Buy these stocks as S&P 500 heads for 11% correction and bitcoin risks fall to $12,000, say strategists.

Stocks are set for a mixed day ahead while crypto is surging, as even the slow days of summer trading continue to keep the black clouds away from financial markets.

It may not last for long.

Our call of the day, from strategists Barry B. Bannister and Thomas R. Carroll at the equity trading desk of investment bank Stifel, is that the S&P 500 is heading for an 11% pullback while bitcoin could fall to $12,000.

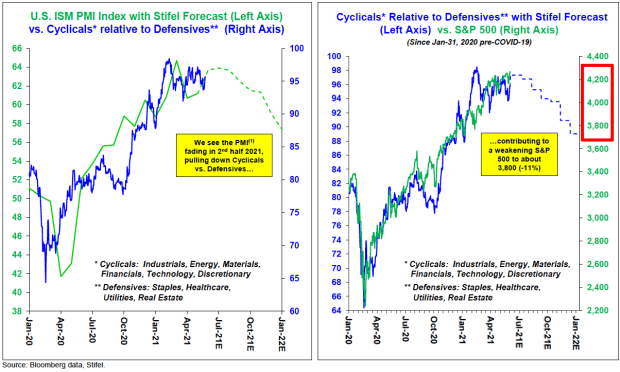

The “recovery trade” that has defined the recent bull market is headed for a further correction in the second half of 2021, the strategists said. Cyclical stocks—industrials, energy, materials, financials, tech, and discretionary—will fall relative to defensive stocks like staples, healthcare, utilities, and real estate, Bannister and Carroll said.

This will weigh down the S&P 500 SPX,

The likely catalysts for this major shift, according to the team at the investment bank, are the U.S. PMI Manufacturing Index fading faster than expected in the second half of the year, and the dollar strengthening.

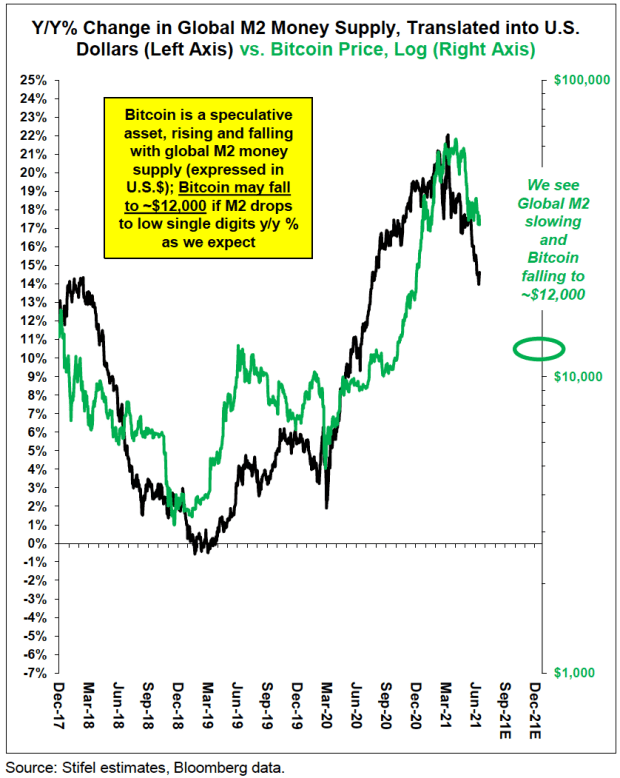

Bannister and Carroll said the primary causes are a slowing global money supply in U.S. dollar terms—as central banks ease pandemic-era supports—as well as distortions from quantitative easing, and the lagged effect of China’s policy tightening.

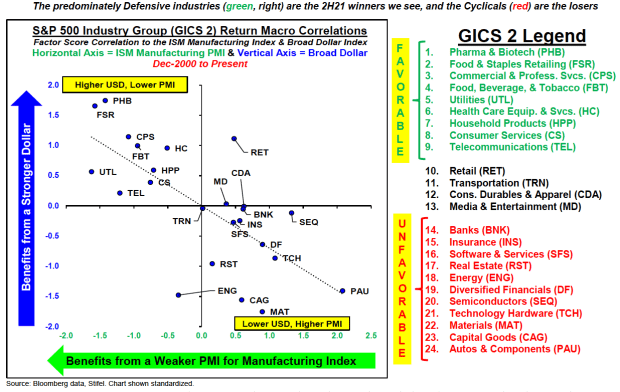

A sea change of this magnitude will create distinctive winners and losers, the strategists said. Investors can prepare by buying shares in companies focused on defensive industries: pharma and biotech; food and staples retailing; commercial and professional services; food, beverage, and tobacco; utilities; healthcare equipment and services; household products; consumer services; and telecommunications.

