Energy crisis? What experts are saying as world faces historic energy-price crunch

Prices of fossil fuels around the globe are surging, leading some commodity pros to refer to the current condition as an “energy crisis” that could have far-reaching implications for American consumers.

It also carries implications for energy policy as the U.S. — and the rest of the world — attempts to wean itself off crude oil and its byproducts and transition to renewable sources of power.

Energy assets from natural-gas futures NG00,

“It’s almost like everything that could go wrong, did go wrong,” Helima Croft, global head of commodity strategy at RBC, told MarketWatch in a phone interview. “It’s a multifaceted story,” said the energy specialist and former senior economic analyst at the Central Intelligence Agency.

What is an energy crisis?

So what is an energy crisis and how did we get here?

Some define it as a bottleneck in the supply of energy resources, with the potential to hamstring economies. Goldman Sachs head of commodity research Jeffrey Currie told MarketWatch that, put simply, an “energy crisis” is the phenomenon of “not enough [energy] supply to go around to meet demand.”

In the early 1970s, an energy crisis gripped the U.S., caused partly by an oil embargo led by major Middle Eastern oil producers, as consumption surged and America was dependent on imported crude.

All of the action in energy is happening against the backdrop of growing concerns about sticky inflation, which is being reinforced by the surge in energy prices.

The stock market has been unsettled, amid the concerns about pricing pressures and its ability to hamstring global economies. The Dow Jones Industrial Average DJIA, the S&P 500 index SPX and the Nasdaq Composite Index COMP have been seeing turbulent trade, and has underperformed the performance of energy assets.

How did we get here?

This time around, rising prices are being blamed on a confluence of events. Those include the reopening of economies from pandemic shutdowns; decisions by China, one of the world’s largest importers of energy products; worries about major energy producers not ramping up output; and a fitful shift to renewable energy sources, while investment in fossil fuels has waned.

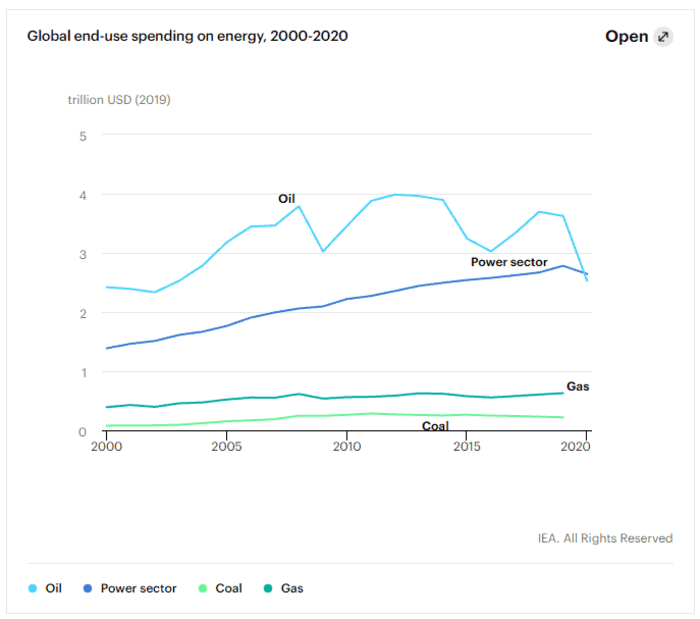

Indeed, the COVID-19 pandemic may have exacerbated a trend of decreasing investments in fossil fuels, with global lockdowns in 2020 to help limit the spread of the deadly virus delivering a notable gut punch to crude-oil production, data from the Paris-based International Energy Agency show.

China’s role

China is the world’s biggest importer of energy products. Reports and data indicate that the country has been caught flat-footed by the post-COVID snapback in demand for energy, forcing it to turn to dirtier coal, even as it had been attempting to comply with standards to lower its carbon emissions.

The Financial Times noted that coal-fired power plants account for about 70% of China’s electricity, but it is severely lacking in the fuel, as it has closed coal plants and mines, partly for environmental reasons.

On top of everything, China banned imports from coal-producing Australia a year ago, due to rising tensions between the countries, which is now limiting Beijing’s ability to outsource the commodity.

That said, Reuters reported last week that China was releasing Australian coal from bonded storage. Some speculate that the country could ultimately end the Australia ban altogether if problems intensify.

China has been ratcheting up its imports of coal, with Beijing purchasing 32.88 million tons of coal in September, a 76% increase from a year earlier, Reuters reported on Wednesday, citing the country’s General Administration of Customs.

Russia’s role

Russia, a major producer of oil and natural gas, has been blamed for amplifying the energy crisis by limiting its global exports to drive prices further higher. Russian leader Vladimir Putin, speaking at a Moscow energy forum on Wednesday, denied these claims and said that Russia’s gas producer Gazprom isn’t holding back output and is adhering to existing contracts to feed gas to Europe.

“‘Higher gas prices in Europe are a consequence of a deficit of energy and not vice versa and that’s why we should not deal in blame shifting, this is what our partners are trying to do.’”

Putin laid the blame for the Continent’s energy woes on European leaders. “The European gas market does not look to be well-balanced and predictable,” he said.

A Kremlin spokesman told reporters on Wednesday that Russia has increased its Europe natural gas supplies as much as possible, and any further increases will need to be negotiated with Gazprom.

