The company intends to capture value in a rapidly expanding market.

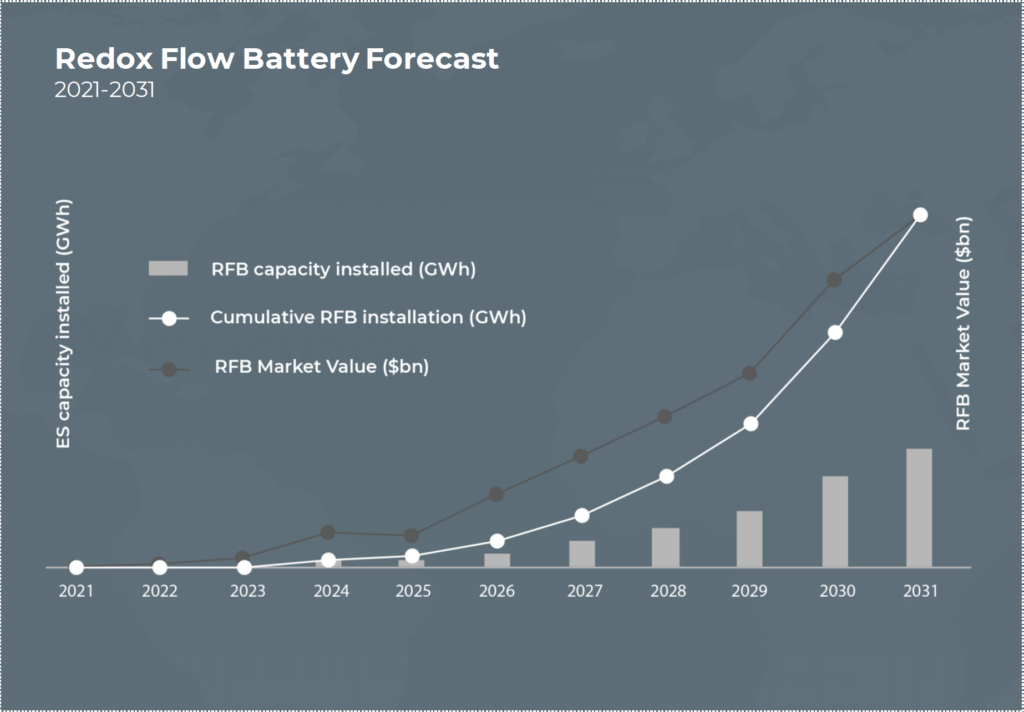

WoodMac expects the global market to grow 27-fold by 2030.

A recent Wood Mackenzie report found global energy storage deployment surged 62% in 2020, with five gigawatt, or nine-gigawatt hours, of new capacity added. This brought the total energy storage market to more than 27 GWh. WoodMac expects the global market to grow 27-fold by 2030.

“The long-duration energy storage battery market has reached an inflexion point with the advent of the new green economy,” said Largo CEO Paulo Misk during the battery day event. The firm’s vanadium batteries were lower cost and lasted longer than rival solutions, such as lithium-ion battery energy storage.

“Largo brings the missing piece to the puzzle, which is to provide stable, low-cost VRFB technology to market,” said Misk.

The vanadium for the batteries comes from Largo’s 17,690-hectare Maracás Menchen mine in the east-central state of Bahia, in Brazil. Misk expects the company’s vertically integrated approach to result in a 30 to 40% reduced cost of deploying VRFBs than traditional vendors.

While vanadium battery technology is not new, it is widely viewed as an up-and-coming industrial solution for renewable energy providers looking to scale up. The technology essentially works by shuttling vanadium electrons between their different valence states.

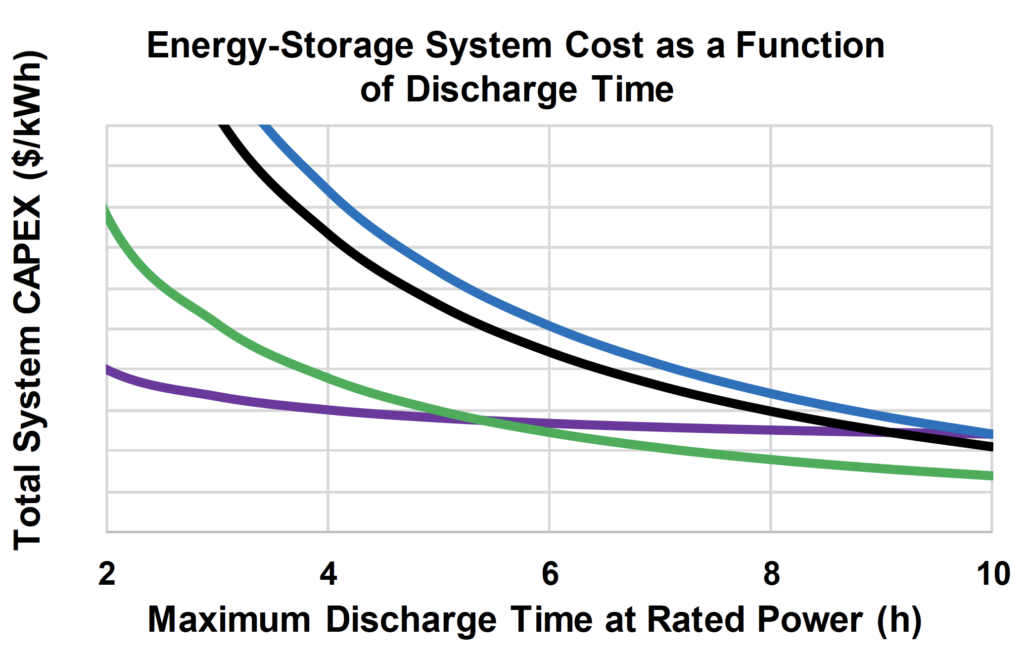

It is considered as a superior solution for applications with long-duration discharge requirements of six hours or more. “That is where VRFBs really come into their own,” said Misk.

Revenue streams

Largo Clean Energy expects to harvest three revenue streams from the VRFB business, capturing potential margins of 110% over the conventional vanadium mining and marketing model.

Largo expects to capture margins of 110% over the conventional vanadium mining model.

The first revenue is taken during the initial capital outlay to install a VRFB facility. The second is a recurring revenue stream from the lease of vanadium electrolyte for use in the facility over the 25-year-plus life; the third comes from the net present value inherent in the vanadium the company recovers from the facility upon shutdown.

Largo Clean Energy is commercialising VRFB technology previously owned by VionX Energy, a firm involved in the renewable energy storage market since 2002.

“The patented VRFB technology and proprietary vanadium electrolyte processing system can deliver cost-competitive performance over its life cycle with nominal degradation. In general, the VRFB is intrinsically safe with no fire risk from thermal runaway,” said Misk.

Additionally, the contained vanadium electrolyte can be recycled for reuse in other VRFB installations at the end of the battery life.

“Over time we expect to build a portfolio of electrolyte rental assets which will potentially attract very high yields,” said Misk.