Treasury yields are flat ahead of the Fed meeting minutes

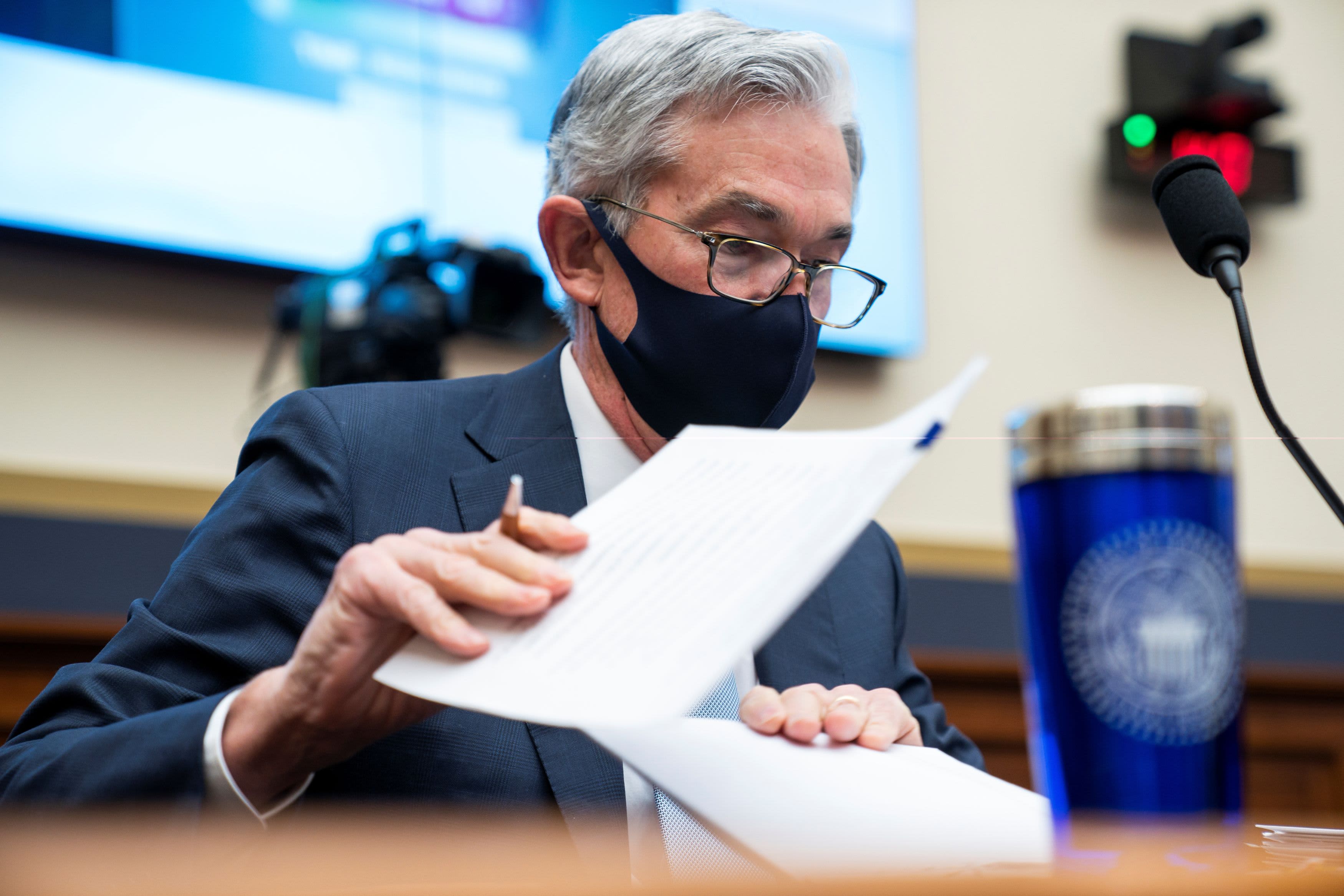

Federal Reserve Chair Jerome Powell prepares for a House Financial Services Committee hearing on “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response” in the Rayburn House Office Building in Washington, D.C. on Dec. 2, 2020.

Jim Lo Scalzo | Reuters

Treasury yields were flat ahead of the release of minutes from the Federal Reserve’s last policy meeting.

The yield on the benchmark 10-year Treasury note dipped to 1.623%. The yield on the 30-year Treasury bond fell to 2.34%. Bond yields move inversely to prices.

Minutes from the Federal Open Market Committee’s meeting in April are due to be published at 2 p.m. ET. Investors will be poring over the meeting minutes for any indication as to the Fed’s views on rising inflation and when it might start to tighten its easy monetary policy.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, told CNBC’s “Squawk Box Europe” on Wednesday that he believed the Fed would stick to its line that rising inflation was transitory.

He argued the Fed wouldn’t “jump into any kind of quick response in the language, never mind even by doing tapering, or heaven-forbid thinking about raising rates.”

Shepherdson believed the minutes would show a “push back” by the central bank on market concerns about inflation.

He also stressed that it was important to remember the Fed has an employment mandate, as well as an inflation mandate, pointing that the unemployment rate was still above 6%. The Fed has said it lets inflation run hotter so long as it sees a fuller recovery in employment.

Prior to the release of the FOMC minutes, Fed Vice Chair for Supervision Randal Quarles is set to make a speech on supervision and regulation before the U.S. House of Representative’s Committee on Financial Services at 10 a.m. ET.

An auction will be held Wednesday for $27 billion of 20-year bonds.