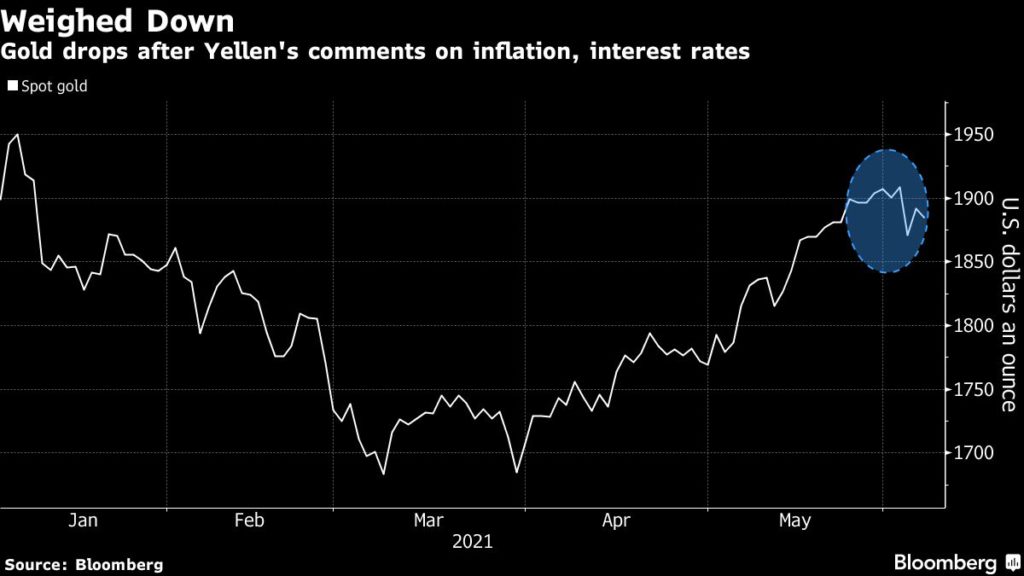

Gold price stays flat as Yellen’s comments drove up US yields

[Click here for an interactive chart of gold prices]

Bullion opened in the red after Yellen said on Sunday that President Joe Biden should push forward with his $4 trillion spending plans even if they trigger inflation that persists into next year, adding that a “slightly higher” interest rate environment would be a “plus.” That helped boost treasury rates, making non-interest bearing gold seem less attractive.

Gold has been hovering around $1,900 an ounce amid a debate around price pressures and speculation over whether the Federal Reserve will start talks on the idea of tapering its massive bond-buying program. On Friday, gold jumped as a Labor Department report showed job gains in May fell short of economists’ estimates, diminishing expectations for early monetary tightening.

Traders will look to Thursday’s US consumer price index report for more clues on whether the central bank will be forced to curb inflation. Bullion is considered a hedge against inflation, which could follow stimulus measures.

“While gold is pretty bullish, US Treasury Secretary Janet Yellen’s comments are keeping a lid on prices,” Bob Haberkorn, senior market strategist at RJO Futures, told Reuters.

“The big thing people are waiting for is the Fed’s plan is on easing and also on (interest) rates and if the Fed remains quiet over the next week or two … you could see a move north of $1,900, while a failure to break above $1,900 could push it down, dependent on the Fed’s stance,” Haberkorn added.

Buoying gold, the dollar index inched down, potentially boosting appeal for those holding other currencies.

(With files from Bloomberg and Reuters)