Stocks to buy and those to avoid as U.S. economy runs faster than the Indy 500

Welcome to the month of June and a week that may wake investors from any early summer slumber, as it ends with a fresh update on U.S. jobs.

Stock futures are climbing after the long weekend, and as investors look past Friday’s data showing the Federal Reserve’s preferred measure of inflation surging to a rate not seen in 13 years.

Take note, the U.S. economy is running faster than an Indy 500 race, BTIG’s chief equity and derivatives strategist Julian Emanuel and equity strategist Michael Chu told clients in a note on Sunday. As evidence they cited second-quarter growth at 9%, “a flood of liquidity sending [an] update of the Fed’s reverse repo to all-time highs,” reopenings everywhere and numerous inflation signals.

“Despite the intensifying price and excess liquidity pressures and the historical evidence that sustained periods of Core PCE [personal consumption expenditures] over 2% have resulted in stock market declines averaging -1.6% per month, the Fed’s ‘Operation Grand Slam’ (the Fed’s balance sheet is approaching $8T) is engineering such inflation, and the Fed is going to get their wish for the next several months,” said the strategists.

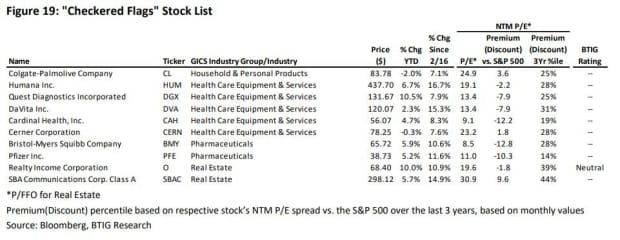

In our call of the day, Emanuel and Chu offered up a “checkered flag” shortlist of stocks that can do well in this climate, and for these reasons: low price/earnings relative to their own 3-year history vs. SPX SPX,

On that buy list are consumer-products group Colgate-Palmolive CL,

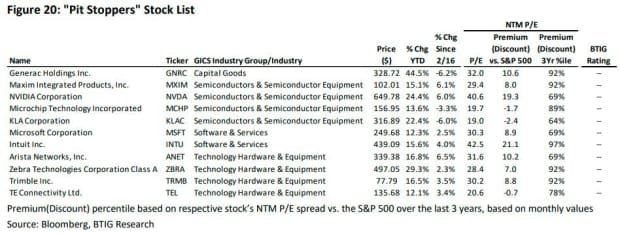

As for the buyer beware or “pit stoppers,” list, BTIG strategists note these prospective underperformers that have the following factors in common: high price/earnings relative to the S&P 500 (top 50% of their own history over the last 3 years), lagged behind since the inflation inflection, yet have outperformed year to date:

Those names are manufacturer Generac Holdings GNRC,

Emanuel and Chu see increased likelihood that markets — via lower stocks and higher bond yields — will force the Fed to address the “potential for inflation expectations to become unanchored,” amid inflation forecasts that have been undershooting. If the S&P 500 pushes into the 4,250 arena, they suggested using it as an opportunity to cut exposure to prospective underperformers or set some index option hedges.

Waiting for OPEC+ and data

U.S. stock futures YM00,

Oil CL00,

Data on tap include the final Markit manufacturing purchasing managers index and the Institute for Supply Management’s manufacturing index, both for May, and construction spending for April.

Shares of movie-operator AMC Entertainment AMC,

Chinese electric-car maker NIO NIO,

The chart

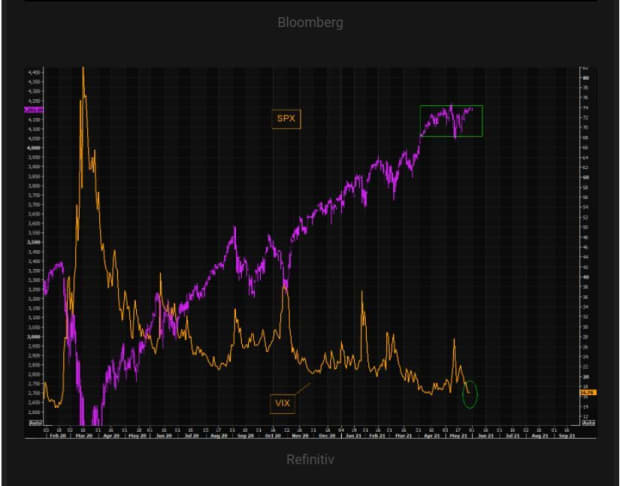

Our chart of the day comes from the blogger behind The Market Ear, who highlights potential troubles from Asian COVID-19 outbreaks, including lockdowns in Malaysia, travel halted in China’s massive Guangzhou region, and struggles in Taiwan and Thailand to name a few. Of course, slow vaccine rollouts are an issue in some spots.

“The question is whether or not the current surge in Asian corona cases will spill over to new supply chain disruptions, which in turn risk feeding over to another pick up in global inflation,” said the blogger, who cautions markets aren’t pricing in the latter.

How to protect from a potential upset? The Cboe Volatility Index VIX,

Random read

A cool $1 million could get you handwritten notes by Isaac Newton, one of history’s greatest minds.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.