Phunware stock was up 1,000% on Friday. What the heck is Phunware?

A tiny, money-losing Trump-linked software company has a stock that is surging, but what’s behind all this PHUN?

At one point early Friday, shares in Phunware PHUN,

That’s not too shabby for a relatively tiny Austin, Texas-based tech outfit specializing in advertising software via mobile applications and location tracking that, according to its own financials, realized a net loss of $8.3 million in the second quarter of 2021 on net revenue of $1.4 million.

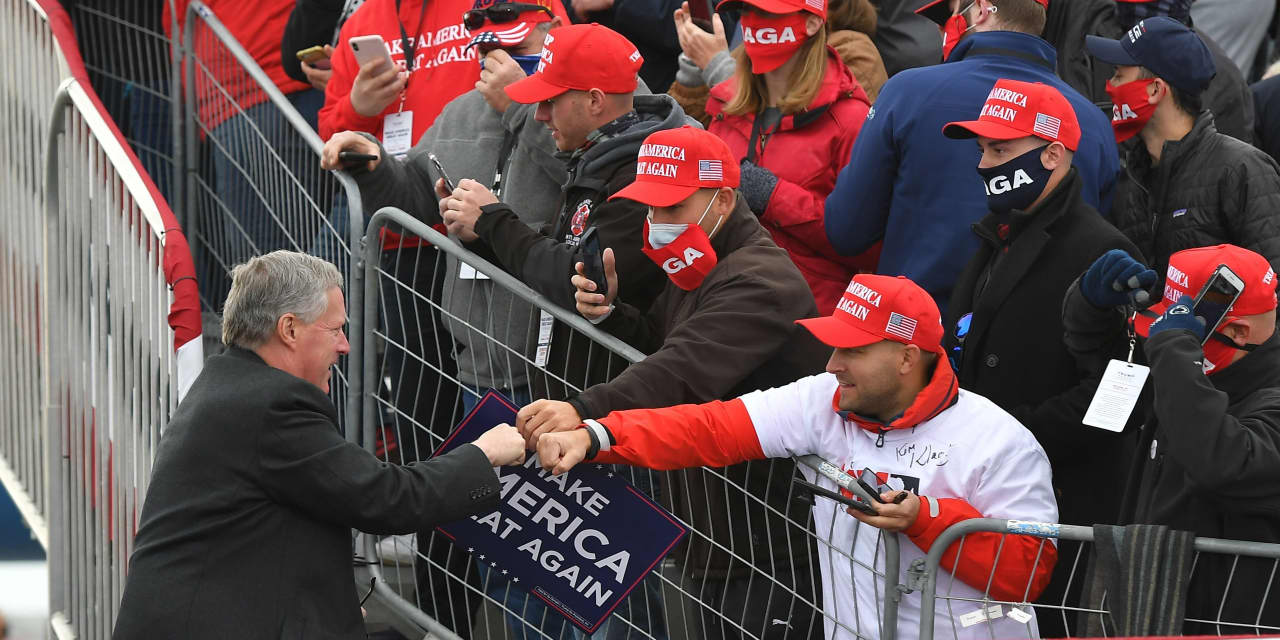

Phunware, founded in 2009, went public via a SPAC in December 2018 and came to some prominence in 2019 for its work with the Trump/Pence reelection campaign. Phunware reportedly received a $3 million contract from Trump’s former campaign manager Brad Parscale and its stock went from $10 a share in December 2018 to more than $300 a share by Feb 1, 2019.

By April 2019, shares were back trading for less than $6 though.

One year later, the company was slapped with a delisting warning from NASDAQ after its stock had traded below $1 for 30 consecutive days. That same month, it was revealed that Phunware had applied for and received $2,850,336 in Paycheck Protection Program loans from JP Morgan Chase, despite being a publicly traded company.

Phunware’s COO Randall Crowder defended the PPP loan at the time by telling a local Texas news channel that the company was in too dire a situation not to take the money.

“Phunware is an 11-year-old technology company with a market cap somewhere around $25 million, with 56 employees. We’ve been unprofitable for the last 11 years,” Crowder explained at the time. “Banks aren’t loaning to unprofitable tech companies. There is no access to capital.”

Phunware managed to get its share price back above a dollar in due time to appease its exchange, but the stock has languished since and was trading at $0.90 a share as recently as October 8.

But thanks to retail investors caught up in what appears to be MAGA mememania, Phunware’s prior relationship with Trump through his fired aide Parscale makes it a possible investment play for everyone looking to capitalize on the madcap froth around Trump’s announced deal with SPAC outfit Digital World Acquisition Corp. DWAC,

On one subreddit, users egged each other on to keep buying PHUN shares and reminding the group of 2019’s massive price rise.

“This stock ran to $500 per in 2019,” blared the headline of one post. “With that being said we all know even higher is possible now.”

Commenters on that post agreed with the sentiment, with many users annoyed that the stock was finding resistance at $20 while a noticeably larger contingent made it clear they were selling their shares in cannabis grower Sundial Growers SNDL,

On Twitter, users backing PHUN had “phun” with the ticker symbol and predicted that the stock would rocket up further, cementing their claims with pro-Trump memes.

While Phunware’s big early gains had been pared back to ‘only’ a 600% gain at midday Friday, retail interest in DWAC remained fervid with the stock soaring another 140% at midday, bringing its not-even two-day price growth to more than 900%.