Tin price hits record highs on low inventories

The most-traded October tin contract on the Shanghai Futures Exchange jumped as much as 4.8% to a record 287,960 yuan ($44,576.54) a tonne.

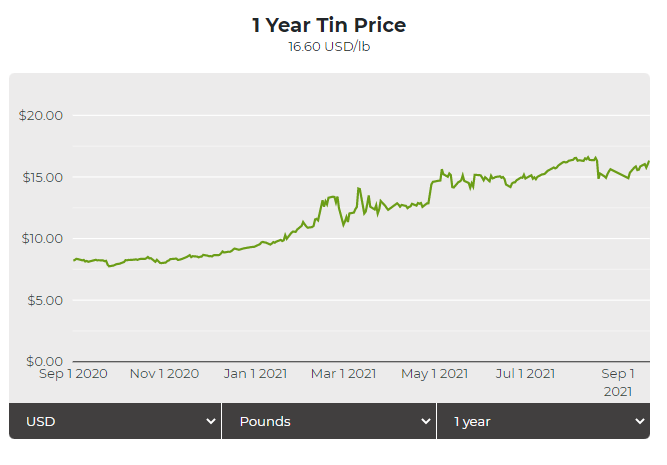

[Click here for an interactive chart of tin prices]

Prices for the metal have been fueled by supply disruptions in major producing countries and booming demand for electronics, where the metal is used for soldering to connect components.

“A combination of supply issues and a pick up in demand means stocks are very low,” said James Willoughby, an analyst at the International Tin Association (ITA).

The global tin market deficit is expected to rise to 12,700 tonnes in 2022 from 10,200 tonnes this year, the ITA said in June.

Malaysian top producer Malaysia Smelting Corporation (MSC) has been hit by a combination of equipment problems and covid-19 controls which culminated in the smelter declaring force majeure in June.

“It’s a good time, especially for producers,” said a tin trader, adding that the production issue at MSC, the world’s third-biggest refined tin maker, was a major factor this year.

“Prices can go up more based on supply and demand, although a rate hike by the US Federal Reserve will likely suppress the rally.”

(With files from Reuters)