But avoid the stocks set to be losers, identified by the team at Stifel as: banks; insurance; software and services; real estate; energy; diversified financials; semiconductors; technology hardware; materials; capital goods; and autos and components.

Other casualties that Bannister and Carroll expect to see are bitcoin BTCUSD,

The buzz

Tesla TSLA,

It’s a light day on the U.S. economic front. Investors can expect more questions about inflation when the New York Federal Reserve President John Williams speaks at 9:00 a.m. Eastern, before the Dallas Fed publishes Texas’ manufacturing outlook survey.

More than 150 people remain missing at the site of the condo building that collapsed in Miami, Florida, early last Thursday, with nine people confirmed dead. No one has been pulled alive from the rubble since hours after the collapse on Thursday.

Over the weekend, the U.K.’s lead financial regulator banned Binance, one of the world’s most popular crypto exchange networks, in the latest regulatory crackdown on digital assets. But cryptos have shrugged off the news, with the likes of bitcoin, ethereum ETHUSD,

European-listed shares in Nokia NOKIA,

The markets

U.S. stock market futures were mixed YM00,

The charts

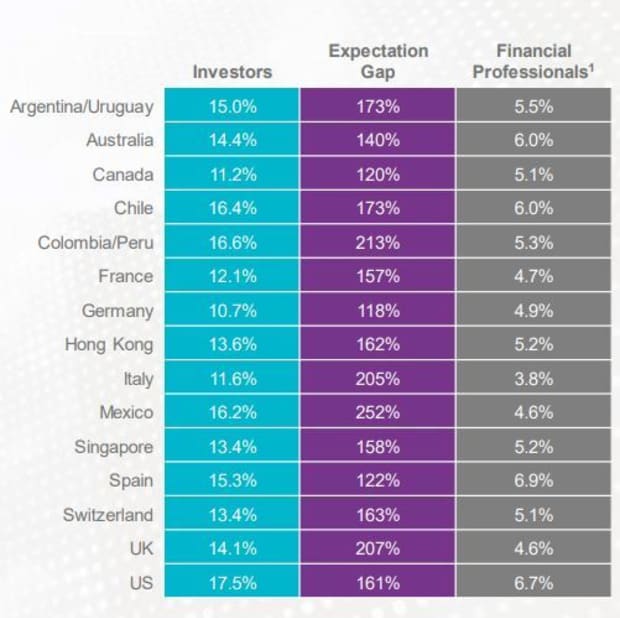

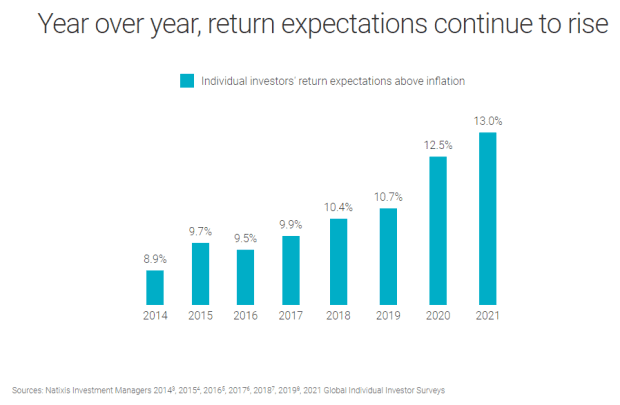

“Investor expectations are way out of whack with reality,” according to Michael Batnick, of the Irrelevant Investor financial blog.

Our chart of the day, from investment bank Natixis, via Batnick, shows the expectation gap between financial professionals and individual investors in 17 countries—and that American investors expect 17.5% real returns over the long term.

“The S&P 500 has returned 10.4% over the long term. The idea that we’re going to get 17% real, after getting 17% nominal over the last 5 years, is nothing short of absurd,” Batnick said.

Moreover, return expectations have continued to rise year-over-year:

Random reads

Doe, doh! Two Australian men were sunbathing nude on a beach when they were startled by a deer—so they ran into a nearby forest, and got lost. Police fined the pair after aircraft and emergency services were scrambled to rescue them.

“I’ve never seen that many zeros”: A couple from Baton Rouge, Louisiana were the recipients of $50 billion mistakenly deposited into their bank account.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.