Stocks Waver on Virus; U.S. Futures Dip; Dollar Up: Markets Wrap

(Bloomberg) — Stocks in Asia fluctuated Monday with U.S. futures as spikes in virus cases in parts the region and lingering inflation concerns weighed on investor sentiment.

Shares gained modestly in Australia and Hong Kong but slipped in Japan and South Korea as markets responded to the latest curbs on activity to halt the spread of Covid-19. U.S. stocks ended in the green Friday after gathering price pressures pushed equity markets globally to their worst weekly loss since February.

China’s stocks climbed, shrugging off some below-forecast readings on retail sales, industrial output and fixed-asset investment.

The spread of the virus is front and center again as Singapore plans to close public schools this week and move to home-based learning. Taiwan is racing to contain its worst outbreak and avert a full lockdown.

Treasury yields were steady after dropping Friday on a report that showed the recent surge in U.S. retail sales stalled in April. The dollar edged up against its major peers.

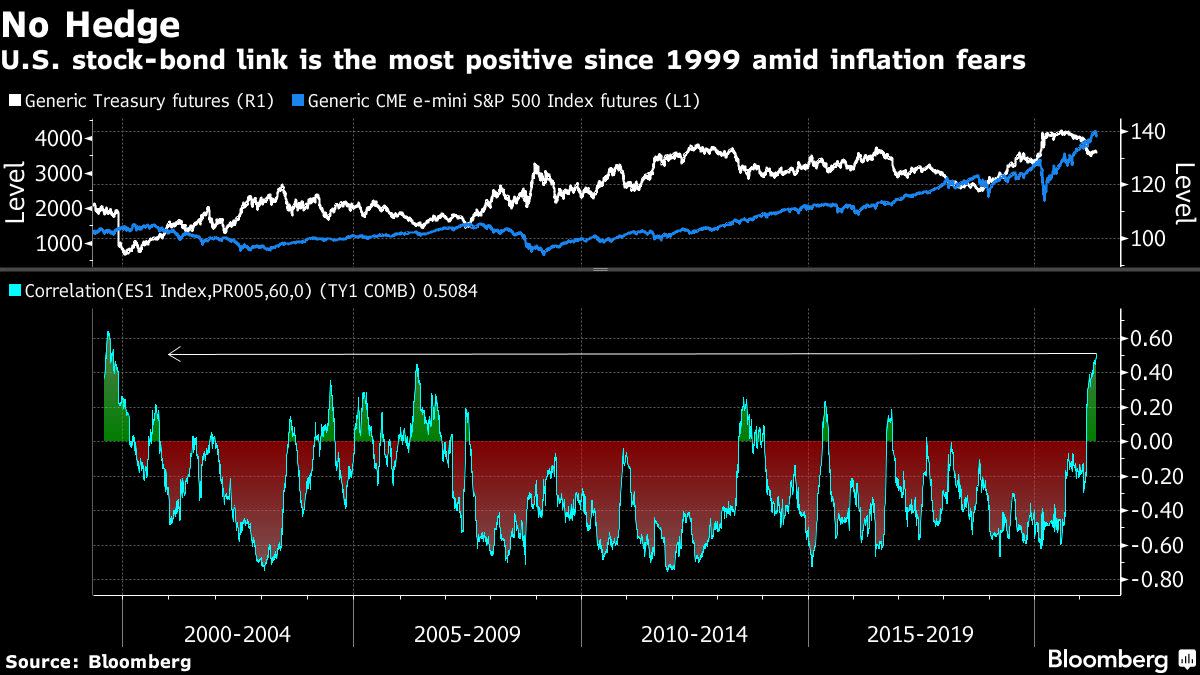

Concerns that policy makers will have to pull back support sooner than expected to quell rising inflation have weighed on global equities. Investors this week will parse the minutes from the Federal Open Market Committee’s latest meeting for any discussion about accelerating price pressures, and hints of a timeline for reducing asset purchases.

“The global economic recovery is well under way; that’s what’s fueling the inflation fears,” Olivier d’Assier, Qontigo head of APAC applied research, said on Bloomberg TV. It’s not surprising to see some profit taking after the rally in equity prices, d’Assier said.

The Federal Reserve’s policy is in a good place right now, said Cleveland Fed President Loretta Mester, while playing down data that she warns will be volatile as the economy reopens. Fed Vice Chair Richard Clarida and Atlanta Fed President Raphael Bostic are due to speak this week.

The momentum in commodity markets seems to have flagged after breakneck gains, with copper and iron ore coming off record highs amid efforts by China to clamp down on surging prices. Oil edged higher.

Meanwhile, Bitcoin fell to the lowest since February. The digital coin extended losses after trading below $45,000 Sunday, as Tesla Inc. founder Elon Musk continued to spar with Bitcoin proponents on Twitter and implied Tesla might sell its holdings.

Click here for MLIV’s Question of the Day: How Far Can East-West Stocks Divergence Go?

Here are some key events this week:

Reserve Bank of Australia publishes minutes of its latest meeting TuesdayFed Vice Chair Richard Clarida and Atlanta Fed President Raphael Bostic are among policy makers speaking this weekThe Fed publishes minutes from its April meeting Wednesday, which may provide clues to officials’ views on the recovery and how they define “transitory” when it comes to inflationAustralia releases employment data for April on Thursday

These are some of the main moves in markets:

Stocks

S&P 500 futures dipped 0.2% as of 12:55 p.m. in Tokyo. The S&P 500 rose 1.5%Nasdaq 100 contracts edged down 0.3%. The Nasdaq 100 rose 2.2%Japan’s Topix Index fell 0.4%Australia’s S&P/ASX 200 Index added 0.3%South Korea’s Kospi index fell 0.9%Hang Seng Index rose 0.4%Shanghai Composite Index gained 1%Euro Stoxx 50 futures rose 0.2%

Currencies

The yen traded at 109.35 per dollarThe offshore yuan was at 6.4413 per dollarThe Bloomberg Dollar Spot Index rose 0.1%The euro edged down to $1.2133

Bonds

The yield on 10-year Treasuries was around 1.62%Australia’s 10-year bond yield fell three basis points to 1.76%

Commodities

West Texas Intermediate crude rose 0.2% to $65.47 a barrelGold advanced 0.5% to $1,851.75

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.