Salesforce stock bucks software selloff after upgrade: ‘Leading franchises do not stay cheap for long’

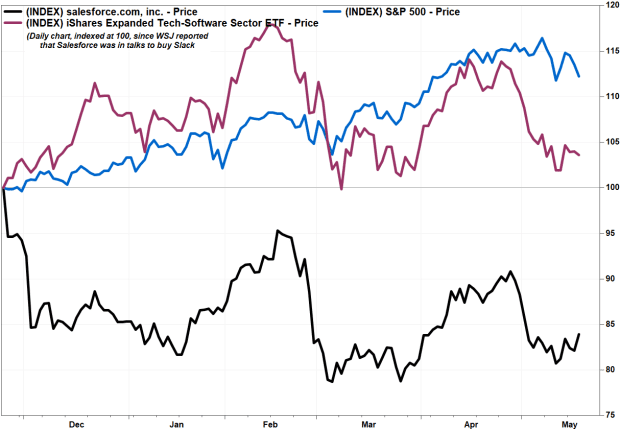

Salesforce.com Inc. shares have underperformed fellow software stocks since the company’s plans to acquire Slack Technologies Inc. were first reported late last year, but one analyst thinks a turnaround is in store.

Morgan Stanley’s Keith Weiss upgraded Salesforce’s stock CRM,

“While concerns on M&A appetite and durable margin expansion may linger, leading franchises do not stay cheap for long, particularly amidst the strong backdrop we foresee over the next several years,” Weiss wrote.

Salesforce shares are up 2.2% in morning trading on a day when the S&P 500 SPX,

The stock is the top performer among components of the Dow Jones Industrial Average DJIA,

With Salesforce shares underperforming large-cap software peers by roughly 25 percentage points and the S&P 500 by more than 30 percentage points through Tuesday’s close, since The Wall Street Journal reported that a deal with Slack WORK,

Salesforce shares lagged following other big acquisitions in the past as well, but they went on to outperform the broader market in the three and 12 months following those “historical M&A sell troughs,” he wrote.

Among catalysts for Salesforce is the “accelerating pace of investment in strategic digital transformation initiatives,” Weiss said in his note to clients. Salesforce’s portfolio of software aimed at improving customer interactions is well positioned to benefit from this trend, in his view.

Investors “may have to be patient to see better demand trends reflected in billings and bookings metrics,” he noted, due to the “lagging nature” of the subscription model and what could be a weaker fiscal year of bookings growth, but he points to the “low bar” set by the company’s first-quarter implied bookings outlook. Salesforce reports fiscal first-quarter results after the closing bell May 27.

He’s upbeat as well about Salesforce’s new chief financial officer and thinks that the company might “start to let revenue outperformance flow through the P&< and display more leverage as the M&A impacts subside.”

Weiss isn’t totally sold on the pending $28 billion Slack acquisition yet. He notes, however, that the messaging company’s last two quarters of performance showed improvement, making Slack “a better asset than many originally thought.” Salesforce will now have an opportunity to prove out the strategic logic behind the deal, and Weiss sees the potential for Slack to help expand Salesforce’s possible user base beyond customers in the sales, service, and marketing industries.

Weiss kept his $270 price target on Salesforce shares, which have lost 11% over the past three months as the S&P 500 has risen about 4%.