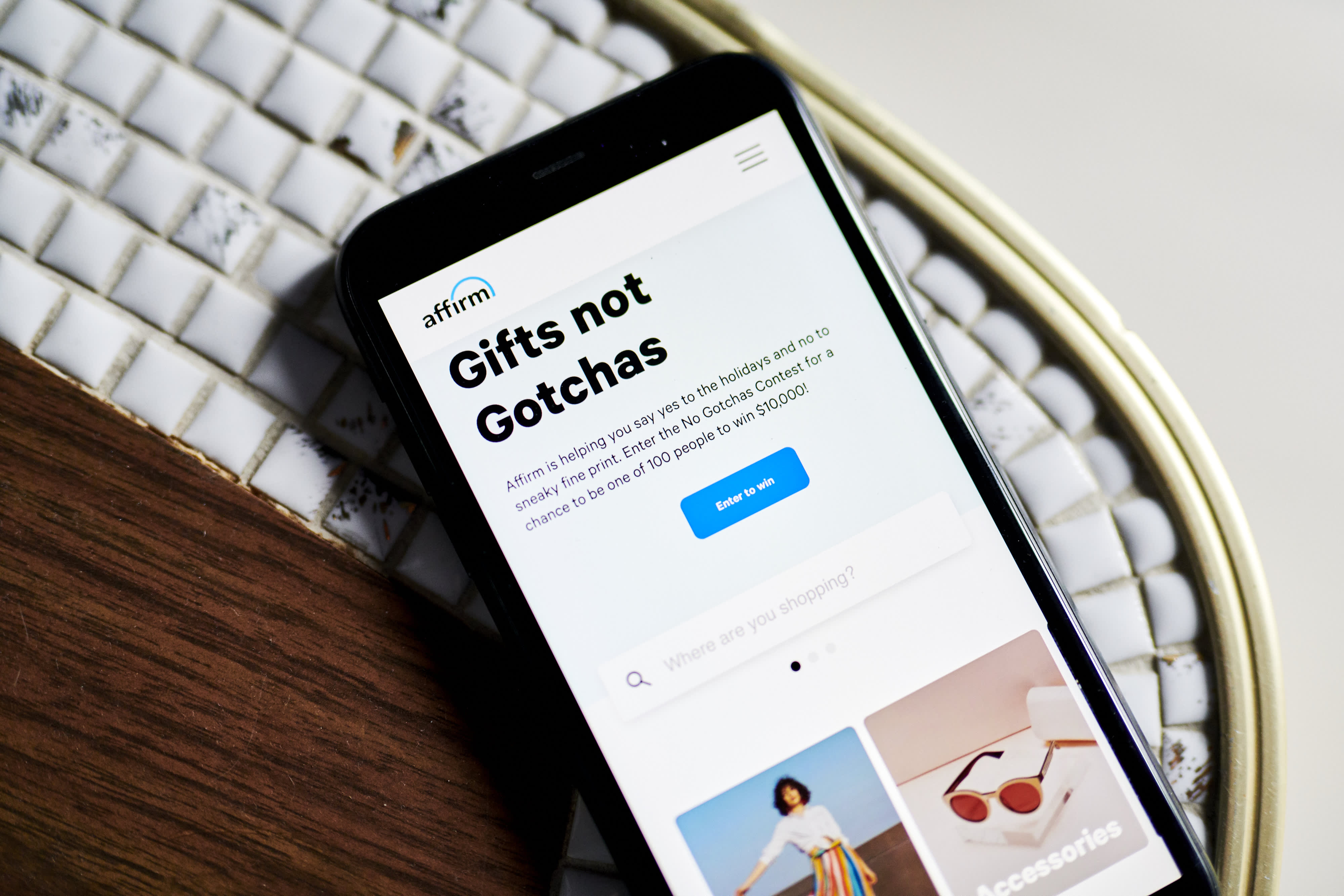

The rise of “buy now, pay later” options could give way to Affirm and Square getting a boost, Ados told CNBC’s “Trading Nation” on Wednesday.

“Because it’s expected to be a very strong holiday season and we have limited availability, consumers have an incentive to buy as much as they can now,” the firm’s chief investment strategist and chief operating officer said.

“But what do they do if they don’t have a credit card like two-thirds of the millennials or if they don’t have sufficient cash? That’s where buy now, pay later comes in.”

From Affirm’s exclusive deal with Amazon to Square’s impending acquisition of Australian fintech company AfterPay, both have catalysts in place to take them higher during the shopping rush, Ados said.

The time to buy traditional retail stocks has likely passed, Blue Line Capital founder and President Bill Baruch said in the same interview.

“This isn’t the time to really be chasing retail names,” said Baruch, whose firm owns shares of Lululemon, Kohl’s and Target. “I wouldn’t be adding exposure at these levels.”

With consumer discretionary stocks meeting resistance relative to the S&P 500, the buying opportunity in retail has likely passed, he said.

“The time to be buying retail stocks was through the August weakness,” Baruch said.

“It’s outperformed for the last four or five weeks, but it’s hit a peak again. I think it’s up there [against] a lot of resistance,” he said. “I do not see consumer discretionary outperforming the S&P 500 for at least the next few weeks or few months.”