Russia has been accused of using its leverage to win approval of Nord Stream 2, a controversial, underwater natural-gas pipeline running from Russia to Germany, which is intended to deliver fuel to the European Union and bypass Ukraine. The pipeline would double Russia’s existing gas pipeline export capacity across the Baltic Sea to 110 billion cubic meters, equating to more than a half of Russia’s total pipeline gas supplies to Europe, Reuters reported.

RBC’s Croft speculated that Russia may still not have sufficient capacity to meet European current demand.

“Even if Nord Stream 2 were magically greenlit, Russia does not have surge capacity to meet the current demand,” the analyst said.

The chain reaction

China’s purchases of coal have sent coal prices soaring. On Wednesday, an important futures contract for coal rose to a record high of 1,640 yuan ($254.44) per ton, according to reports.

“‘We don’t even have a coal analyst…We got rid of them all in 2014.’”

Higher prices in coal are forcing energy users to turn to alternatives that could be cheaper, or that are more readily accessible, including fuel oil, a distillate of crude that is used for heating oil, and natural gas.

“Because we had an unseasonably cold winter in Asia, it pulled supplies away from European natural-gas stocks,” Croft said.

Goldman’s Currie said that coal prices are surging after it had seemingly been written off in this new green age. He noted that Goldman (as did some other research firms) ended coverage of coal several years ago.

“We don’t even have a coal analyst…We got rid of them all in 2014,” he said.

The Goldman analyst said that because energy markets were already unbalanced, it didn’t take very much to knock it off kilter.

Europe’s energy crisis

In the U.K., where the government is transitioning to renewables like offshore wind generation, a summer bereft of wind to turn turbines that, in turn, create power, has resulted in demand for energy outstripping availability.

Difficulties transporting natural-gas supplies, due to labor shortages and other factors, also has worsened the crisis.

As a result of those problems, prices for regional natural-gas futures GWM00,

The outlook

Croft said that investors need to morph into meteorologists soon, because the severity of cold in winter this year may be the biggest determinant of where the crisis goes from here. A cold winter could prompt greater demand for natural gas and heating fuels, which would produce another fillip to already elevated prices.

Read: U.S. consumers brace for double-digit percentage gains in winter heating bills

Currie described the energy crisis as “revenge of the old economy” as many have been promoting a faster shift to electric vehicles and sources of energy considered to be more environmentally friendly.

“The capital has been redirected to the new economy and is choking off what’s needed to grow the supply base in [the old economy, i.e., fossil fuels],” Currie said.

That is why the Goldman analysts sees this crisis as holding the potential to lead to a “multidecade commodity supercycle.” That is a reiteration of an assessment that Currie and his colleagues made back in January, where the investment bank declared a surge in prices “the beginning of a much longer structural bull market for commodities.”

To be sure, Goldman had anticipated that this current supercycle might be underpinned by the transition to renewables, but it isn’t clear that transition will play out as smoothly has had been predicted by commodity and green-energy backers.

Climate crisis meet energy crisis

A report by IEA outlined a plan to achieve net-zero carbon emissions by 2050, but recent developments, including increased demand for coal and doubts about the reliability of green-energy sources as a form of baseload power has, perhaps, raised doubts about achieving those global environmental goals.

“‘[It’s] a wake-up call to policy makers that we will have to have a more balanced approach to this transition…and if we don’t this is going to be a disaster.’”

“All of this is happening against the backdrop of COP 26,” said Croft, referring to the 2021 United Nations Climate Change Conference, which is set to take place on Oct. 31.

The World Health Organization, in a recent report, called on governments to “act with urgency” on what a climate crisis that it described as the “single biggest health threat facing humanity.”

Critics argue that the push to go green is highlighting structural problems in the existing energy complex.

This energy crisis is “a wake-up call to policy makers that we will have to have a more balanced approach to this transition…and if we don’t, this is going to be a disaster,” Phil Flynn, senior market analyst at The Price Futures Group, told MarketWatch.

Policy makers “have to find a way to do this that makes sense if their goal is to lower carbon,” Flynn said.

In the U.S.

Robert Yawger, director of energy futures at Mizuho Securities, said U.S. consumers may feel the pinch most at the gasoline pump, particularly if prices hit $4 a gallon. That would be the equivalent, he said, of West Texas Intermediate oil CL00,

Yawger also said that heating oil, as the U.S. heads toward winter, will be the next commodity that speculators jump on.

Hurricane Ida, one of the most powerful storms ever to hit the U.S., shut down 90% of Gulf Coast energy production. The slow recovery from those shutdowns also helped to add to energy problems elsewhere in the globe.

The massive storm, one of the worst in recent memories, underscored the changes to the environment that are under way, including a heat wave on the U.S. West Coast, droughts, and a deep freeze in Texas that unmasked problems with energy infrastructure in the Lone Star state.

One sign that the energy market is unsettled is that renewables, outside of uranium, haven’t caught much of a bid, despite the surge in fossil fuels. That’s illustrated by the performance of the Energy Select Sector SPDR Fund ETF XLE,

Yawger said that the clean-energy initiative, in his view, is a move in the right direction, but that markets will be in for a bumpy ride along the way.

“This is all one big circle of life in the energy space,” he said, referring to how moves in one commodity ripple through the rest of the complex.