ESG to assume center stage in lithium extraction – report

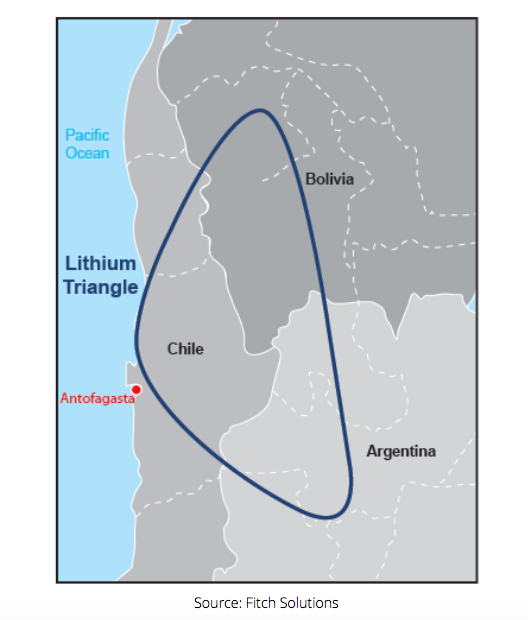

Lithium extraction from salt brines will come under increasing scrutiny in the coming years, Fitch says, as more than 50% of global lithium reserves are held within the Lithium Triangle,’ covering parts of Argentina, Chile and Bolivia.

Historically, extraction within the salt flats of the lithium triangle has been substantially water-intensive, requiring approximately 2m litres of water per tonne of lithium extracted. This presents a strong risk of water shortages for future agricultural needs in a region that already has a reputation as one of the driest places on the globe. A rural municipality around the salt flats of Argentina, Pastos Chicos, has to have potable water driven into the community.

The threat of pollution of local water supplies will result in a persisting risk for social unrest and rising risk of opposition to lithium operations and new projects, Fitch says. Large evaporation pools, which generally sit for over a year, have the potential to leak toxic chemicals and contaminate bodies of water.

In Tibet, for example, a chemical leak from the Ganzizhou Rongda lithium mine in 2016 damaged the ecosystem within the Liqi River and resulted in the mass death of fish. The local community in turn protested lithium mining.

The consideration of local communities to become a non-negotiable in lithium developments as ESG requirements for financing tighten

Within the lithium triangle, Indigenous communities have spoken out against lithium extraction. In October 2019, indigenous Chileans from the Atacama salt flats blocked access to local lithium operations, supporting protests against social inequality, and also protesting the environmental impacts of lithium mining within their community.

Fitch expects the consideration of local communities to become a non-negotiable in lithium developments in the medium- to-long term, as ESG requirements for financing tighten. This could present challenges to countries looking to expand lithium output over the analyst’s forecast period amid the growth in the sector. For example, the Fernández administration in Argentina aims to raise annual lithium carbonate output from 40kt at present to over 230kt by the end of 2022.

Government pressure and a rise in environmental, social and corporate governance (ESG) investing will motivate firms to alter existing techniques, Fitch asserts. As a part of the European Green Deal, the European Commission proposed in December 2020 that beginning July 2024, only rechargeable electric vehicles (EVs) and industrial batteries with declared carbon footprints will be permitted into the EU.

ESG investing is fast becoming mainstream, and in November 2020, the Partnership for Carbon Accounting Financials rolled out the Global Green House Gas Accounting and Reporting Standard for the Financial Industry, bringing emissions associated with banks and investors lending and investment activities to the forefront of public attention.

New players advance extraction techniques that hold the potential to upend lithium supply, Fitch points out. Lake Resources and Standard Lithium, for example, have developed direct lithium extraction (DLE) techniques that claim to reduce the environmental impact compared with traditional evaporation methods.

Fitch forecasts DLE technology to dominate the future lithium mining sector within geothermal brines in Europe and the UK, as well as within the salt flats of South America.

(Read the full report here).