Tesla’s ‘noisy quarter’ gets mixed reviews from Wall Street

Tesla Inc.’s record quarter earned some praise among investors, but the stock fell on Tuesday on a mix of concern for the near-term prospects for the Silicon Valley electric-car maker and less appetite for tech and tech-related names.

Tesla TSLA,

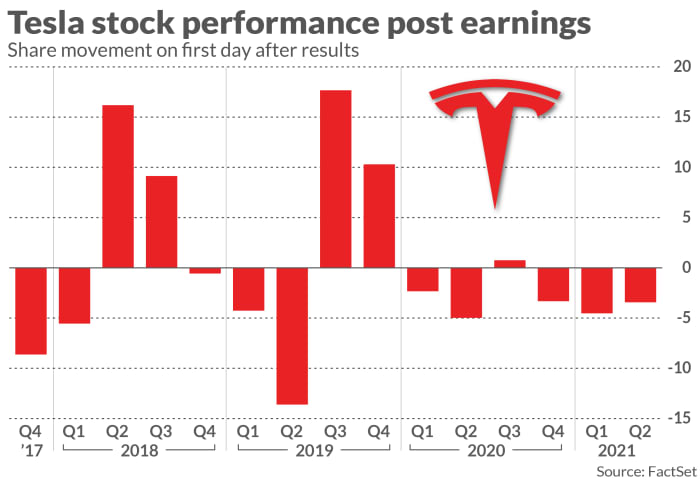

The stock fell more than 3% in midday trading, the third straight time that the shares traded lower on the first trading day after earnings. That further eroded Tesla stock’s performance this year, down 10%. That contrasts with gains of around 17% for the S&P 500 index SPX,

Tesla reported “strong” margins for the April-June period but it was a “noisy quarter,” Jeffrey Osborne with Cowen said in a note Tuesday. Moreover, guidance for 2021 “and comments about next continue to be vague,” he said, keeping his equivalent of a hold rating on Tesla stock.

News that Chief Executive Elon Musk would be unlikely to be at future Tesla earnings calls was “odd,” Osborne said, adding that on the late Monday’s call Musk took only 16 minutes of questions from Wall Street analysts and spent most of the hourlong call answering “softballs from retail and institutional investors.”

See also: Elon Musk says Tesla will open up ‘Supercharger’ stations to other EVs

Emmanuel Rosner at Deutsche Bank, who has a buy rating on Tesla, said that the “particularly strong” results were even more impressive considering that Tesla only saw a small benefit from “large” price increases in the U.S. for some of its vehicles late in the quarter, “pointing additional margin upside in 2H.”

“Mid-term, we continue to believe Tesla’s impressive trajectory for its battery

technology, capacity and especially cost could help accelerate the world’s shift to

electric vehicles and extend Tesla’s EV lead considerably,” Rosner said.

John Murphy with B. of A. Securities struck a more cautious tone. Despite the beat, “competition is fierce and heating up,” he said. “(Tesla’s) operating environment is shifting from that of a vacuum to an increasingly crowded space.”

Related: Aurora to go public in SPAC deal, promises autonomous vehicle by 2023

The quarterly beat was “very much helped by positive pricing dynamics and good execution,” and Murphy raised his price target on the stock to $800 from $750, which represents an upside around 26% from Tuesday’s prices. He kept B. of A.’s neutral rating on the stock.

Joseph Spak at RBC Capital also raised his price target on Tesla shares, to $745 from $718, and kept the equivalent of a hold rating on the stock. Spak also praised the EV maker’s margins, but highlighted worries about its new battery format.