Bitcoin and bonds won’t cut it. Buy these 6 types of assets for protection in a bear market, says strategist.

Wednesday was a quiet day for markets, and Thursday looks set for the same in what may be a taste of doldrums in the summer ahead.

But that doesn’t mean investors should kick back and relax in the sun just yet, because major risks to stocks remain. If a bear market is indeed on the horizon, investors need to look for new, uncorrelated assets to survive the next selloff, advised Vincent Deluard, a strategist at broker StoneX, in our call of the day. The strategist said to look at six types of assets in particular, because bitcoin and bonds just won’t cut it.

“Risks are everywhere in a time of peak liquidity, peak valuations, and peak economic optimism,” the strategist said, with stocks 50% to 100% more expensive than they were at the height of the 1990s dot-com bubble.

And market concentration is also more extreme, with U.S. stocks accounting for 56% of the MSCI World Index. In fact, tech giants Apple AAPL,

This sets the stage for stocks on a hair trigger. “Unfortunately for investors, traditional hedges are expensive or ineffective, or both,” Deluard said.

For the first time in 15 years, long-term Treasuries — “the ultimate risk-off asset of the past decade” — are positively correlated with stocks, and the typical inverse relationship between stock valuations and the price of options has broken down.

“Investors’ desperate rush for the holy grail of diversification has reduced the appeal offered by traditionally uncorrelated assets: gold GOLD,

According to Deluard, the five main risks of 2021 are rising yields, inflation surprises, wider spread, an equity market selloff, and a “blowup” of overpriced growth stocks.

Deluard’s advice is to look at six types of assets to best protect yourself against these specific risks in the year ahead. Financials, commodities, and energy stocks are the best hedges, Deluard said, which dovetails with his bullish view on Latin American — and especially Mexican — assets. Bets on those cyclical sectors should be complemented by traditional risk-off plays such as gold and Japanese stocks, the strategist added.

“This barbell portfolio should protect investors against the main risks of 2021 at a relatively cheap price,” Deluard said. “Rare, good news in an otherwise bleak environment.”

The buzz

Tesla is set to make the rare move of paying in advance for semiconductors to secure supply amid a global shortage, according to a report from the Financial Times. It is also considering buying a plant as part of its efforts to overcome chip supply issues facing the automobile industry, the report said.

Iran has banned cryptocurrency mining for four months, cracking down on the power-intensive practice that verifies transactions on the blockchain — the decentralized ledger technology underpinning bitcoin and other crypto assets. The move from Tehran comes as the country faces major power outages.

On the U.S. economic front, investors can expect labor data at 8:30 a.m. Eastern in the form of initial jobless claims for last week and continuing jobless claims for the week of May 15. At the same time, a second estimate of U.S. gross domestic product is due, along with durable goods orders, before the pending home sales index for April.

Shares in Figs, the apparel and lifestyle group for healthcare workers, are expected to start trading on the New York Stock Exchange on Thursday. The company priced its initial public offering at $22 a share — above the $19 top-end of its expected range — as it expanded its stock offering to raise nearly $581 million.

Banking giant HSBC HSBA,

The markets

U.S. stock market futures YM00,

The chart

Between stories of fast-food restaurants struggling to find burger flippers and news that Amazon will hire 75,000 workers at an average pay of more than $17 an hour — well above U.S. minimum wage — rising pay is on the mind.

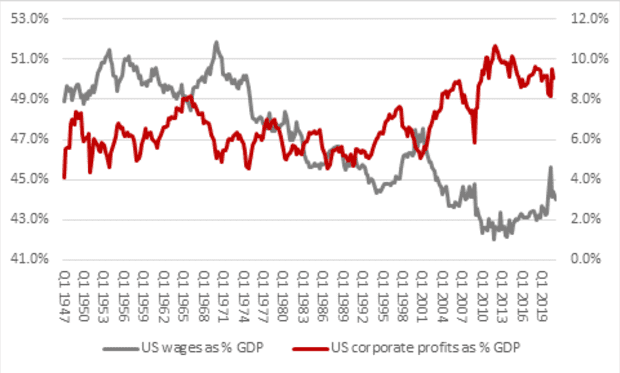

“Workers and their families may well be thinking ‘about time, too,’” said Russ Mould, an analyst at AJ Bell, who provided our chart of the day. “Since 1947, Americans’ pay has fallen by 5 percentage points as a portion of GDP. American corporate profits have increased by almost exactly the same amount.”

Random reads

GM to the moon? General Motors GM,

Ornithological horror in Henley-on-Thames: Birds of prey in U.K. Prime Minister Boris Johnson’s former constituency are creating terror by attacking people and snatching their food.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.