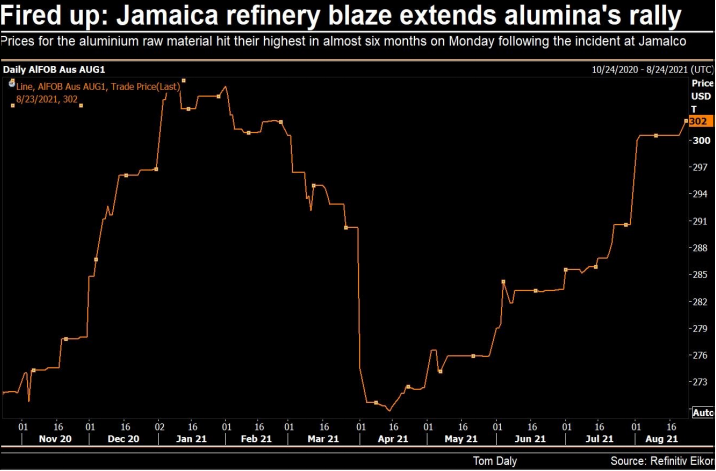

Aluminum price near 3-years high after Jamaica refinery blaze

[Click here for interactive aluminum price chart]

The metal is also rising on bets that China, the biggest producer, will curb supply to cut emissions. There are also signs that the slump in metal prices last week is enticing consumers back to the market.

“That dynamic is obviously unusual and doesn’t make economic sense, but it’s a sign that perhaps the selloff was getting ahead of fundamentals,” Colin Hamilton, managing director for commodities research at BMO, told Bloomberg.

“We do have some initial signs that Chinese buyers have stopped destocking and are coming back to the market.”

Aluminum rose as much as 0.5% to $2,629 a tonne on the LME, near the $2,642 it hit on July 30, the highest level since April 2018.

In Shanghai, the metal rose as much as 1.4% to 20,705 yuan a tonne, the highest since 2008.

A major fire at a Jamaican alumina refinery is also expected to push the premium buyers pay for aluminum shipped to the US Midwest to new highs.

Hong Kong-based Noble Group Holdings, which partners the Jamaican government in the Jamalco refinery, said a “major fire” broke out in the powerhouse that produces power, compressed air and steam for alumina-refining operations on Sunday.

It has since been extinguished, with no serious injuries reported, the company said on Monday, adding that “a full assessment of the damage will be done in the coming days.”

The Jamalco plant can produce up to 1.4 million tonnes per year of alumina, which is refined from bauxite.

Global alumina production in 2020 was 134.4 million tonnes, according to the International Aluminium Institute.

“It is expected that market participants will be focused on the possibility of a disruption to production,” Australian investment management firm Shaw and Partners said in a note to clients on Tuesday.

(With files from Reuters and Bloomberg)