Nasdaq rises to an all-time closing high, S&P 500 ekes out another record

The Nasdaq Composite jumped to a record high on Monday as investors rotated back into growth-oriented stocks ahead of a key Federal Reserve meeting.

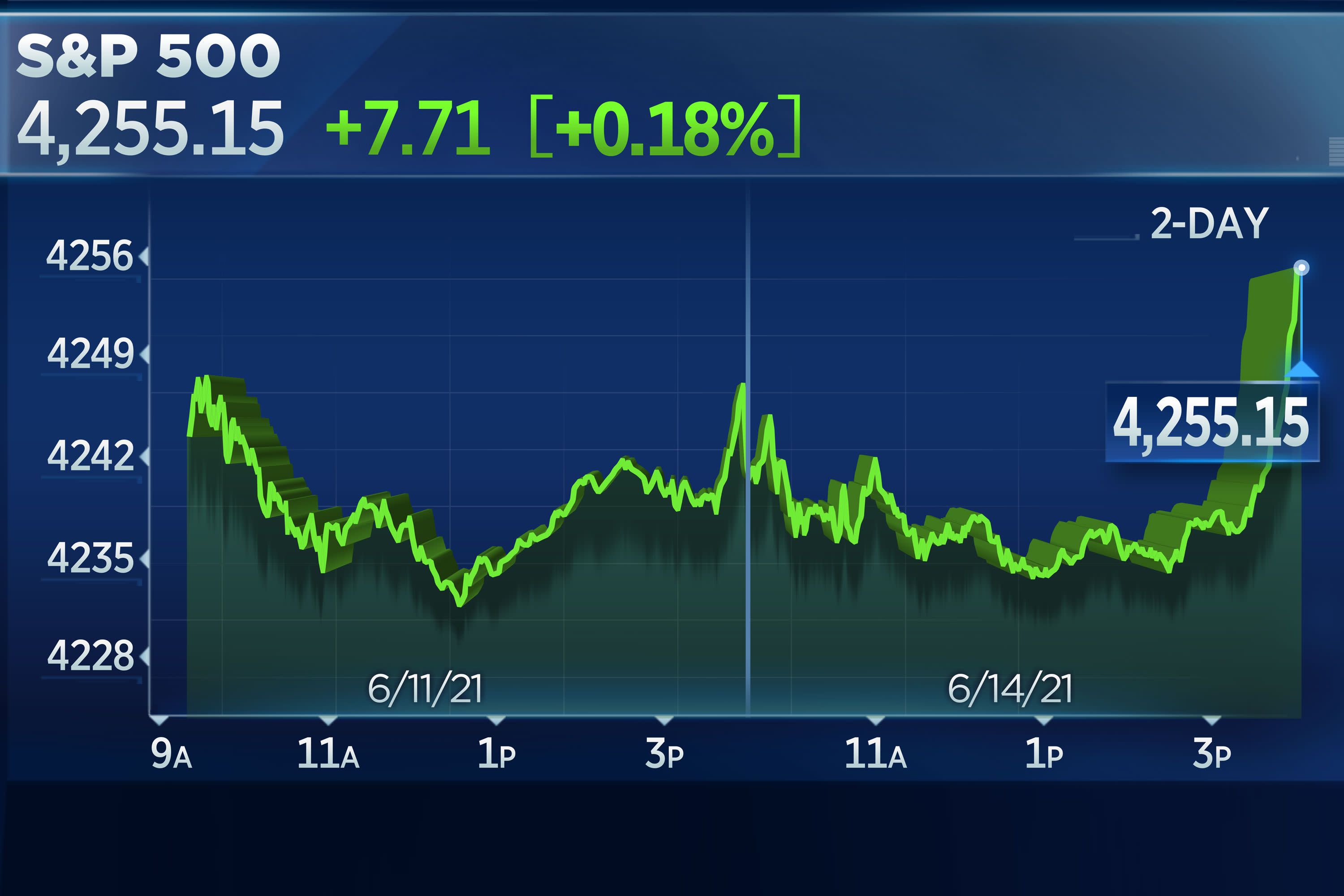

The tech-heavy benchmark rose 0.7% to an all-time closing high of 14,174.14, overtaking the previous record on April 26. The S&P 500 gained about 0.2% to another record close 4,255.15, boosted by the technology sector. The Dow Jones Industrial Average slipped 85.85 points, or nearly 0.3%, to 34,393,75.

Investors are giving growth and tech stocks another chance as bond yields come down. The 10-year Treasury fell below 1.43% on Friday, a three-month low. Cathie Wood’s Ark Innovation, an ETF that focuses on disruptive technology, returned about 6% last week. The fund rose 1.9% Monday even as the benchmark Treasury yield rose briefly back to 1.5%. Apple and Netflix both jumped more than 2%, while Amazon, Microsoft and Facebook also registered gains.

Boosting cryptocurrency sentiment, Tesla CEO Elon Musk on Sunday said the company will resume bitcoin transactions once it confirms there is reasonable clean energy usage by miners. Bitcoin recovered back above $40,000 Monday. Tesla, a big holder of bitcoin, climbed nearly 1.3%.

“The broad market’s modest performance is pretty much in line with historical patterns— specifically, June’s tendency for generally quiet trading,” said Chris Larkin, managing director of trading at E-Trade Financial. “As the market continues to sort through potential moves made by the Fed and looming inflation, we could continue to see this narrative play out in the short-term.”

The Fed’s two-day policy meeting will likely dominate investor behavior this week. Although the central bank is not expected to take any action, its forecasts for interest rates, inflation and the economy could move the markets. The Fed could possibly move up its forecast for a rate hike after saying in its last quarterly update that it would keep its benchmark rate near zero through 2023, the Wall Street Journal reported on Monday.

Fed Chairman Jerome Powell will speak to the press after the central bank issues its statement Wednesday. Traders will be parsing his comments for any clues as to when the Fed could start to end its aggressive monthly asset purchases, especially given recent hotter-than-expected inflation readings.

Billionaire hedge fund manager Paul Tudor Jones said this week’s Fed meeting could be the most important in Powell’s career, and he warned that the chairman could spark a big sell-off in risk assets if he doesn’t do a good job of signaling a taper.

“If they course correct, if they say, ‘We’ve got incoming data, we’ve accomplished our mission or we’re on the way very rapidly to accomplishing our mission on employment,’ then you’re going to get a taper tantrum,” Tudor Jones said. “You’re going to get a sell-off in fixed income. You’re going to get a correction in stocks.”

U.S. stocks ended last week with a record closing high for the S&P 500 and the beginning of a rotation back into growth names.

Last week, the 30-stock Dow Jones Industrial Average fell 0.8%, but the S&P 500 rose 0.4%, for its third straight positive week. The Nasdaq Composite was the outperformer with a gain of nearly 1.9%, posting its fourth winning week in a row as the tech trade came back into favor.

Enjoyed this article?

For exclusive stock picks, investment ideas and CNBC global livestream

Sign up for CNBC Pro

Start your free trial now

— with reporting from CNBC’s Patti Domm.