S&P 500 jumps for a second day, Nasdaq hits all-time high amid bitcoin’s comeback

The S&P 500 ended the day just short of a new closing record, while the tech-heavy Nasdaq Composite climbed to an all-time high as bitcoin staged an intraday comeback.

The blue-chip Dow Jones Industrial Average gained 68 points after posting its best day since March on Monday. The S&P 500 climbed about 0.5%m while Nasdaq erased earlier losses and climbed 0.8% to hit a fresh intraday record.

Bitcoin is in the middle of a wild session where it briefly broke below $30,000 and then turned green on the day. At one point Tuesday, the world’s largest crypto currency wiped out 2021 gains. Tesla, a bitcoin holder, reversed 1% higher as the digital token bounced off its low.

Major technology shares led the market rally Tuesday as Netflix climbed 3%, while Amazon, Facebook, Apple and Microsoft all gained at least 1%. Alphabet shares turned higher even after the European Commission opened a probe into Google’s advertising unit.

On Monday, the blue-chip Dow gained 580 points for its best day since March 5 as shares tied to the economic recovery snapped back from last week’s sell-off induced by the Federal Reserve’s updated projections on inflation and interest rate hikes.

“This is a precarious time — stocks have gone a relatively long period without any major sell-off, and there is heightened sensitivity to every utterance from the Fed as it attempts to transition to the start of normalization,” Invesco Chief Global Market Strategist Kristina Hooper said in a note.

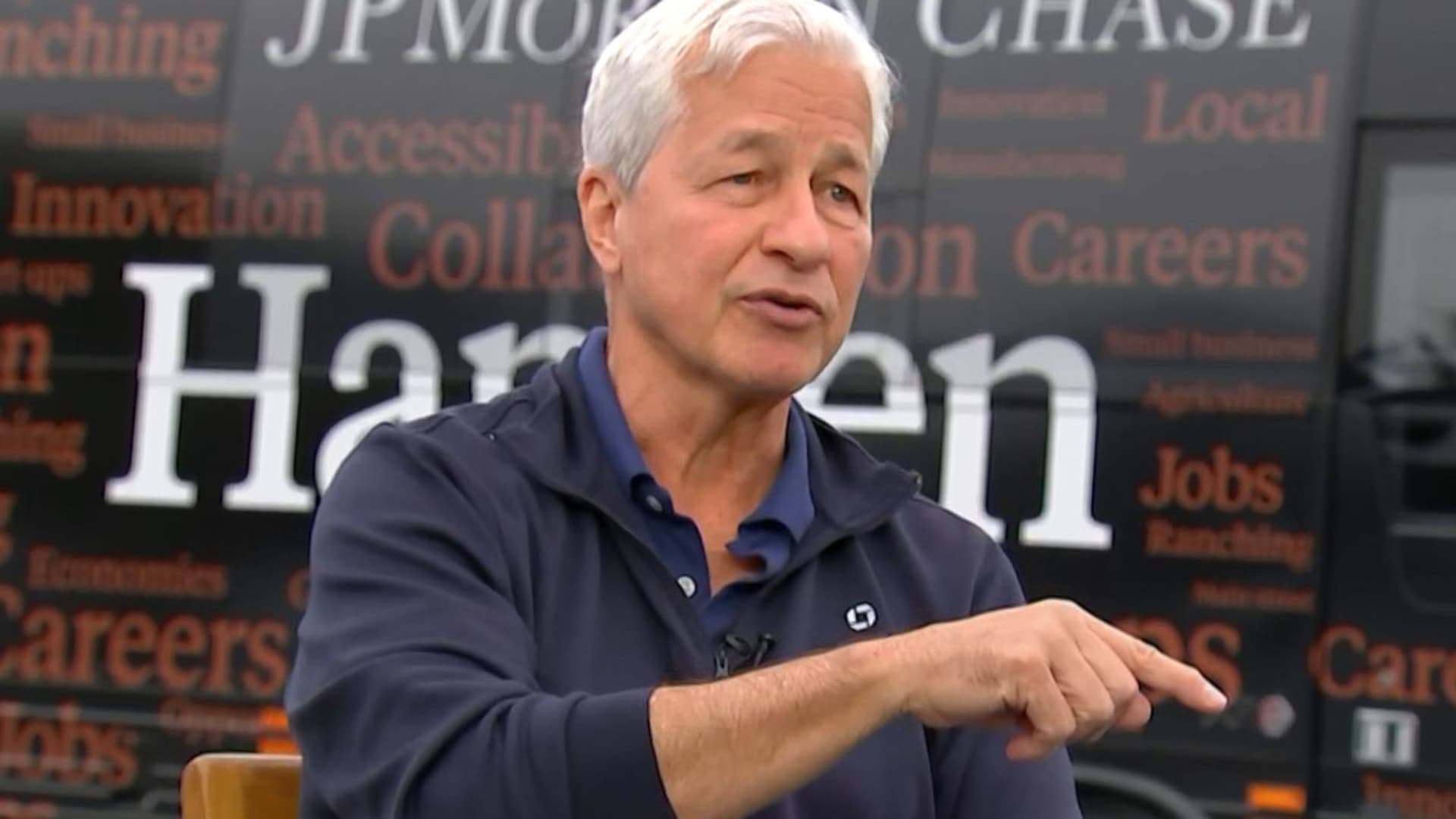

Fed Chairman Jerome Powell is testifying before the House of Representatives Tuesday on the central bank’s response to the pandemic. His remarks, which were released ahead of the hearing Monday evening, supported the notion that the Fed is ready to soon start discussing removing some of its unprecedented stimulus measures enacted during the pandemic.

Indexes hit their highs of the session as Powell answered questions from House members. There was no headline from Powell that looked to be clearly responsible for the gains, but the Fed chief was bullish on the economic comeback and maintained that inflation forces were transitory. There also could have been some relief buying from traders worried that Powell would be a bit more hawkish on rate increases than the central bank was last week.

“Since we last met, the economy has shown sustained improvement,” Powell said Tuesday, according to the Fed release. “Widespread vaccinations have joined unprecedented monetary and fiscal policy actions in providing strong support to the recovery. Indicators of economic activity and employment have continued to strengthen, and real GDP this year appears to be on track to post its fastest rate of increase in decades.”

“Inflation has increased notably in recent months,” Powell said. But the Fed chief will note that most of those are a temporary effect and that inflation should settle back to 2% over the long term.