Stocks, Futures Climb on Dip Buying; Dollar Slips: Markets Wrap

(Bloomberg) — Asian stocks rose Monday as traders sought to take advantage of last week’s selloff while keeping a wary eye on risks from the delta virus strain and China’s crackdown on private industries. The dollar fell.

MSCI Inc.’s gauge of Asia-Pacific shares posted one of its biggest daily rallies this month, led by Japan. Chinese technology stocks rebounded from a prolonged selloff, while South Korea climbed as export data signaled resilient global demand. U.S. and European equity futures were in the green after dip buyers spurred an advance in the S&P 500 and Nasdaq 100 on Friday.

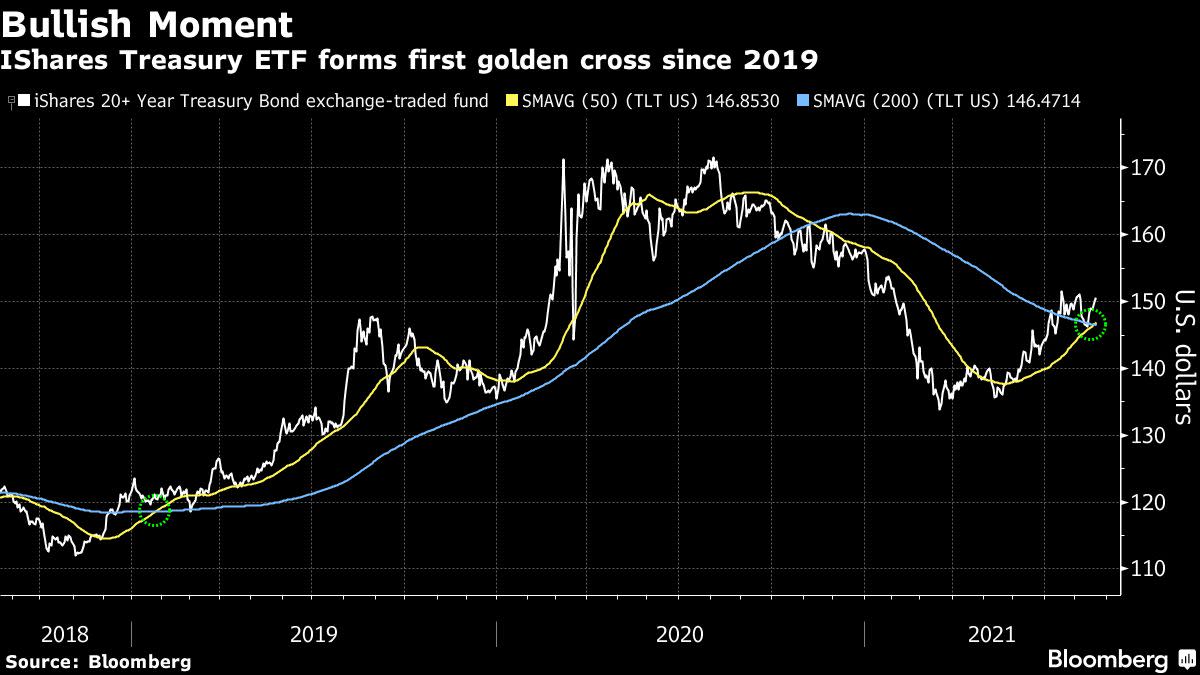

Treasury yields ticked up and the dollar dipped for the first day in six on easing demand for havens. Investors are also looking ahead to the Jackson Hole symposium Thursday, which may offer insights into how the Federal Reserve plans to taper bond purchases.

Some of the recent weakness in commodities abated, with oil pushing past $63 a barrel. Commodity-linked currencies like the Australian dollar strengthened. Bitcoin retook $50,000 for the first time since mid-May.

How long the recent turbulence in stocks will subside remains an open question. China continues to pursue a sweeping regulatory clampdown under President Xi Jinping, whose rhetoric this year signals a commitment to closing the country’s yawning wealth gap. Meanwhile, the delta variant and the prospect of reduced Federal Reserve stimulus have sowed doubts about the global economic recovery.

“Markets react to interest-rate hikes much more than tapering and we expect a pause between tapering and the first hike, suggesting liftoff in 2023 and not before,” Esty Dwek, head of global market strategy at Natixis Investment Managers, wrote in a note. The pandemic is still with us and growth will soften into 2022, she added.

Dallas Fed President Robert Kaplan said he’s open to adjusting his view that the Fed should start tapering its asset-purchase program sooner rather than later if the delta strain persists and hurts economic progress. Treasury Secretary Janet Yellen endorsed Jerome Powell for a second term as Fed chair, a move that could reduce uncertainty about the path for monetary policy.

On the the virus front, China once again squelched local Covid-19 cases down to zero. Australia and New Zealand are reviewing their strategies of eliminating infections. Australian Prime Minister Scott Morrison said it’s highly unlikely his country will ever return to zero cases.

Here are some events to watch this week:

U.S. Markit manufacturing PMI and existing home sales MondayBank of Korea policy decision; briefing by Governor Lee Ju-yeol ThursdayFed officials attend the Jackson Hole Economic Policy Symposium from Thursday through SaturdayU.S. GDP, initial jobless claims ThursdayJuly U.S. personal income and spending data Friday. Investors will scrutinize the personal consumption expenditures price index, an inflation measure closely watched by the Fed.

For more market analysis read our MLIV blog.

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 12:45 p.m. in Tokyo. The S&P 500 rose 0.8% FridayNasdaq 100 futures rose 0.4%. The Nasdaq 100 climbed 1.1%Japan’s Topix index rose 1.8%Australia’s S&P/ASX 200 Index added 0.3%South Korea’s Kospi index gained 1.4%Hong Kong’s Hang Seng Index increased 1.8%China’s Shanghai Composite Index gained 1%Euro Stoxx 50 futures were up 0.6%

Currencies

The Japanese yen was at 109.86 per dollarThe offshore yuan was at 6.4935 per dollarThe Bloomberg Dollar Spot Index dipped 0.2%The euro was at $1.1722

Bonds

The yield on 10-year Treasuries edged up one basis point to 1.27%Australia’s 10-year bond yield rose about two basis points to 1.10%

Commodities

West Texas Intermediate crude was at $63.24 a barrel, up 1.8%Gold was at $1,787.44 an ounce, increasing 0.4%

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.