Reopening Stocks Fuel $6 Trillion Boom in a Post-Pandemic Market

(Bloomberg) — A $6 trillion boom in U.S. equities to open 2021 is leaving the pandemic’s winners in the dust as investors shift their focus to companies taking advantage of a reopening economy.

Americans’ renewed interest in shopping and travel — not to mention meme stocks — helped send the S&P 500 Index to a 14% gain through Friday. Losing out were the stay-at-home stalwarts of 2020, such as Peloton Interactive Inc. and Clorox Co., with Covid-19 vaccines banishing fears of infection. The tech-heavy Nasdaq 100 Index eked out a 11% gain so far this year, a far cry from its threefold outperformance of the S&P 500 in 2020.

History, of course, is not a perfect a guide to what’s next in the market. Joseph Saluzzi, partner and co-head of equity trading at Themis Trading LLC, is expecting a technology rebound as investors peer beyond the pandemic recovery.

“The market is looking for the next move,” he said in an interview. “I think it’ll look at sectors that it overlooked for a while.”

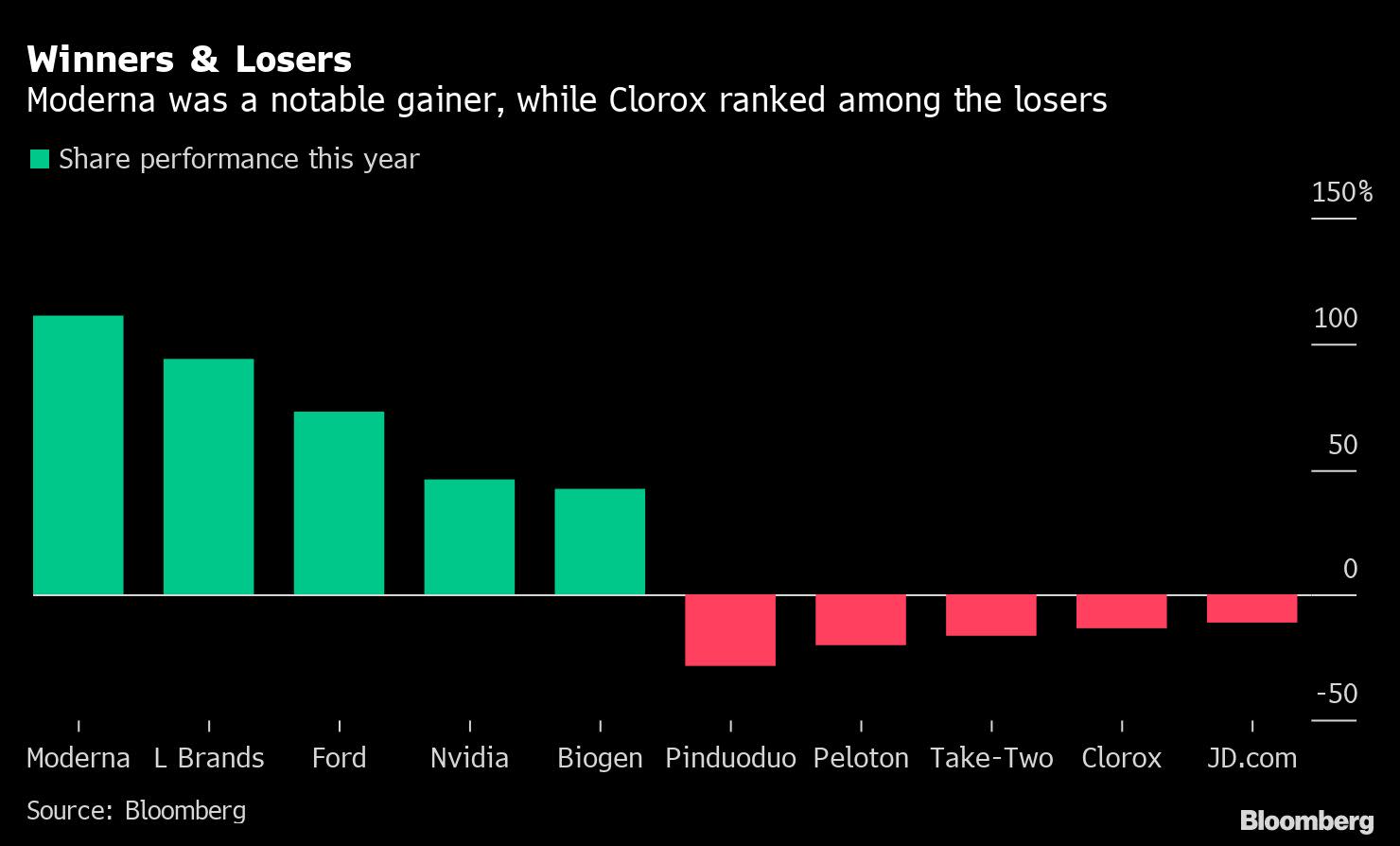

Here are some of the standout winning and losing trades from the first six months of 2021.

Winners

Despite the Nasdaq 100’s underperformance, Moderna Inc. was a standout as the only stock in the index that’s more than doubled this year, fueled by the success of its Covid-19 vaccine. Biotech Biogen Inc. also ranks among the top Nasdaq 100 gainers, surging 38% in a single session in June after its Alzheimer’s disease therapy was approved by U.S. regulators.The rotation into value stocks was a key theme in the first half amid expectations for higher inflation and faster economic growth as pandemic restrictions eased. The energy sector, which benefited from rising oil prices as demand returns, has been leading the S&P 500 this year with a 46% advance. Financials are the second-best performers over the first six months with a 25% gain.However, this shift to value may not last as growth-oriented stocks have gained traction after the Federal Reserve signaled it’s preparing to slow stimulus.L Brands Inc. is the third strongest performer in the S&P 500 this year, behind only energy stocks Marathon Oil Corp. and Diamondback Energy Inc. The Victoria’s Secret owner rallied on a shopping surge spurred by stimulus checks and the relaxing of Covid-19 restrictions, as well as a clear timetable for separating the lingerie company from Bath & Body Works. The shares are up nearly 700% from a March 2020 low.Ford Motor Co. also ranks among the best-performing stocks in the S&P 500 for the first six months of the year with a 73% advance. Last month, the shares rallied to the highest since 2015 after the automaker revealed plans to boost its spending on electric vehicles to $30 billion.Semiconductor stocks dominated the top 10 first-half performers in the Nasdaq 100 amid an industry supply crunch. Nvidia Corp. climbed 46% fueled in part by growing anticipation regarding regulatory approval for its proposed acquisition of Arm Ltd. Top performers also include Applied Materials Inc., ASML Holding NV and Lam Research Corp.It’d be remiss to discuss the most notable trades of the first half without giving a nod to the so-called meme stocks. AMC Entertainment Holdings Inc., Cassava Sciences Inc. and GameStop Corp. — three companies often touted by retail traders on Reddit’s WallStreetBets forum — were the Russell 2000’s strongest stocks in the first six months of the year.

Losers

The rout in shares of stay-at-home beneficiaries stood out in the first half. Peloton, which became synonymous with the lockdown era, tumbled from near the top of the Nasdaq 100 in 2020 to become one of its worst performers so far in 2021. Likewise, Take-Two Interactive Software Inc. sank 16% in the first six months of the year and is hovering near the bottom of the S&P 500 after video-game stocks rallied in 2020. And Netflix Inc. lost 2.5% in the first half after rising 67% in 2020 amid a boom in at-home entertainment.Another pandemic winner, Clorox, has had a bumpy start to the year as the demand for disinfecting wipes diminishes, dropping 13% in the first six months of 2021 amid growing concerns about its ability to maintain robust growth.The retreat in American depository receipts of Chinese technology companies also was hard to miss, as the sector faces increasing scrutiny from China’s government. Pinduoduo Inc. has been the worst performer in the Nasdaq 100 so far this year. The e-commerce company is facing increasing pressure to defend its market share, and it was among the more than 30 internet firms Chinese regulators ordered to rectify anti-competitive business practices.In addition, Chinese technology stocks JD.com Inc. and Baidu Inc. are among the worst performers in the Nasdaq 100 over the first six months of the year.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.