What asset is the perfect inflation hedge?

The perfect inflation hedge could very well turn out to be a terrible investment.

That’s crucial information if you’ve been spooked by recent reports that inflation has spiked upward and might remain high—or even go higher. The latest CPI report, released in mid-September, showed inflation to be running at (but for a brief exception in 2008) the highest rate in three decades.

Retirees have the most to lose from high inflation, since they tend to hold an outsize proportion of their portfolios allocated to fixed income investments. So it’s understandable that they have been asking which assets are the best inflation hedges.

It turns out that there is no one answer to their question. It depends crucially on the time frame over which one measures an asset’s correlation with the Consumer Price Index. When focusing on short-term periods, one asset will emerge as having the highest correlation. When instead focusing on longer periods, in contrast, that asset may turn out to be inversely correlated.

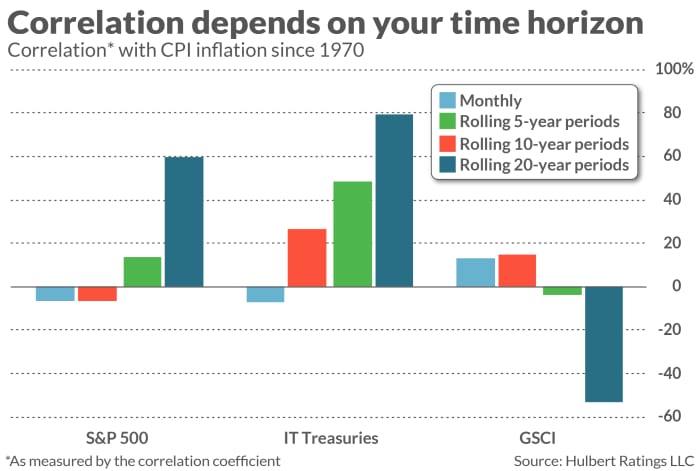

This is illustrated in the accompanying chart, which reports the correlation coefficient between the CPI on the one hand and, on the other, stocks, bonds, and commodities (as measured by the S&P GSCI Index). The coefficients were calculated based on data since the beginning of 1970. For each asset, I varied the periodicity of the data: In addition to correlating monthly returns, I focused on the correlations between all rolling 5-year, 10-year and 20-year periods.

The correlation coefficient would be 100% if the CPI and the asset in question were perfectly correlated, rising and falling in perfect lockstep. The coefficient would be minus 100% if the correlation were perfectly inverse—with one of the two assets rising whenever the other fell, and vice versa. The coefficient would be zero if there was no detectable relationship one way or the other.

Notice that the magnitude and sign of the coefficients vary depending on the time horizon. Take commodities, for example, which are real assets and assumed to be good inflation hedges. Notice that the correlation between monthly changes in the GSCI and CPI is far higher than for either stocks or bonds, as you might expect. But at the 10- and 20-year horizons, the GSCI’s correlation with CPI is lower than for either stocks and bonds—and is actually negative. This means that, while commodities have a decent (though not great) ability to hedge inflation over the short term, their longer-term inflation-hedging abilities leave much to be desired.

Just the opposite pattern exists for stocks. Notice that the correlation with the CPI is negative over the one-month and 5-year horizons. But the correlation is significantly positive at the 10- and 20-year horizons. This means that, while stocks tend to lose money over the short-term when inflation heats up, over the long term they produce higher nominal rates of return when inflation is high.

That’s just what we should want if we are long-term investors.

This distinction between the shorter and longer terms was highlighted recently by a report authored by two members of the Asset Allocation team at Boston-based GMO (James Montier and Philip Pilkington). They describe the distinction as between a hedge, which applies to the shorter-term, and a store of value, which applies to the longer term.

“To us, the term hedge implies a tight correlation with inflation… The concept of store of value is probably more important to a long-term investor. We think of this as an asset that should outperform inflation but isn’t necessarily closely correlated with inflation (especially in the short term). Equities… meet the criteria for a store of value. However, [over shorter horizons]… they don’t correlate well with inflation as a hedge. Hence, they are a store of value but not an inflation hedge. Figuring out which of these two dimensions is important to you is vital when it comes to the choices you will make.”

A word about bonds

I want next to focus on bonds. As you’ll see from the accompanying chart, the correlation coefficients between intermediate-term Treasuries and inflation at the 5-, 10- and 20-year horizons are even higher than for stocks. It’s important to understand why this is and what it means.

It does not mean that bonds outperform stocks over these longer-term horizons, on average. It instead means that bonds’ rolling 5-, 10- and 20-year returns are more closely correlated with the CPI than is the case for stocks, and that makes sense. If you hold a bond long enough, its return will equal its starting yield. And since yields move up and down in fairly close lockstep with inflation, we should expect bonds’ longer-term returns to also be highly correlated with inflation.

Over shorter-term horizons, however, bonds’ correlation with inflation will be negative.

TIPS

GMO’s distinction between an inflation hedge and a long-term store of value is especially helpful for understanding TIPS—the Treasury’s Inflation-Protected Securities. They haven’t existed since 1970, so the relevant statistics don’t appear in the accompanying chart. But their yield is guaranteed to rise and fall in lockstep with inflation.

So that means that the correlation coefficient between TIPS’ total return and CPI will be 100%. But that high coefficient comes with a price: The 10-year TIPS’ current yield is 1% below the CPI, so any investment in TIPS at today’s yields are guaranteed to lag inflation by 1% if you hold to maturity.

The bottom line? Before you embark on a search for an inflation hedge, you need to first determine what exactly you want from your hedge. If you want an asset that has a high correlation with the CPI’s short-term fluctuations, your search will take you in one direction. You will be led in a different direction if you want an asset that beats inflation over the long term.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected].