Costco’s stock set up to fall after earnings, and that’s the time to buy it, analyst says

Shares of Costco Wholesale Corp. are likely to dip after the membership-based warehouse retail giant reports earnings, but that’s when investors should buy, said long-time bullish analyst Rupesh Parikh at Oppenheimer.

Parikh said after he spent time reviewing Costco’s prospects heading into the earnings release, he believes there is “limited earnings upside.” He said he also believes that after the stock’s recent outperformance, the “robust and accelerating [same-store sales] trends” reported in recent months are already priced into the shares.

“As a result, we see the setup on the print as less attractive,” Parikh wrote in a research note.

The stock COST,

Coscto is scheduled to report fiscal fourth-quarter results on Sept. 23, after the closing bell. The FactSet consensus is for earnings per share to rise to $3.57 from $3.51 a year ago, for sales to grow 15.0% to $61.4 billion and for same-store sales to increase 12.4%.

Earlier this month, Costco said sales for the four weeks ended Aug. 29 rose 16.2% from a year ago to $13.56 billion, while total same-store sales grew 14.2%, including 14.7% growth in the U.S.

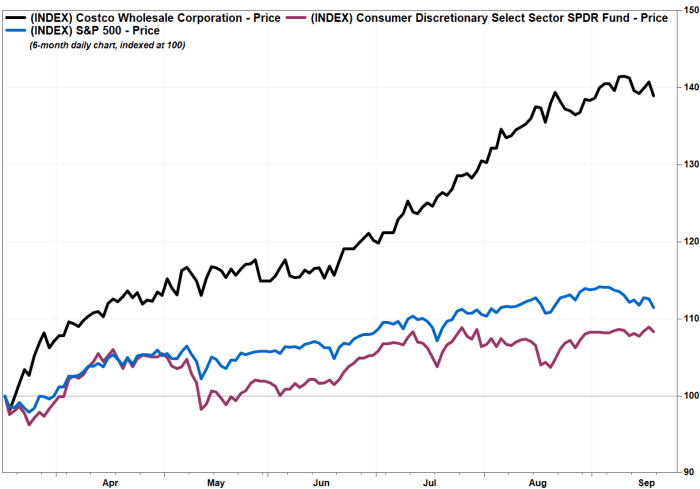

The stock has run up 39.0% over the past six months, while the SPDR Consumer Staples Select Sector exchange-traded fund XLP,

One of the reasons for Parikh’s caution ahead of earnings is that the stock has historically not performed well following the results.

Costco’s stock has lost ground on the day after six of the past seven quarterly reports, and after 11 of the past 14 reports, according to FactSet data. That’s even after Costco beat EPS and same-store sales expectations in 10 of the past 14 quarters and sales expectations in 12 of the past 14 quarters.

But if the stock falls again, Parikh said that’s when investors should jump in.

“We would take advantage of any potential profit taking in what we view as a high-expectation setup following the rally,” Parikh wrote. “As we look forward, we expect sticky market share gains, inflation benefits, prospects for another special dividend and a potential membership fee increase next year to help fuel the next leg higher for shares.”

He reiterated the outperform rating he’s had on the stock for at least the past three years. He kept his price target at $500, which is about 9.2% above current levels.