Base metals demand expected to benefit from green revolution – report

Yet, the green revolution – despite accounting for less than 5% of global copper demand in 2020 – may throw some surprise punches and boost demand for the red metal and for nickel beyond expected levels, the report states.

In fact, CRU’s calculations see global copper consumption from renewables increasing from 700,000 t/y in 2020 to 1.8 Mt/y in 2030, boosted by applications in wind and solar power facilities, electric vehicles, and new electricity infrastructure.

According to the consultancy firm, zinc demand could also benefit from renewables in the coming years because offshore energy is one of the more zinc-intensive clean energy sectors and is set to grow rapidly in the next decades, although from a small base.

Specifically, solar power is expected to account for an increasing portion of refined zinc demand going forward because the metal is commonly used in solar arrays that are mounted on galvanized steel frames and that cover vast areas.

Zinc is also the key component of some utility-scale batteries, whose current market is small but – in CRU’s view – has the potential to become a fast-growing one, adding to overall renewables-related zinc demand.

Looking at the role of electric vehicles in base metals demand, the report forecasts that global EV-related copper demand will increase from around 300,000 t in 2020 to over 4 Mt in 2040.

The prediction is based on the fact that, in spite of the pandemic, 2020 seems to have been an inflection point for the electric vehicle industry, with European sales of electric plugins breaking the 1-million unit barrier.

When it comes to copper, EV manufacturers tend to incorporate the metal in their designs, with the intensity of use at around 80kg per vehicle, which is up to four times that for a standard internal combustion engine.

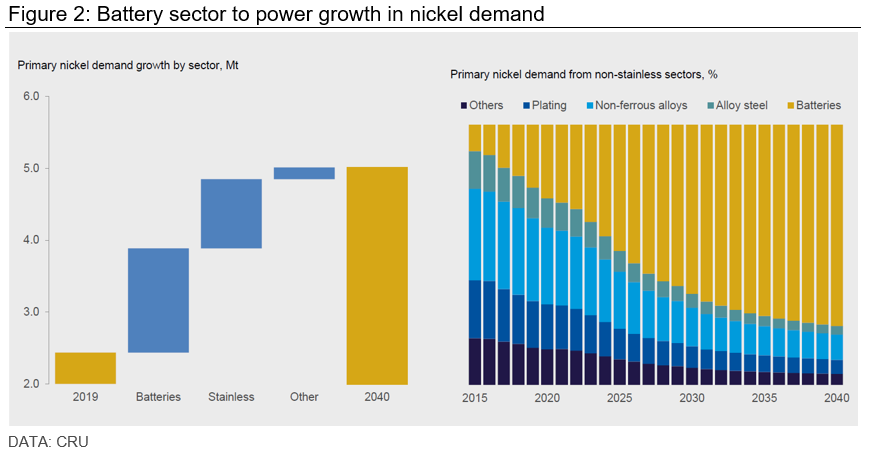

The battery sector is also seen as a major nickel consumer in the years to come, accounting for almost 60% of nickel demand growth out to 2040. This rise will come on the back of increasing penetration of electric vehicles in the automotive sector, using nickel intensive batteries.

Nickel is also expected to benefit from lithium-nickel-manganese-cobalt oxide (NMC) battery chemistries cementing its position as the “industry standard,” considering that they provide higher charger densities than their non-nickel-based counterparts.

The only “but” in this prediction is that lithium-iron-phosphate battery (LFP) chemistries are holding more market share than what the industry foresaw, particularly in the Chinese BEV sector.

“LFP is a risk for nickel, and several western OEMs have made investments in LFP technology. If LFP’s share is greater than we forecast, the need for new nickel capacity will be lower in the long run,” the analysis reads. “There are longer-term technological risks which could displace NMC batteries, pushing a move away from nickel-intensive batteries. These technologies seem at least a decade away but could surprise to the upside.”

Other threats

In the view of CRU, zinc is also facing challenges due to the trend towards light-weighting of vehicles, which began as automakers tried to meet stricter emissions regulations and which will continue as they aim to maximize EV battery performance.

“While substitution of galvanised steel for aluminium auto sheet is still confined mostly to high-end vehicles, the trend will continue to chip away at auto-related zinc demand,” the firm’s document states.

Aluminium is also considered a threat for copper, due to price rations rising, which has led to a growth in the primary aluminium market from 15 Mt to almost 65 Mt, whereas the refined copper market has only increased from 10 Mt to 23 Mt.

CRU points out that, in addition to the prior, aluminium scores highly in the EV sector not only in terms of cost but also because of potential weight savings. Yet, one thing plays in favour of copper: the fact that aluminium’s cross-sectional area needs to be over 50% greater than that for copper for the same level of conductivity.