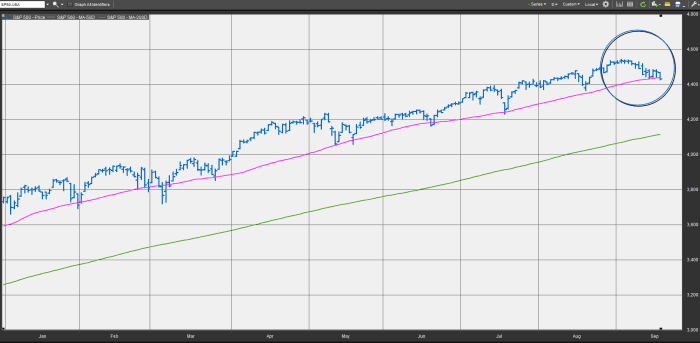

S&P 500 closes below a key bullish trend line for the first time since June, signaling bearish tilt

The broad-market S&P 500 index closed below its short-term trend line for the first time since mid June, signaling that a bearish turn is taking hold of the U.S. stock market ahead of the policy-setting Federal Open Market Committee meeting next week.

The S&P 500 index SPX,

Many technical analysts see the 50-day MA as a guide to the short- to intermediate-term trend, so a close below the line could portend further weakness.

Friday’s decline marked the second in a row for the S&P 500, led by a drop on the session in information technology SP500.45,

The S&P 500 ended the week off 0.6%, while the Dow Jones Industrial Average DJIA,