Stocks Retreat, Treasuries Climb on Growth Caution: Markets Wrap

(Bloomberg) — Stocks and U.S. equity futures fell Monday and Treasuries edged up on concerns about the possible economic fallout of Covid-19 outbreaks and elevated inflation. Oil slipped after an OPEC+ supply deal.

MSCI Inc.’s gauge of Asia-Pacific shares hit the lowest in about a week, with Japan and Hong Kong underperforming and technology stocks struggling. European, S&P 500 and Nasdaq 100 futures dropped after the S&P 500 pulled back for the first week in four.

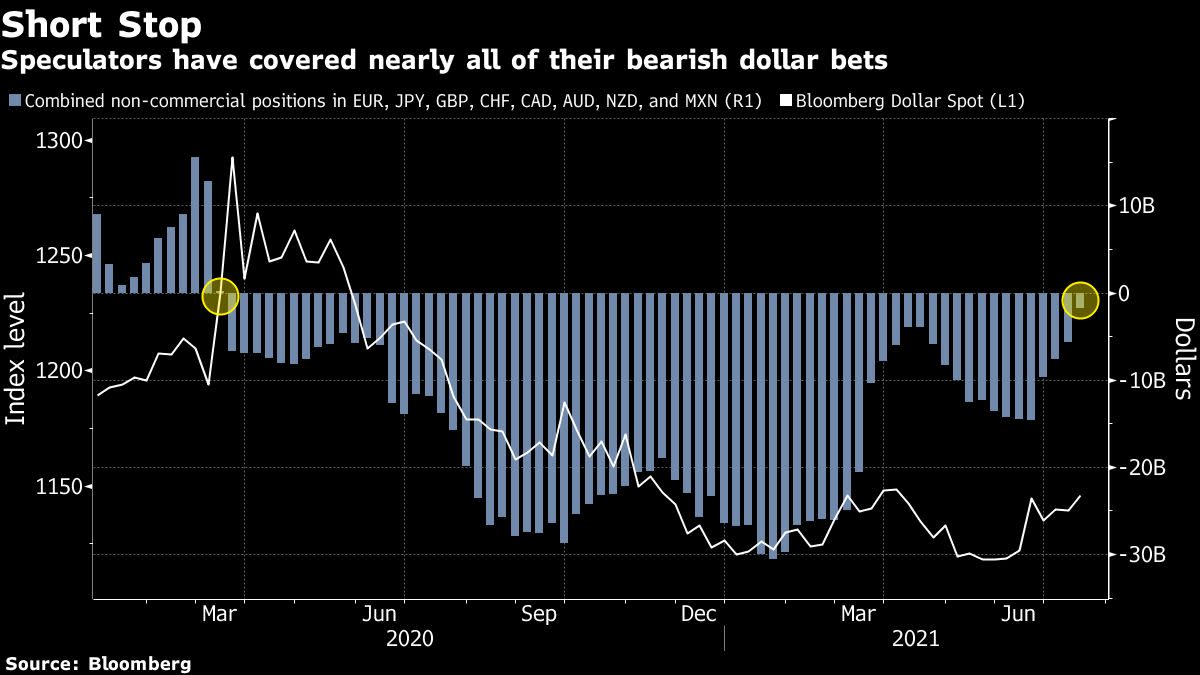

The rally in Treasuries continued, sending 10-year yields further below 1.3%. The yen and the dollar ticked up amid cautious sentiment. Oil slid after an OPEC+ agreement to boost output into 2022 resolved a bitter internal spat.

A global rally in equities has paused as investors consider whether price pressures will sap the economic rebound from the pandemic, in part by leading central banks to pare monetary policy support. Investors are also trying to make sense of the decline in Treasury yields. For some, the trend is a signal of cracks in the global recovery as the delta Covid-19 variant forces some nations to impose virus curbs, while for others the bond rally may have gone too far.

“The Covid backdrop is just one of several factors that may be adversely impacting the reflation trade,” Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, said in a note. Others include the prospect of the Federal Reserve tapering stimulus and hiking sooner than expected, she wrote.

Data at the end of last week showed retail sales remained robust in the U.S. but consumer sentiment unexpectedly declined as mounting concerns over rising prices led to a deterioration in buying conditions for big-ticket items.

Another week of major earnings reports lies ahead. While stock bulls hope they will provide support for equities, companies are evidently also focused on price pressures. The word “inflation” was mentioned on 87% of the earnings conference calls by S&P 500 companies tracked by Bloomberg this month, compared with 33% in the same period a year ago.

Elsewhere, the U.K. is due to lift remaining virus curbs in England. At the same time, Prime Minister Boris Johnson agreed to self isolate after being exposed to Covid-19 and U.K. virus cases increased the most in the world, signaling the challenge nations face to fully reopen their economies. The pound dipped.

For more market commentary, follow the MLIV blog.

Here are some key events to watch this week:

Reserve Bank of Australia meeting minutes TuesdayEuropean Central Bank rate decision ThursdayBank Indonesia rate decision ThursdayU.S. existing home sales ThursdayThe Tokyo Summer Olympics begin Friday

Stocks

S&P 500 futures slipped 0.4% as of 7 a.m. in London. The S&P 500 fell 0.8% FridayNasdaq 100 futures fell 0.2%. The Nasdaq 100 lost 0.8%Japan’s Topix index fell 1.3%Australia’s S&P/ASX 200 index dropped 0.7%South Korea’s Kospi index slid 0.9%Hong Kong’s Hang Seng index lost 2%China’s Shanghai Composite index declined 0.4%Euro Stoxx 50 futures were down 0.7%

Currencies

The Japanese yen edged up 0.1% to 109.95 per dollarThe offshore yuan was at 6.4852 per dollarThe Bloomberg Dollar Spot Index edged up 0.1%The euro was little changed at $1.1803

Bonds

The yield on 10-year Treasuries fell one basis point to 1.28%Australia’s 10-year bond yield fell four basis points to 1.24%

Commodities

West Texas Intermediate crude dipped 1% to $71.08 a barrelGold was at $1,811.33 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.