Here’s what Vanguard found to be the most potent inflation-fighting asset class

Not all inflation hedges are created equally.

Investors certainly have been flocking to Treasury inflation-protected securities, or TIPS, with the yield on the 10-year TIPS near a record low, at negative 1.08% on Monday. But according to research from index fund giant Vanguard, the beta to unexpected inflation is around 1. That is, a 1% rise in unexpected inflation would produce a 1% rise in the value of TIPS.

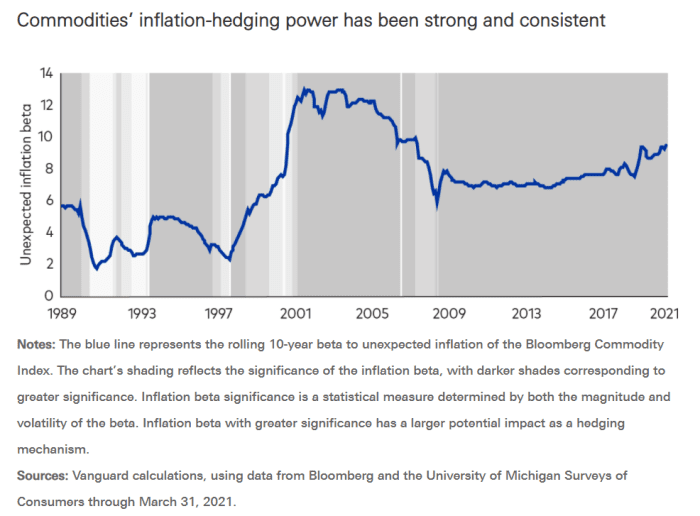

Commodities’ inflation-hedging power, by contrast, is far stronger, and it has been for some time. Over the last decade, commodities’ inflation beta has fluctuated between 7 and 9, meaning that a 1% rise in unexpected inflation would produce a 7% to 9% rise in commodities.

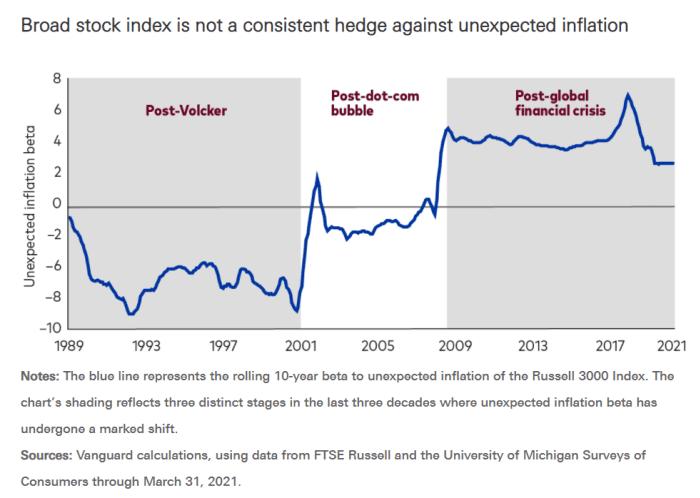

Equities, of late, have been a better inflation-fighting hedge, though still not as good as commodities. The beta of the Russell 3000 to inflation is now positive — unlike in the 1990s — though it has declined in recent years. The Vanguard research notes that commodity-related sectors such as energy and materials now represent a smaller part of the equity market than before, while ineffective inflation hedges technology and consumer discretionary sectors are larger.

And the worst inflation hedge is bonds, as rising interest rates erode their value.

The buzz

U.S. retail sales slumped a faster-than-forecast 1.1% in July. Even excluding autos, retail sales still fell, by 0.4%.

U.S. stock futures ES00,

Home-improvement retailer Home Depot HD,

The U.S. is set to recommend booster COVID-19 shots eight months after vaccination, according to the New York Times. New Zealand went into a three-day national lockdown over a single COVID case.

Quarterly filings made by fund managers showed that Berkshire Hathaway increased its bet on grocery chain Kroger KR,

In a series of tweets, Wood defended her stance.

The chart

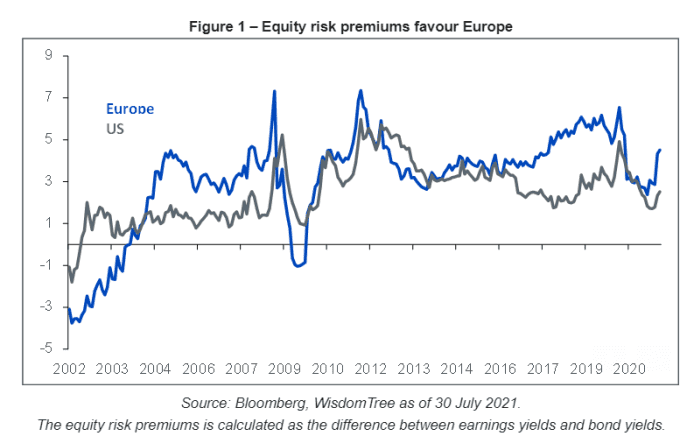

The equity risk premium — the difference between earnings and bond yields — has climbed to a 15-month high in Europe, thanks to strong earnings that have sent the net analyst revision ratio to the highest level since 2017, according to data compiled by fund manager WisdomTree. The Stoxx Europe 600 SXXP,

Random reads

Magnetic strips will be phased out of Mastercard credit cards.

Pi has now been calculated to a staggering 62.8 trillion digits.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.