These Are the Stocks to Watch as Covid Enters Its Next Phase

(Bloomberg) — The first pill to treat Covid-19 is on its way and vaccine producers are rolling out booster shots in wealthy countries. For investors, the next stage of the pandemic means a tougher landscape for stockpicking.

Most Read from Bloomberg

The success of Merck & Co.’s oral antiviral treatment in a clinical trial has shifted the momentum in the stock market, weighing on shares of the companies that developed the most effective vaccines, Moderna Inc. and the duo of Pfizer Inc. and BioNTech SE.

Nineteen months into the pandemic, a successful rollout of a Covid-19 pill could quicken and broaden the world’s recovery, opening up a plethora of investment opportunities in stock markets.

Here are some stocks seen by traders as possible winners and losers:

Pill Makers

Dozens of companies around the globe have said they’re trying to do what Merck appears to have succeeded at: Develop an easily administered treatment that reduces the risk of serious illness or death for people infected with coronavirus. For most of them, the effort has come to nothing, and after brief share spikes, their stocks have fallen back.

Among the bigger companies still working on antivirals are Pfizer, Shionogi & Co. and Roche Holding AG with partner Atea Pharmaceuticals Inc. All plan to publish results from late-stage clinical trials by the end of the year. Shionogi’s pill could be a $2 billion drug, the Japanese company said Friday.

A tiny Israeli biotech, RedHill Biopharma Ltd., said Oct. 4 its experimental oral therapy showed promise in helping hospitalized patients. The study consisted of only 251 people; weeks earlier RedHill had said the drug failed to show an effect in a broader group of patients. The company is discussing next steps with regulators.

“The Covid pills are really a complement to the vaccines,” said Shane Oliver, head of investment strategy at AMP Capital Investors Ltd. in Sydney. They could reduce demand for costlier treatments such as intravenous medicines, he added.

Another tiny company, Synairgen Plc of the U.K., was one of the last year’s investor favorites, soaring 2,520% on optimism for its inhaled treatment for Covid-19. The stock has fallen 2% this year. It too expects late-stage trial data by year’s end.

Vaccines

The possible arrival of Merck’s molnupiravir pill, coupled with the prospect that the pandemic will wane further, already is weighing on the valuations of jab makers.

