AMC’s over 3,000% gain so far in 2021 makes it by far the best performing U.S. stock, but its bonds say otherwise

Get out the popcorn! AMC Entertainment is having the best year of any U.S. stock with a market cap of at least $3 billion.

The movie chain’s shares are up over 3,000% in the year to date and its surge on Thursday was drawing awe from observers of financial markets, along with strident finger wagging from traditional investors who view the meme-driven asset’s surge as nothing more than a bubble-fueled frenzy that is certain to pop soon.

At last check, shares of AMC Entertainment AMC,

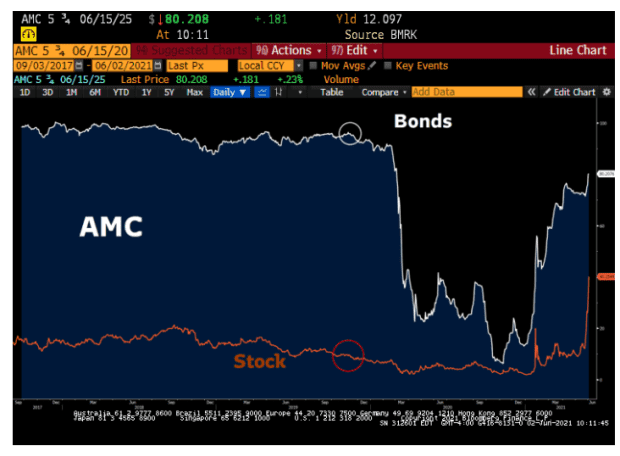

However, the jump in its shares represents a disconnect from how its bonds are trading, according to Wall Street veteran Larry McDonald, a former Lehman Brothers executive and author of financial blog Bear Traps Report.

In a post published Wednesday, McDonald points to AMC Entertainment’s 5.75% coupon bond maturing in 2025, which was trading at a nearly 20% discount to par.

McDonald surmised that the disconnect between the soaring stock and the company’s bond, which is trading well below par at 81, highlights broken markets and silly trading in his view.

The bond trading may imply that fixed-income investors aren’t as assured of the future as the social-media community is. AMC’s cinema operations have been hobbled by the pandemic-driven lockdowns and social-distancing protocols, but its stock has nonetheless enjoyed a stellar Reddit-fueled runup.

AMC’s enterprise value is about $26 billion, compared with $6.2 billion or so at the end of 2018.

AMC could see a storybook ending if it can generate $600 million in free cash flow annually, which would put the stock at about a 4% free cash flow yield. That compares against the S&P 500 index, which trades for about a 3% free cash flow yield, Barron’s writes. MarketWatch’s sister publication notes that there are still challenges for AMC aplenty, including competitors and the fact that it hasn’t historically been able to generate substantial free cash flow.

“What we know for sure is that the bond and the stock disagree about the risks inherent in AMC’s future,” Bear Traps Report’s McDonald writes.