Crypto tumble overshadows bitcoin’s bullish bid for ‘golden cross,’ amid China contagion fear

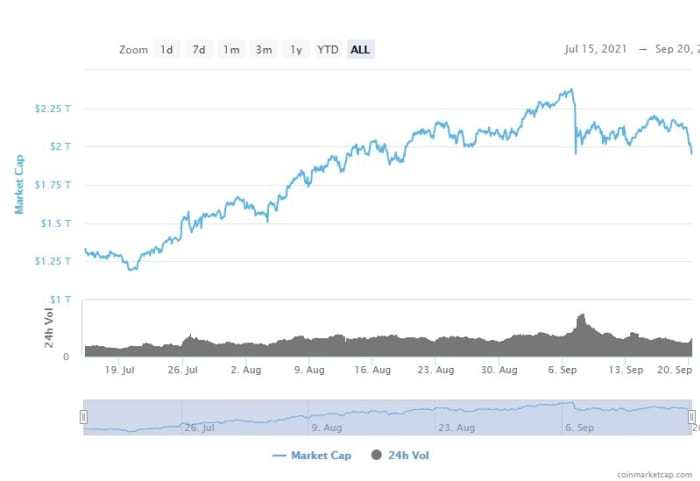

The total crypto complex was down over $200 billion on Monday, and bitcoin was registering solid losses, imperiling a potential bullish formation in the charts for the world’s No. 1 digital asset.

At last check, bitcoin BTCUSD,

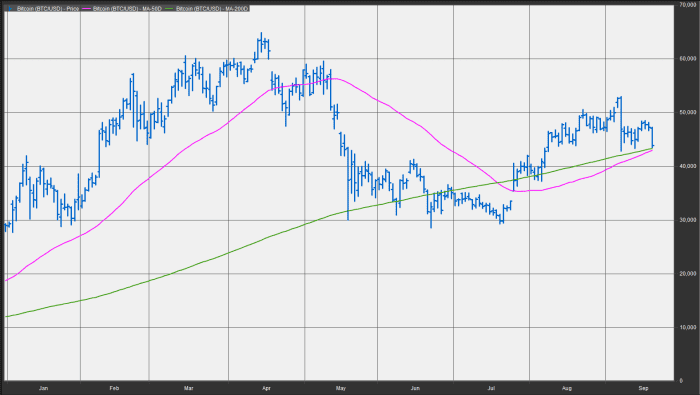

However, the recent pullback in bitcoin, and crypto more broadly, could undercut positive momentum for the digital asset. A death cross in bitcoin, when the 50-day falls below the long-term average, occurred back in late July (see attached chart), bitcoin has been steadily grinding higher, of late.

Crosses aren’t necessarily good market-timing indicators, as they are well telegraphed, but they can help put an asset’s move into perspective.

“Bitcoin and Ethereum have started the week on the back foot and the massive bullish signal that traders were focused on, the golden cross, seems to have lost its luster,” wrote Naeem Aslam, chief market analyst at AvaTrade, in a Monday note.

The slump in crypto had shaved some $214 billion from the crypto market, data from CoinMarketCap.com show. The moves also comes as futures for the Dow Jones Industrial Average DJIA,

“Crypto traders are certainly going to wake up to a rough day and it is likely that Bitcoin price may actually touch the early 40K price level now as the price has failed to keep its upward momentum,” wrote Aslam.

Elsewhere in crypto, Ether ETHUSD,