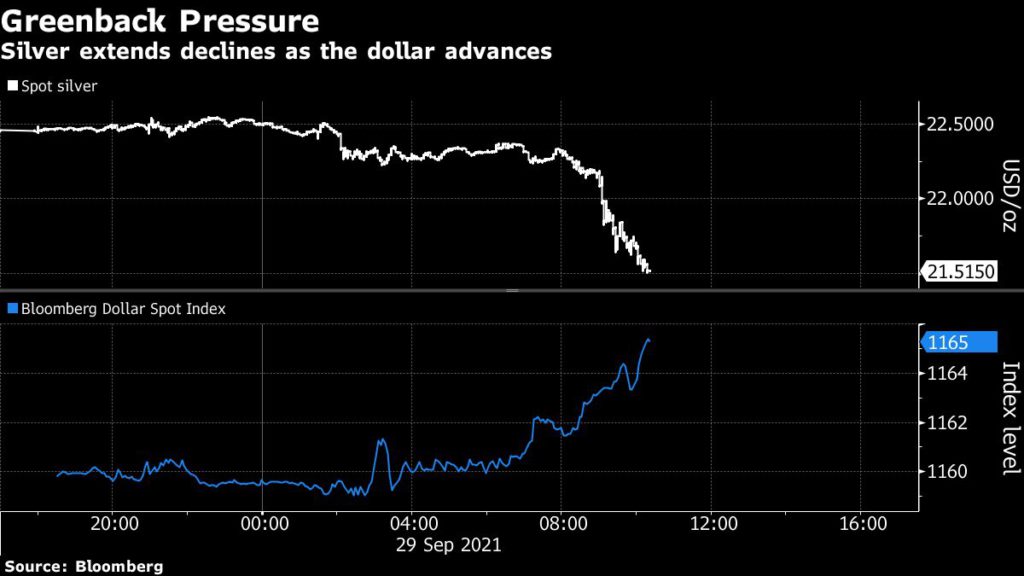

Silver price drops to lowest in a year against stronger dollar

[Click here for an interactive chart of gold prices]

Meanwhile, the US dollar index touched a fresh 10-month high, reducing the appeal of precious metals for foreign currency investors. The greenback has remained strong since the Federal Reserve signaled last week that a reduction in stimulus could happen soon, which also drove up Treasury yields.

“We continue to expect silver to underperform gold on a risk-adjusted basis, as a normalization in industrial demand further weighs on the white metal, while flow effects from tapering QE should also weigh on silver,” TD Securities analysts led by Bart Melek said in a Bloomberg note.

Silver is now headed for its worst month in a year, while gold is on course for its biggest monthly drop since June. Both precious metals are under pressure this year as more central banks start signaling a pullback in stimulus measures used to cushion the economic impact of the pandemic.

Federal Reserve Chair Jerome Powell said last week that the US central bank could begin scaling back asset purchases in November and complete the process by mid-2022. The Bank of England has left the prospect of a 2021 rate hike open, while Norway’s central bank began tightening policy last week.

The current high level of inflation in the US should dissipate when supply-chain issues are resolved, Powell said during a Senate Banking Committee hearing Tuesday, adding that the economy was still far from full employment. The comments reassured investors that rate hikes were still a long way off.

Philadelphia Fed President Patrick Harker said he sees taper starting soon and rate hikes in late 2022 at a virtual event hosted by the Risk Management Association, Philadelphia Chapter.

“Set against rising real rates and a strengthening US dollar, we don’t see inflation as strong enough to outweigh policy developments,” analysts at Morgan Stanley wrote in a note.

“We see lower prices ahead,” averaging $1,621 an ounce next year, they added.

(With files from Bloomberg)