U.S. cannabis producers are now favored by Wall Street analysts, who’ve soured on Canadian companies

April 20 has become a day of celebration for people who support the full legalization of marijuana — including for recreational use.

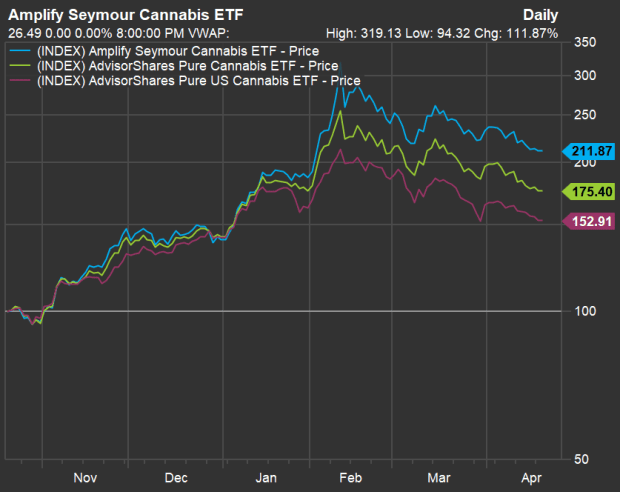

But there’s no denying how volatile the cannabis sector can be for investors. Here’s a six-month chart showing total returns for three actively managed exchange traded funds in the space through April 19:

Read: Cannabis-banking bill approved is by House

Those are eye-watering numbers for any investment in a six-month period. But they also point to wild volatility. All three hit their all-time intraday highs Feb. 10. Since then, the Amplify Seymour Cannabis ETF CNBS,

New banking bill passes House

A piece of supportive news came Monday night, as the the House approved a bill that would give cannabis businesses access to the U.S. banking system.

Before that, a lot of good news for the industry had been priced in. For example, the real legalization of marijuana in New York state March 30 — recreational use is now allowed and the legislation doesn’t hide behind flaccid “decriminalization” language — hadn’t reversed cannabis stocks’ swoon.

A critical distinction that investors need to understand is that the five largest Canadian marijuana companies are publicly listed on U.S. exchanges, but the U.S. producers are listed only on Canadian exchanges. Shares of the U.S. multistate operators, known as MSOs, are available over-the-counter or on Canadian exchanges because marijuana for recreational use is still illegal on the U.S. federal level.

This means several of the best-known marijuana companies — the Canadian ones — cannot sell product in the U.S., while the MSOs have free rein only in the 16 states where recreational use has been legalized.

YOLO and MSOS have been able to get around that problem by holding total return swaps for the MSOs. And on April 20 — yes, on 4/20, the international day of marijuana smoking — Amplify ETFs announced that CNBS will now be able to purchase MSO total return swaps as well.

The “big four” MSOs are Curaleaf Holdings Inc. CURLF,

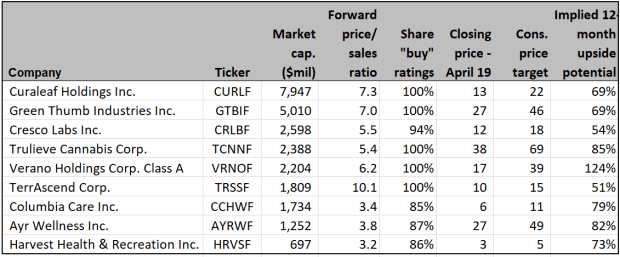

You can see below how favorable the opinion of Wall Street analysts is for the MSOs, while the group has few “buy” ratings on the “big five” Canadian producers: Canopy Growth Corp. CGC,

Click here for a detailed description of the three ETFs and how they invest in U.S. and Canadian marijuana producers.

Analysts’ opinions

Despite being kept off U.S. exchanges, MSOs have plenty of coverage among analysts working for brokerage companies. In order to look beyond the big four MSOs, Dan Ahrens, the portfolio manager for YOLO and MSOS, has supplied a list of six of “the current most significant ones.”

One of those, TPCO Holding Corp. GRAMF,

Here’s a summary of opinion among Wall Street analysts for nine MSOS:

The first screen includes only percentages of “buy” or equivalent ratings, because none of the analysts have “sell” or equivalent ratings on any of the listed MSOs. You can see that sentiment is strong for the U.S. producers.

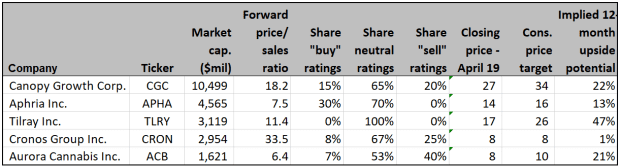

The ratings roundup is much different for the big five Canadian producers:

Forward price-to-sales ratios are shown, rather than price-to-earnings, because companies at such an early growth stage don’t focus on booking profits. For comparison, the forward price-to-sales ratio for the Nasdaq Composite Index COMP,

Click here for an update on the proposed merger of Aphria Inc. and Tilray Inc.