What crypto analysts say investors should do as bitcoin market hit by ‘extreme fear’

Crypto markets are in the midst of a substantial selloff that has shaken the conviction of some new investors in the nascent sector.

A popular crypto sentiment reading from Alternative.me indicates a reading of “extreme fear” at 23, as bitcoin BTCUSD,

Bitcoin prices were down over 40% from their peak and other popular assets were also down sharply. Parody crypto dogecoin DOGEUSD,

However, some strategists say that investors need to remain calm and plan ahead in a market that is notoriously turbulent like crypto.

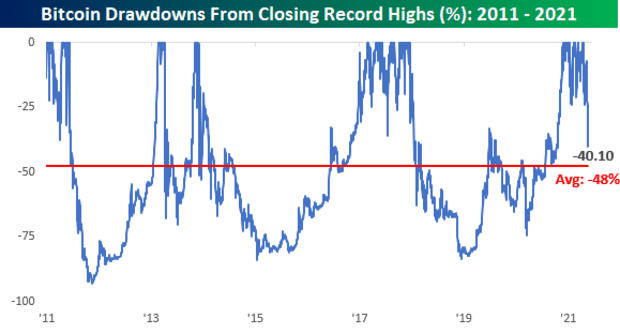

However, major drops are commonplace, note researchers at Bespoke Investment Group. Bitcoin’s average drawdown from a record high on any given day is close to 50%, and on 69% of all trading days during this span bitcoin has been down more than 40% from its record high (see attached chart):

“In the bull market, seeing these big drops is common,” said Ganesh Swami, CEO and co-founder of Covalent, a blockchain data provider.

“The last time we saw a bull run, bitcoin dropped at least half a dozen times by 20-30% before it went to the then all-time high,” he wrote.

However, UBS Global Wealth Management’s chief investment officer, Mark Haefele says that crypto’s volatility is one thing that makes it a risky investment and perhaps unpalatable for some investors who may be risk averse.

“The high volatility of cryptos makes them an unreliable store of value. Weekly moves of more than 10% in Bitcoin are common. In the week to 14 May, bitcoin fell 24%, which would be a high level of volatility for a small-cap stock, let alone a currency,” the strategist wrote.

That turbulence may make it an investment that average investors should steer clear of.

Julius de Kempenaer, senior technical analyst at Stockcharts.com, told MarketWatch via emailed comments that the slump is damaging to the outlook for bitcoin, in the near term.

“A more than 50% decline from the highs within a month is certainly damaging the outlook for bitcoin,” he wrote.

He said recent trading action shows “how, despite the rise and new participants, immature these markets still are.”

He speculated that investors should brace for further downside if bitcoin breaches $30,000, which could take bitcoin to $20,000, near its November 2020 levels.

The most recent downturn was being blamed on reports suggesting that China was cracking down on digital assets. Dogecoin co-founder Billy Markus made light of that serving as one of the reasons for the slump, noting that bitcoin and crypto have seen a number of instances attributed to China crypto bans.

Leeor Shimron, vice president of digital asset strategy at Fundstrat Global Advisors, told MarketWatch that he recommends that investors “stay the course,” by using a dollar-cost averaging approach to investing. Dollar-cost averaging is usually defined as buying into a holding with a fixed dollar amount at fixed time intervals.

“This allows investors to ride out the volatility and average into their positions,” Shimron said.

He said that new investors should avoid leveraging, or using debt to amplify returns in crypto.

“One of the main drivers of the pullback is excess leverage and the selloff has been magnified as overleveraged long traders were liquidated, creating a slingshot effect to the downside,” the Fundstrat analyst said.

Some investors were expressing their own desire to “buy the dip”

That said, investors need to be careful with that strategy.

“The saying never catch a falling knife seems very appropriate as it is raining knives in the crypto space at the moment,” said Kempenaer.

It is worth noting that the decline in crypto also came as the Dow Jones Industrial Average DJIA,