Stocks, Dollar Rise After Fed Minutes; Bonds Waver: Markets Wrap

(Bloomberg) — Stocks hovered near a record and Treasuries fluctuated after the Federal Reserve refrained from signaling any changes to its bond-buying program any time soon. The dollar advanced.

Minutes from the latest Fed meeting said there would likely be “some time” before the conditions are met for scaling back the asset-purchase program of $120 billion per month. Officials still saw elevated uncertainty in the growth outlook, which is in line with an “accommodative” stance.

“The rate side is still somewhat front and center, and probably the biggest risk to what is going on with equity valuations,” said Mark Heppenstall, chief investment officer at Penn Mutual Asset Management. “Clearly, there’s been a repricing of inflation expectations higher this year, and at times, the stock market has struggled with it. I would say that’s to me the biggest risk at this point — that inflation readings start to come in to the point where the Fed potentially has to alter their plans.”

Rates are going higher for the “next several months, just like they have over the previous several months,” Jim Bianco, president of Bianco Research, said on a Bloomberg Television interview. Bond yields have recently fallen because they’ve had a “relentless rise,” he noted.

Read: JPMorgan’s Dimon Says ‘This Boom Could Easily Run Into 2023’

If yields are going up because the economy is reopening and massive real growth is expected, that “won’t bother the economy or the stock market,” Bianco said. “But if interest rates are going up because of inflation,” which is a loss of purchasing power, “that’s a problem for the economy and the stock market, and we’re going to continue to have that debate.”

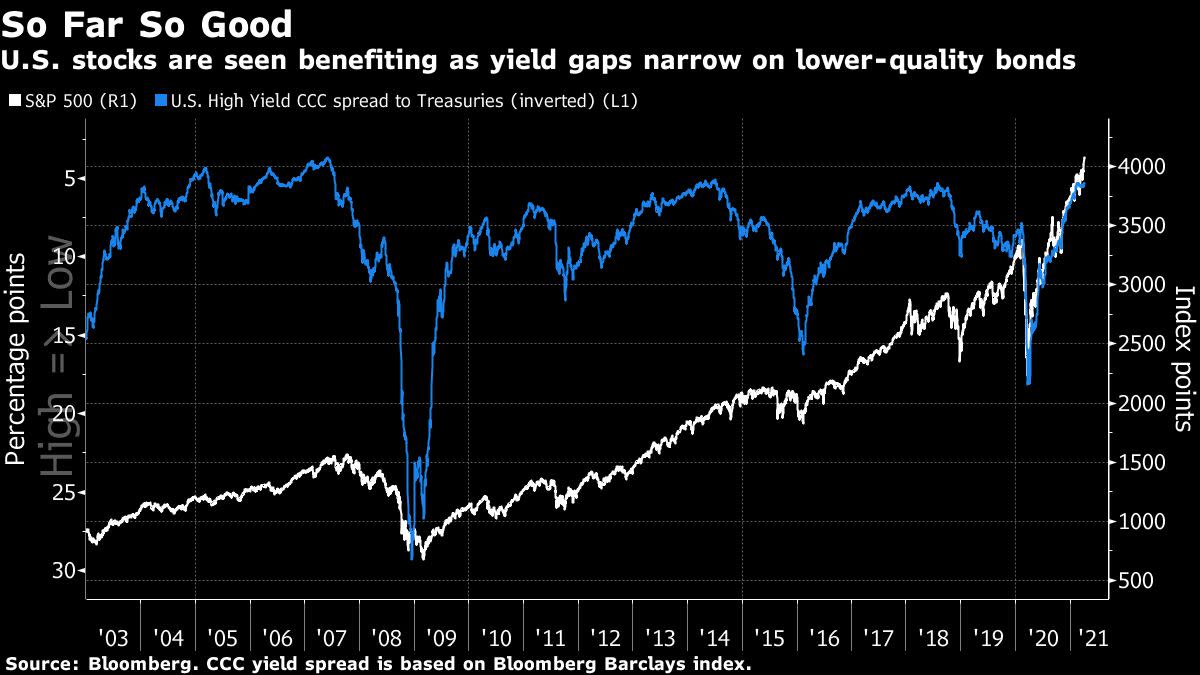

Credit markets have yet to signal any type of impending weakness ahead for U.S. stocks, according to Ian McMillan, a market technician at Client First Tax & Wealth Advisors. He compared the S&P 500 with the yield gap between some of the lowest-rated high-yield bonds and Treasuries. This week began with the gap for the Bloomberg Barclays Caa U.S. High Yield Index moving to its narrowest level since July 2018. A widening of high-yield spreads would be a caution signal for equities, he wrote.

Some key events to watch this week:

The 2021 Spring Meetings of the IMF and the World Bank Group take place virtually. Federal Reserve Chairman Jerome Powell takes part in a panel about the global economy on Thursday.Japan releases its balance of payments numbers Thursday.China’s consumer and producer prices data are due Friday.

These are some of the main moves in markets:

Stocks

The S&P 500 gained 0.2% as of 2:20 p.m. New York time.The Stoxx Europe 600 Index fell 0.2%.The MSCI Asia Pacific Index decreased 0.2%.

Currencies

The Bloomberg Dollar Spot Index increased 0.2%.The euro rose 0.1% to $1.1885.The Japanese yen was little changed at 109.76 per dollar.

Bonds

The yield on two-year Treasuries fell one basis point to 0.15%.The yield on 10-year Treasuries declined one basis point to 1.65%.The yield on 30-year Treasuries climbed one basis point to 2.33%.

Commodities

West Texas Intermediate crude rose 0.7% to $59.72 a barrel.Gold weakened 0.1% to $1,741.89 an ounce.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.