AMC Entertainment’s 130% spike this week isn’t done yet, analyst speculates — here’s why

Shareholders of AMC Entertainment had a ticket to ride this week, and the surge in the stock of the movie chain isn’t likely to dissipate just yet, according to one analysis.

AMC Entertainment Holdings AMC,

Read: GameStop stalls, AMC soars in rare divergence — short interest might hold the key

A surge in shares of the company on Thursday were particularly notable, and implied that the so-called meme stock, which has been the subject of a push by individual investors on social-media sites like Reddit and Discord to catapult its shares to fresh heights, had more room to run.

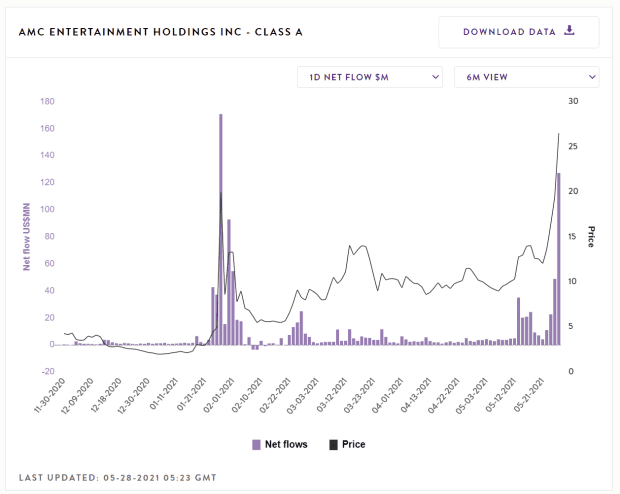

VandaTrack, a tracker of individual investor purchases, said that Thursday’s action, when AMC surged 36%, for its highest close since May 12, 2017, was fueled by $800 million in retail purchases, accounting for 15% of the total purchases on the session.

The researchers at VandaTrack said retail flows hit an average of $127 million a day after Thursday’s rally.

It is “quite impressive as the stock has only a US$13 bn market cap,” said the folks at VandaTrack, including analyst Giacomo Pierantoni.

VandaTrack, which says it uses a proprietary algorithm to identify the daily notional net purchases of all U.S. listed stocks and exchange-traded funds by individual investors, speculates that buying in AMC will continue its rally for a few more days after the recent spike.

AMC ranked as the second-most-traded stock in the U.S. market on Wednesday and posted its largest single-day trading volume since late February, according to Dow Jones Market Data.

Friday’s action is reminiscent of a surge in meme assets earlier this year and suggests that another brawl may be brewing between bullish and bearish forces as the stock vacillate between sharp losses and gains.

The Wall Street Journal, also citing data from VandaTrack, said that conviction among individual investors is that meme stocks like AMC and GameStop Corp. GME,

GameStop’s shares are down 7.1% Friday and up 34% so far this week. The videogame retailer is up 1,147% year to date.

By comparison, the Dow Jones Industrial Average DJIA,

So-called meme stocks are ones that tend to be influenced by hype on social media rather than just company financials. Individual investors have been banding together in an effort to squeeze out professional investors betting that prices of shares of AMC and GME will fall, given those businesses have been harmed by by lockdown conditions prevalent amid the COVID pandemic as well as by ongoing technology changes.

VandaTrack says that the recent surge in AMC and GME mirror January’s surge and could portend increasing momentum for retail bulls.

“We’re likely to mirror the [January] playbook here and so you can imagine that retail momentum buying will continue for a few more days after this big spike,” the researchers wrote.