This signal is telling investors that highflying stocks are ready to fall back to Earth, says fund manager

It has been a good year for value investors. The Russell 1000 value index RLV,

That parenthetical is used to introduce the latest musings of Ben Inker, the head of asset allocation at GMO, the Boston value fund manager. Inker and GMO have made many warnings about the heady valuations of stocks, but in the investment firm’s latest quarterly letter, he points to supply as being a good predictor of future busts.

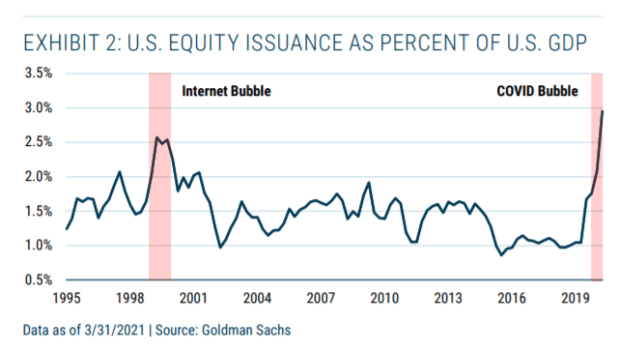

U.S. equity issuance as a percent of gross domestic product, he notes, is higher now than even the internet bubble. The last 12 months have seen 2.5 times the total issuance of special-purpose acquisition companies, or SPACs, in all of history up until then.

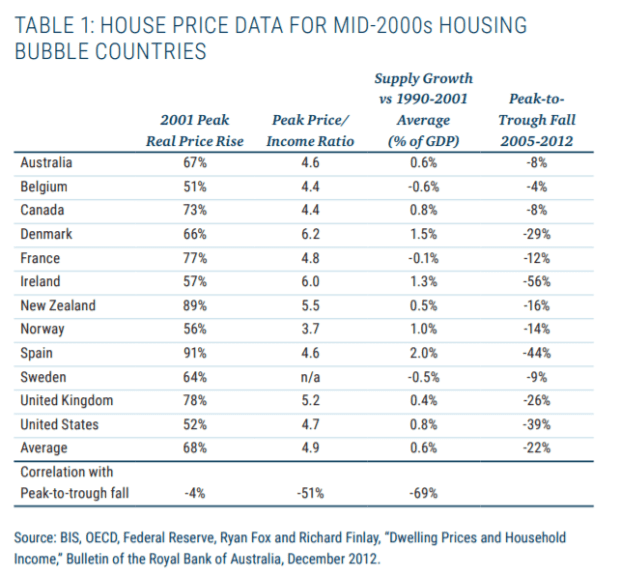

Inker took to the housing market to show how supply can be a predictor of future price busts. House prices, heading into the 2008 global financial crisis, only had a 4% correlation with the subsequent decline. Price-to-income valuations did a better job, with a 51% correlation, but the best predictor was the increase in housing supply, with a correlation of 69%. “Correlation, famously, does not prove causality, but the data for the 2000s’ housing boom is certainly consistent with increased supply eventually putting pressure on prices, with supply being as big a problem as valuations in a speculative boom,” says Inker.

Inker says the time scale for the eventual deflation of the current speculative bubble won’t be “all that long” and worries that the rest of the market may slide with the most speculative plays. “If the whole of the market is dominated by speculators with outsized expectations, it seems likely that deflation in the obviously speculative tier will take the overall market with it,” says Inker.

The broader market needs a “combination of economic growth solid enough to keep corporate profitability strong and not so strong as to reignite inflationary concerns,” he adds.

Inker says the easy protection isn’t to own the speculative end of growth. “It is not a coincidence that value today is close to as cheap as it has ever been relative to the market, but it is convenient nevertheless. You can protect your equity portfolios by choosing to bias them toward value and away from the most expensive end of growth,” he says.

Fed minutes on tap

Minutes of the most recent Federal Reserve interest-rate setting meeting will be released at 2 p.m. While traders will pore over comments about how the central bank was viewing inflation and its view on its bond-buying program, the meeting occurred before the Labor Department released consumer price data for April, which showed inflation jumping to a nearly 13-year high.

Another day of retail-sector earnings was in focus, as discounter Target TGT,

Wells Fargo WFC,

The European Central Bank warned that the removal of COVID-19 pandemic support by governments could lead to rising insolvencies in the euro area.

Speaker of the House Nancy Pelosi called for a diplomatic boycott of the coming 2022 Winter Olympics in Beijing over human-rights abuses.

Wobbly stocks as bitcoin slumps

The S&P 500 SPX,

The more severe action was in the cryptocurrency space, with bitcoin BTCUSD,

Random reads

Researchers are using slime molds to plan urban transport networks and fire-escape routes for large buildings.

This U.K. soccer club has thrived under U.S. ownership with a tiny budget, thanks to its analytical approach.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers