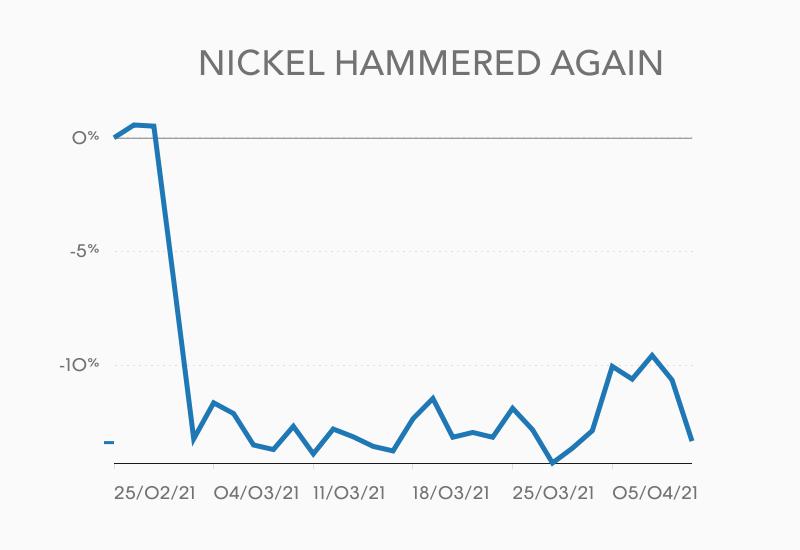

Nickel price falls as China warns on raw material prices

While we don’t expect to see substantial releases from strategic stockpiles, we do expect amplified rhetoric about the potential to release these in order to send a signal to the market

Copper prices declined for a second day in New York but managed to hold just above the pivotal $4.00 a pound ($8,800 a tonne) level after coming close to all-time highs of $10,000 at the end of February.

Chinese Premier Li Keqiang stressed the need to strengthen market regulation of raw materials to ease cost pressures for companies amid rising global commodities prices, China’s official Xinhua news agency reported.

“Comments from Chinese Premier Li Keqiang weighed on markets as it is the second time in just a few days top officials talk about cost controls,” commodities broker Anna Stablum was quoted by Reuters as saying.

Chinese vice-premier Liu He who chairs the country’s Financial Stability and Development Commission on Thursday warned about the need to keep prices stable after producer price inflation rose 4% – the fastest annual pace in nearly three years.

BMO in a research note said Liu’s comments highlights again that inflationary pressure is starting to become a concern for Beijing, particularly if this is passed on to end consumers:

“We think there may be even more emphasis placed on growing self-sufficiency in raw materials, including potential overseas acquisitions (though perhaps not at current prices) and enhanced scrap recovery from the domestic market.

“Moreover, while we don’t expect to see substantial releases from strategic stockpiles, we do expect amplified rhetoric about the potential to release these in order to send a signal to the market.”

The price of aluminum tumbled last month after reports that China is considering selling about 500,000 metric tonnes of the metal from state reserves.