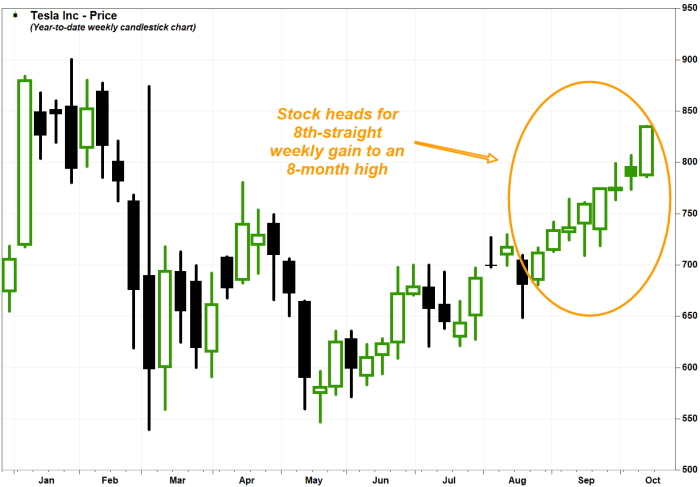

Tesla stock climbs toward 8-month high after Jefferies boosts price target, profit view

Shares of Tesla Inc. kept their rally going Friday toward an eight-month high, after Jefferies analyst Philippe Houchois raised his price target and earnings estimates, saying concerns over demand in the electric vehicle leader’s key China market have now been put to rest.

And regarding worries about the negative effects of the global semiconductor shortage on automobile production, Houchois said Tesla is better positioned to deal with the shortage than its peers.

The stock TSLA,

Houchois raised his stock price target to $950, which is 7.6% above the Jan. 26 record close of $883.09, from $850, as his research and analysis suggests higher capacity ramp and sustained demand. He reiterated the buy rating he’s had on Tesla since August.

“For some time the narrative has been legacy [original equipment manufacturers] closing the gap; we see little evidence as Tesla continues to challenge at multiple levels,” Houchois wrote in a note to clients.

“The final details of Q3 also showed China domestic sales of 73.6K units, putting to rest concerns about domestic demand, while annualized Q3 output yields 530K, i.e., Shanghai running at more than full capacity,” he added.

Houchois raised his 2021 estimate for adjusted earnings per share to $5.59 from $5.12 and for revenue to $54.09 billion from $53.62 billion, which are now well above the FactSet consensus for EPS of $5.30 and for revenue of $51.05 billion.

He said while Tesla hasn’t been immune to supply disruptions, it has outperformed its peers in sourcing chips.

“From discussions with a senior expert in semiconductor sourcing and manufacturing, we understand this partly reflects Tesla in-sourcing chip design with an ability to effect rapid redesign and secure more direct souring than peers,” Houchois wrote.

What is also helping Tesla outproduce its OEM peers is the design of its manufacturing facilities, which are focused on simplicity and flow, Houchois said.

“In a global auto industry plagued by complexity, Tesla continues to reduce complexity and set new standards for simplicity of design and assembly,” he wrote.

Tesla’s stock, which is on course for the highest close since Feb. 9, has run up 22.7% over the past eight weeks, and soared 86.0% over the past 12 months. In comparison, the S&P 500 index SPX,