Energy stocks have perked up — here are Wall Street’s favorite sector plays

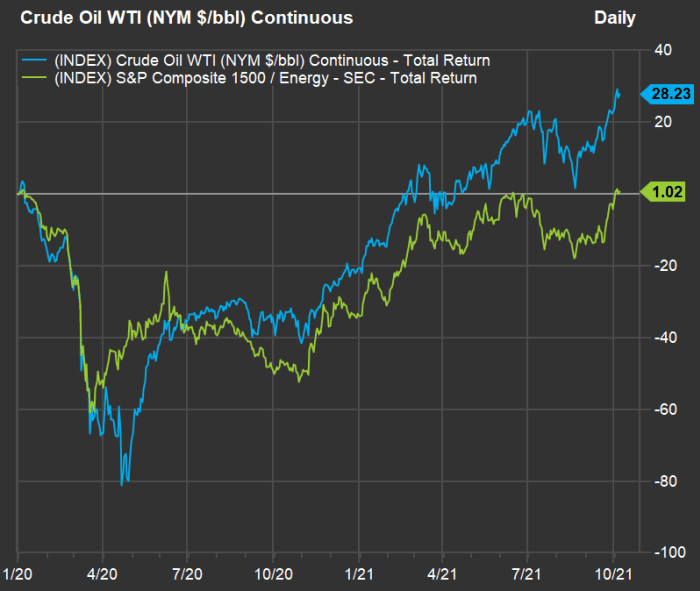

Energy stocks have strengthened over the past month, but they curiously still trail the remarkable increase in oil prices. Even with crude oil prices up 61% this year, analysts at J.P. Morgan think the U.S. economy can “support” another 66% increase without a significant detriment to consumers’ financial health.

A list of favorite energy stocks among Wall Street analysts is listed below.

Read: Stock market can absorb $130 oil, JPMorgan’s Kolanovic says

From the end of 2019 — before the pandemic — the price of West Texas Intermediate crude oil CL00,

Energy stocks as a group have trailed the brisk recovery of the price of oil from the pandemic doldrums in 2020, and then some. WTI is now at its highest level since mid-November 2014, when it was in the midst of a long slide from its 10-year intraday peak at $112 in late-August 2013.

But over the past month, the S&P 1500 energy sector has been keeping up, with a 15.4% return as WTI has risen 14.6%.

Among the S&P 1500, all other sectors except financials have pulled back over the past month. It would seem investors are catching on to what a team of analysts at J.P. Morgan, led by Dubravko Lakos-Bujas, called “one of our favorite sectors” because of rising demand during a period of supply disruptions.

Lakos-Bujas went so far as to write in a note to clients on Oct. 7 that “the U.S. market can support ~$130 oil given [the] S&P 500’s lower relative exposure to goods producing sectors and the U.S. economy’s declining energy intensity.”

Energy stocks are still cheap

“Energy offers attractive risk/reward with improving fundamentals, increasing capital return, as well as low valuation relative to the market and relative to its credit (where the disconnect has grown larger),” Lakos-Bujas wrote.

Looking back 10 years, the S&P 1500 energy sector has returned 18%, while the full S&P 1500 has returned 360%. (All returns in this article include reinvested dividends.) For the the 10-year period, WTI has declined 6%.

If we look at weighed forward price-to-earnings valuations, the S&P 1500 energy sector trades for 13.6 times consensus estimates over the next 12 months, among analysts polled by FactSet. The forward price-to-earnings ratio for the full S&P 1500 is 20, so the energy stocks as a group trade for 68% of the full index’s valuation.

But over the long haul, energy stocks have tended to trade higher than the broad index. Over the past 10 years, the average forward P/E for the S&P 1500 energy sector has been 19.8, or 119% of the full index’s 10-year average forward P/E of 16.6. For 15 years, the energy sector’s average P/E has been 17, or 110% of the full index’s average forward P/E of 15.5.

To go along with a bright outlook for the commodity price, Lakos-Bujas wrote that 100% of U.S. oil producers were profitable during the second quarter, and that current prices are well above the production break-even point for all of them.

Screen of energy stocks

“Small-cap energy offers the strongest upside given its higher gearing to oil, balance sheet recovery, and potential M&A targets as larger peers look to strategically build up reserves,” Lakos-Bujas wrote.

In order to present an energy -stock screen with a broad base, we began with the Russell 3000 Index RUA,

Among the Russell 3000, there are 107 energy stocks, with 86 covered by at least five analysts polled by FactSet. Here are the 20 stocks with majority “buy” or equivalent ratings that analysts expect to rise the most over the next 12 months:

| Company | Share “Buy” ratings | Closing price – Oct. 7 | Consensus price target | Implied 12-month upside potential | Market cap. ($mil) |

| Clean Energy Fuels Corp. CLNE, |

63% | $8.39 | $15.43 | 84% | $1,871 |

| Renewable Energy Group Inc. REGI, |

80% | $53.52 | $82.50 | 54% | $2,689 |

| Earthstone Energy Inc. Class A ESTE, |

86% | $11.27 | $16.18 | 44% | $571 |

| National Energy Services Reunited Corp. NESR, |

100% | $12.67 | $17.75 | 40% | $1,154 |

| CNX Resources Corp. CNX, |

57% | $13.21 | $18.17 | 38% | $2,879 |

| EQT Corp. EQT, |

70% | $21.30 | $29.09 | 37% | $8,050 |

| Green Plains Inc. GPRE, |

90% | $34.05 | $46.10 | 35% | $1,827 |

| Expro Group Holdings N.V. XPRO, |

60% | $18.71 | $25.13 | 34% | $712 |

| Dorian LPG Ltd. LPG, |

75% | $12.67 | $17.00 | 34% | $509 |

| Talos Energy Inc. TALO, |

100% | $13.42 | $18.00 | 34% | $1,099 |

| PDC Energy Inc. PDCE, |

88% | $47.56 | $63.06 | 33% | $4,692 |

| Chesapeake Energy Corp. CHK, |

78% | $64.75 | $84.78 | 31% | $6,364 |

| Bonanza Creek Energy Inc. BCEI, |

100% | $50.16 | $63.17 | 26% | $1,547 |

| NexTier Oilfield Solutions Inc. NEX, |

82% | $4.68 | $5.83 | 25% | $1,010 |

| Falcon Minerals Corp. Class A FLMN, |

71% | $5.43 | $6.76 | 24% | $255 |

| Denbury Inc. DEN, |

83% | $72.52 | $89.25 | 23% | $3,634 |

| Oasis Petroleum Inc. OAS, |

86% | $103.00 | $125.86 | 22% | $2,050 |

| Energy Fuels Inc. UUUU, |

100% | $8.22 | $9.90 | 20% | $1,222 |

| Northern Oil and Gas Inc. NOG, |

100% | $24.62 | $29.58 | 20% | $1,629 |

| Hess Corp. HES, |

63% | $83.61 | $99.75 | 19% | $25,892 |

| Source: FactSet | |||||

Click on the tickers for more about each company. Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on MarketWatch’s quote page.

Most of the listed companies are oil producers. But the two stocks ranking highest on the list, in terms of consensus price targets, are producers of fuel sourced from alternative sources. Clean Energy Fuels Corp. CLNE,

Don’t miss: In today’s market, small-cap stocks are punching up as large caps have lagged behind