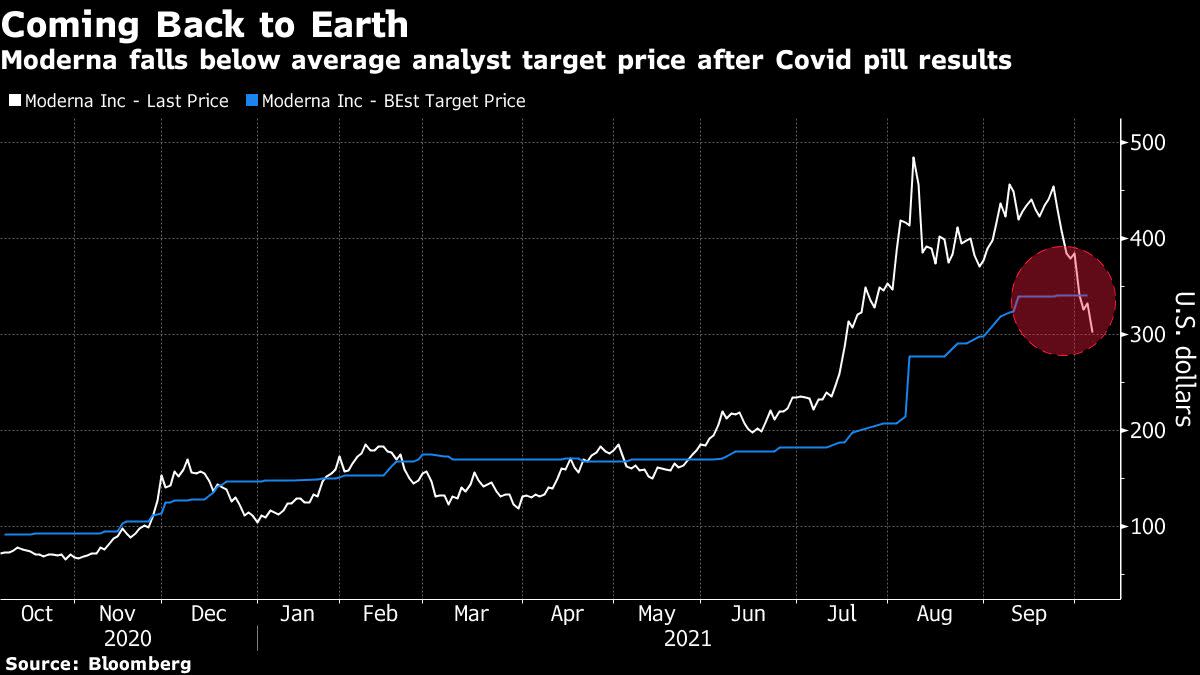

Moderna’s share price has almost tripled in 2021 after surging 434% last year. The stock’s inclusion in the S&P 500 in July further propelled it to a record and sent it soaring past analysts’ price targets.

Still, it’s now priced at 11 times estimated earnings, down from 147 times in July 2020. The recent selloff finally brought the stock back in line with analysts’ 12-month projections for the first time in more than four months.

The share price of Pfizer’s German partner BioNTech is even cheaper at 5.9 times earnings, despite tripling this year.

“Vaccines remain the primary prevention measure and largest market opportunity,” Morgan Stanley analyst Matthew Harrison wrote in a note dated Oct. 5.

Still, it’s unclear how big that market will be: Harrison’s forecast for annual coronavirus vaccine sales over the long term ranges from $3 billion to $30 billion. He has equal-weight ratings on Pfizer and Moderna.

The vaccine leaders may also lose market share if new inoculations from Sanofi, Novavax Inc. or Valneva SE succeed and if mix-and-match boosting appears to be effective. The U.S. FDA is reviewing results of a study of adults who received booster doses of different vaccines than their original shots.

Pfizer and BioNTech are seeking U.S. approval for use of their shots on children ages 5-11, while Moderna is testing its shot in kids as well.

In Asia, watch firms such as Shanghai Fosun Pharmaceutical Group Co., which has a deal to distribute BioNTech and Pfizer’s vaccine in greater China, and South Korea’s SK Bioscience Co., a local production partner for AstraZeneca Plc.

Intravenous Treatments

The convenience of a pill for Covid could take market share from expensive infusions that need to be done in a clinic, namely the monoclonal antibody treatments from Eli Lilly & Co., Regeneron Pharmaceuticals Inc., Gilead Sciences Inc., GlaxoSmithKline Plc and partner Vir Biotechnology Inc.

New oral antivirals “could open up a broader population to Covid-19 treatments in a true outpatient setting,” wrote Goldman Sachs Group Inc. analyst Chris Shibutani in an Oct. 1 research note.

Covid Testing

The continuing vaccination and a possible therapeutic may also curb the need for Covid testing kits.

“Less hospitalizations as a result of Covid (which will surely be aided by molnupiravir and similar treatments) will result in a dialed-back pandemic response, which should then result in less demand for asymptomatic testing — especially for rapid testing,” said Tycho Peterson, an analyst at JPMorgan Chase & Co.

Goldman analysts are more pessimistic, saying the market for rapid Covid tests will “collapse” in 2022 to less than $200 million outside of symptomatic and PCR testing. Companies making those quick diagnostics, known as antigen tests, namely Qiagen NV, DiaSorin SpA and Abbott Laboratories, have all slumped from their recent peaks in September.

Quidel Corp., Orasure Technologies Inc. and Abbott will be in focus in the U.S. Sugentech Inc., Biolidics Ltd., Metropolis Heathcare Ltd., Thyrocare Technologies Ltd. and Dr Lal PathLabs Ltd. are on traders’ radar in Asia.

Other stocks to watch include lab operator Eurofins Scientific SE and suppliers of lab equipment such as Fluidigm Corp., Sartorius AG, Sartorius Stedim Biotech and Tecan Group AG.

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.