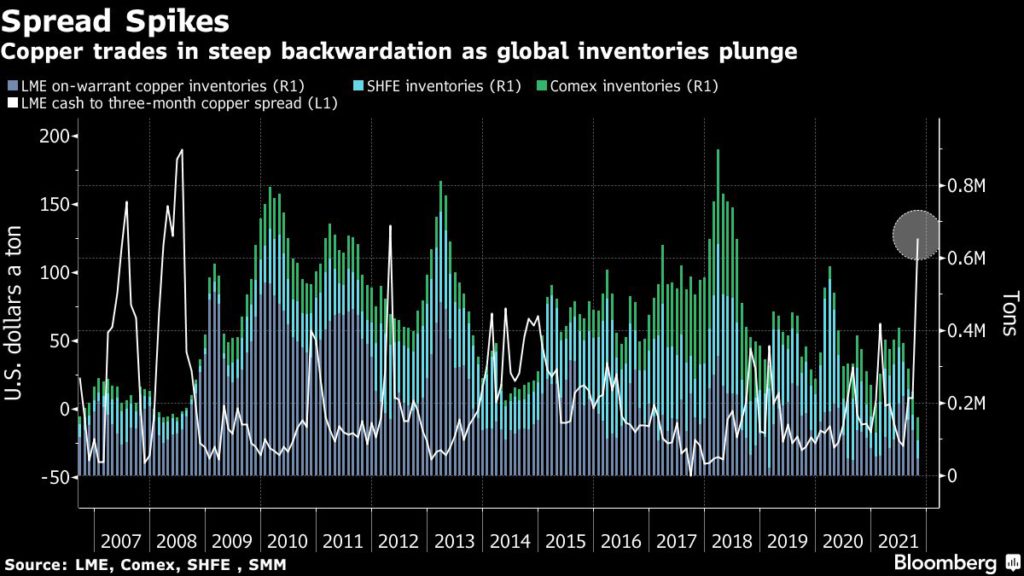

Copper climbed as much as 3.6% to $9,994 a tonne in London. The cash-to-three-month spread was trading at the biggest gap since 2012, as global exchange inventories plummet. Five out of the six base-metal contracts on the LME are now in backwardation (prompt delivery metal pricier than futures), signalling broad pressure on spot supply.

[Click here for an interactive chart of copper prices]

The rally fed through to producers with shares in BHP Group up 3.8%, Glencore plc up 3.3%, Freeport-McMoRan up 5.2%, KGHM up 4.8% and Southern Copper up 4.4%. First Quantum Minerals rose more than 6% on the day.

Metal supply cuts are spreading from China to Europe, as energy shortages drive up costs for electricity and natural gas, threatening more inflationary pressure from rising commodity prices.

On Wednesday, the world’s second largest zinc producer Nyrstar said it will cut output at three European smelters by up to 50%, making the metal price surge to its highest price since 2007.

China growth concerns

The rebound in copper prices also comes despite concerns surrounding China and its debt-addled property sector.

“In the short term there are some headwinds, mainly due to concerns about China’s economy,” Jay Tatum, portfolio manager at New York-based Valent Asset Management, recently told Bloomberg.

“But once the world gets back to normal growth rates, evenly spread across the economy, we still think there’s a strong case to be made for metals like copper.”

Not everyone is convinced that copper’s outlook is rosy.

The International Monetary Fund has expressed concern that the world’s economic recovery, which drove copper’s blistering rally in May, has lost momentum and become increasingly divided.

Citigroup — one of the biggest cheerleaders for copper earlier this year — recently warned Bloomberg that prices could fall another 10%, with demand shrinking over the next three months.

(With files from Bloomberg and Reuters)