U.S. Futures Edge Up, Asia Stocks Eye Steady Start: Markets Wrap

(Bloomberg) — U.S. futures edged up Monday and Asian stocks were set for a steady start as investors continue to weigh inflation risks and await key U.S. jobs data to gauge the strength of the economic recovery.

Equity contracts were little changed in Japan, Australia and Hong Kong after U.S. stocks notched their fourth-straight monthly advance. Treasury yields ticked back below 1.60% on Friday. There is no cash trading in Asia amid holidays in the U.S. and U.K.

The offshore yuan slipped in the wake of comments leaning against its climb. The currency’s rapid appreciation against the U.S. dollar probably won’t last, according to a former Chinese central bank official, while the People’s Bank of China-backed Financial News said in an editorial Sunday that the yuan may depreciate in future.

Bitcoin fluctuated around $36,000, following a Friday slump as Bank of Japan Governor Haruhiko Kuroda warned about the token’s volatility and speculative trading.

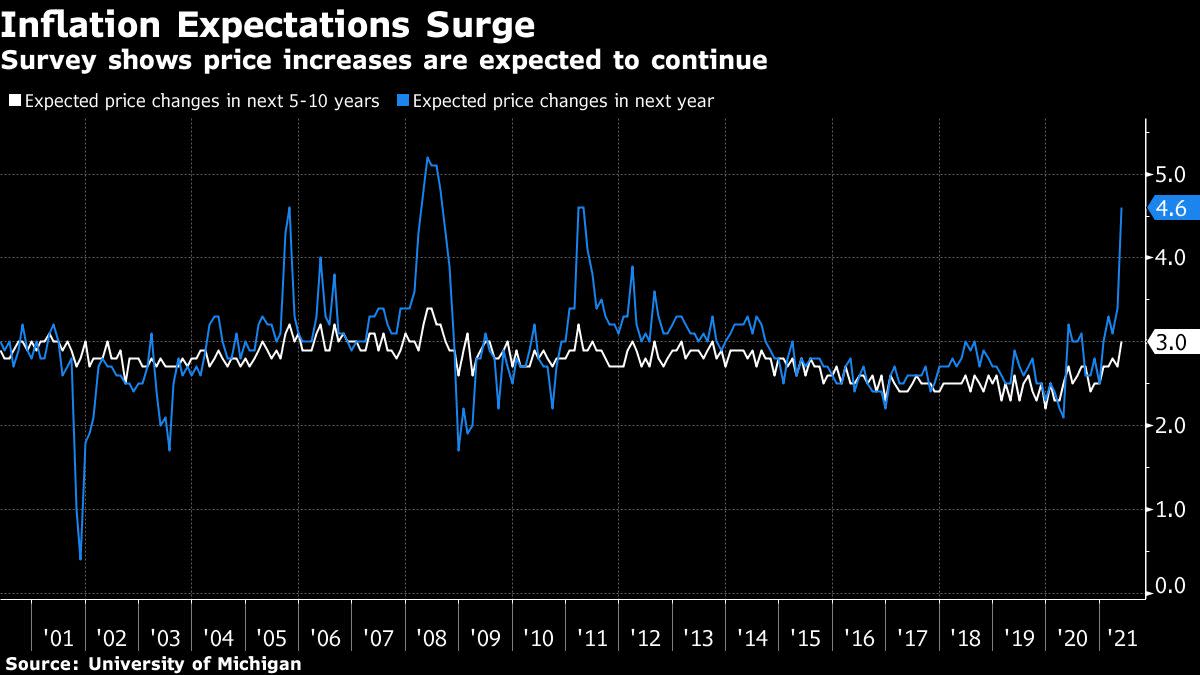

Global stocks remain near a record, lifted by the ongoing economic recovery from the pandemic and injections of stimulus. The rally has so far weathered concerns that price pressures could force an earlier-than-expected reduction in central bank support. But investors remain sensitive to the risk, and this week’s U.S. non-farm payrolls report could buffet markets if it changes perceptions of the rebound’s strength.

“There is likely more upside to go on the inflation scare front in the months ahead as base effects, the lagged impact of commodity price hikes and bottlenecks continue to feed through, but there are now a few more signs that it will be transitory,” Shane Oliver, head of investment strategy and chief economist at AMP Capital, wrote in a note.

Here are key events to watch this week:

U.S. markets will be closed for the Memorial Day holiday. U.K. markets will be closed for the Spring Bank holidayReserve Bank of Australia policy decision TuesdayOPEC+ meets to review oil production levels TuesdayPhiladelphia Fed President Patrick Harker, Chicago Fed President Charles Evans, Atlanta Fed President Raphael Bostic and Dallas Fed President Robert Kaplan speak WednesdayU.S. employment report for May on Friday

These are some of the main moves in markets:

Stocks

S&P 500 futures rose 0.1% as of 7:35 a.m. in Tokyo. The S&P 500 rose 0.1% FridayNasdaq 100 contracts climbed 0.2%. The Nasdaq 100 rose 0.2%Nikkei 225 futures fell 0.1%Australia’s S&P/ASX 200 Index futures added 0.1%Hong Kong’s Hang Seng Index futures rose 0.3% earlier

Currencies

The Japanese yen was at 109.85 per dollarThe offshore yuan was at 6.3679 per dollar, down 0.1%The euro was little changed at $1.2193

Bonds

The yield on 10-year Treasuries declined one basis point to 1.59% FridayAustralia’s 10-year bond yields was steady at 1.68%

Commodities

West Texas Intermediate crude rose 0.5% to $66.62 a barrelGold was at $1,903.74 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.