Biotech Shares Soar as Biogen Drug Approval Stokes Optimism

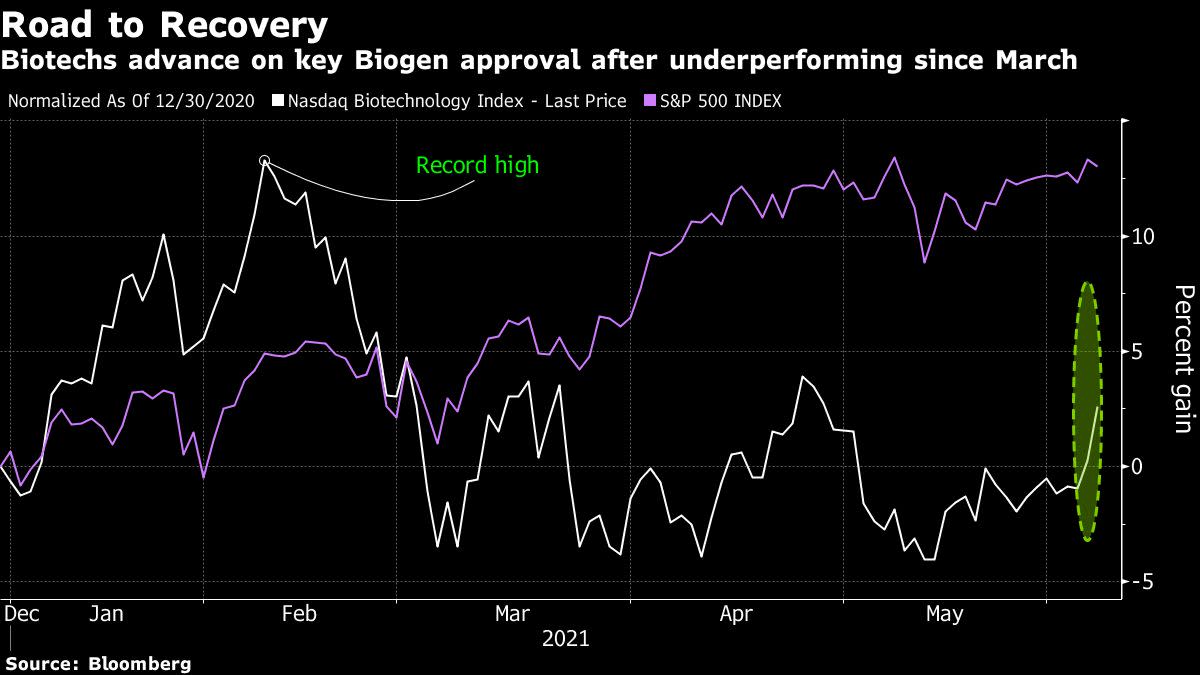

(Bloomberg) — The approval of Biogen Inc.’s new Alzheimer’s disease treatment spurred broad gains in the sector, driving the Nasdaq Biotech Index to its highest level in more than three months.

Shares of Eli Lilly & Co. jumped as much as 16% and touched a record high, while Biogen’s partner in Japan, Eisai Co., surged as much as 75% in U.S. trading, the biggest gain ever for the stock. Small-cap companies working on treatments for the disease also climbed: Cassava Sciences Inc. rose 19%, while Annovis Bio Inc. gained 31%.

The Nasdaq Biotech Index rallied 4.3% at 1:52 p.m. in New York, the biggest jump since Nov. 4, as Biogen resumed trading and soared as much as 64% to an intraday record of $468.55. Before the approval, the most bullish analyst estimates had put trading at around $450 a share.

Traders viewed the approval as a precedent-setting event which could signal the Food and Drug Administration’s stance on other new medicines, and particularly those tied to the brain-wasting disease. “We believe there has been an important shift at FDA, where the agency has begun to create a more supportive, cooperative, and constructive regulatory environment,” Goldman Sachs analyst Graig Suvannavejh said.

Analysts at JPMorgan were more cautious on extending the optimism to other areas of medicine. “We think it’s difficult to extrapolate too much to other areas outside of Alzheimer’s. Of course, the sector will broadly respond well to this,” Cory Kasimov, an analyst with JPMorgan said.

“Hopefully this run of recent favorable FDA decisions can inject some sustained momentum into the group, but the saga of adu has felt like an independent one for quite some time,” Kasimov wrote in a note to clients, referring to Biogen’s drug which will be commercially available as Aduhelm.

Read more: Biogen Alzheimer’s Drug Approved in Disease Landmark

Lilly, which is working on its own Alzheimer’s medicine, donanemab, traded as high as $233.33, up 16%.

The approval “suggests Eli Lilly may be able to revisit its decision on the filing of donanemab, given its strong effects on brain amyloid levels,” Bloomberg Intelligence analyst Sam Fazeli wrote in a note. It could also bode well for Roche’s gantenerumab, he said.

Roche advanced 4.4% in U.S. trading to the highest since Sept. 21.

The label for Biogen’s medicine was even broader than most on the Street were expecting, though some were still negative on the trial results that led to the approval. “Unmet need wins over science as the FDA finds a way to approve the drug,” Citi analyst Mohit Bansal wrote in a note to clients.

The decision on Aduhelm is one of three big catalysts for the sector that analysts have been saying could turn around flagging sentiment. Investors will now be awaiting results from a Vertex Pharmaceuticals Inc. study as well as another Biogen update. Next up for Biogen will be the release of data on a drug for depression developed with partner Sage Therapeutics Inc.

(Updates trading throughout, adds JPMorgan and Goldman commentary.)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.