Copper price up as inflation runs hot

Related Article: Home: Shanghai squeeze revitalises flagging nickel market

The surge in commodities, as well as soaring shipping and power costs, is fueling global consumer prices. China’s factory-gate inflation accelerated to a 13-year high, while US consumer prices are forecast to rise by more than 5% for a third straight month.

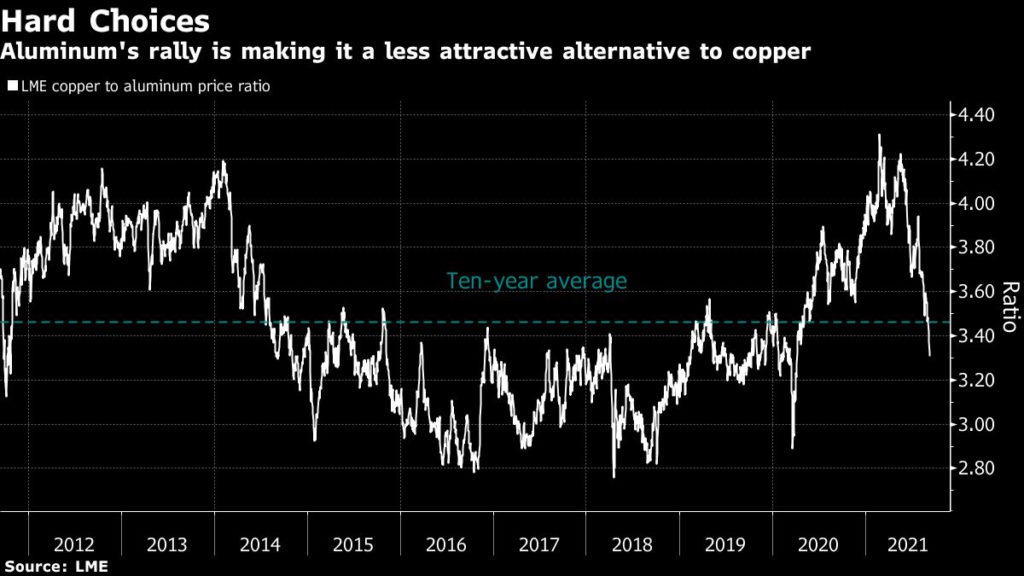

With aluminum prices surging 43% this year, the lightweight metal’s cost-competitiveness against copper is fading fast.

After consecutive losses, copper for delivery in December regained strength and jumped 4.2% from Thursday’s settlement price, touching $4.469 per pound ($9,831 per tonne) on the Comex market in New York.

Click here for an interactive chart of copper prices

Shanghai copper stocks fell 10.7% from the previous week, the bourse said on Friday, sinking to their lowest level in almost 10 years as tight supplies push metal prices higher.

Deliverable copper stocks in warehouses monitored by the Shanghai Futures Exchange now stand at 61,838 tonnes, the lowest since December 2011, Refinitiv Eikon data show.

(With files from Bloomberg and Reuters)