Jeff Bezos says he supports a hike to corporate tax rate

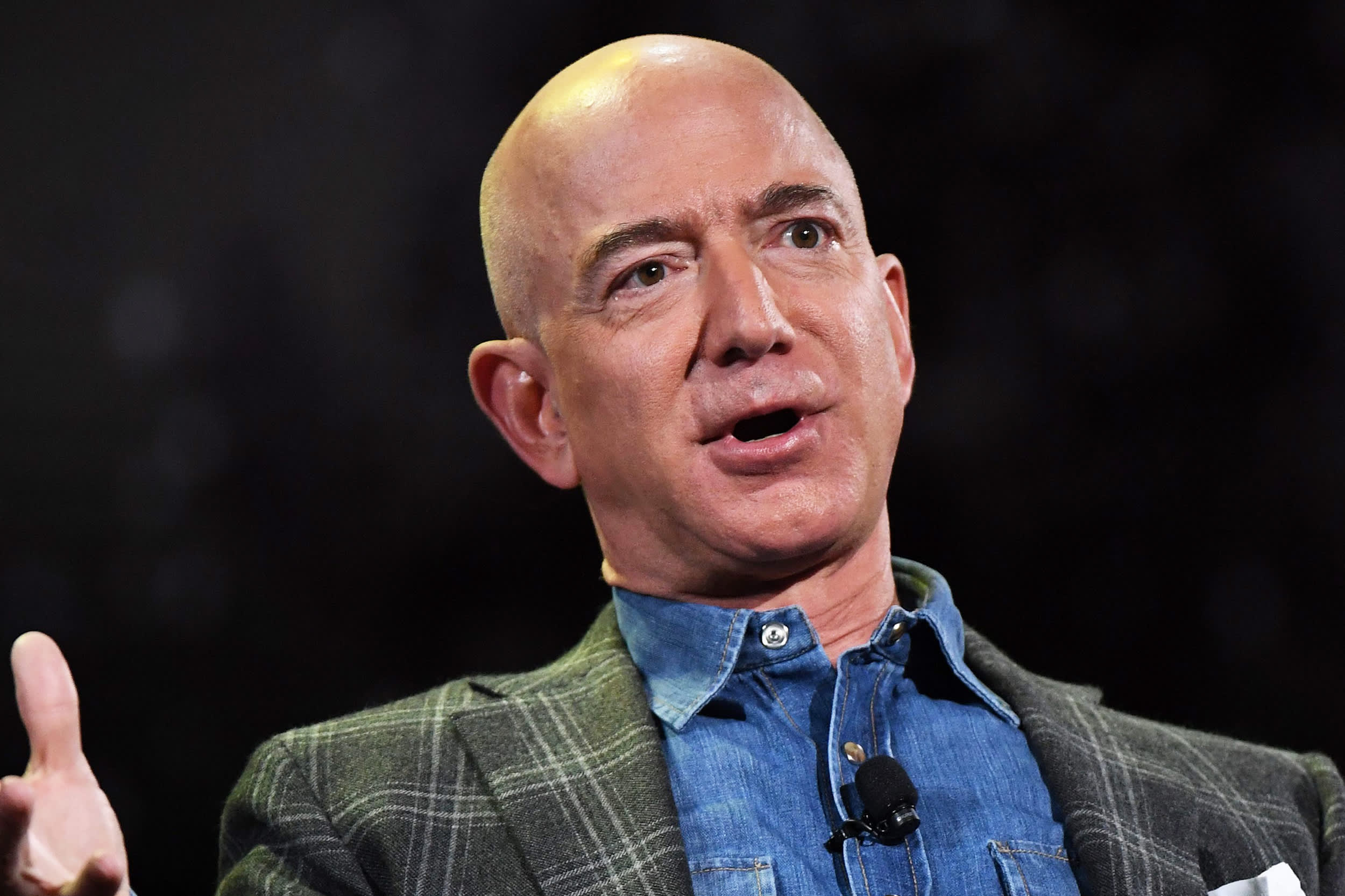

Amazon Founder and CEO Jeff Bezos

Mark Ralston | AFP | Getty Images

Amazon CEO Jeff Bezos on Tuesday voiced support for raising the corporate tax rate, but stopped short of saying he supports President Joe Biden’s plan for the increase.

“We support the Biden Administration’s focus on making bold investments in American infrastructure,” Bezos said in a statement. “We recognize this investment will require concessions from all sides — both on the specifics of what’s included as well as how it gets paid for (we’re supportive of a rise in the corporate tax rate).”

Last week, Biden unveiled a more than $2 trillion package that outlines sweeping upgrades to the nation’s bridges, roads, public transport, airports, among other transportation infrastructure, as well as investments in care for elderly and disabled Americans, building and retrofitting affordable housing and advancing American manufacturing and job training efforts, among other goals.

To fund the package, Biden has proposed hiking the corporate tax rate to 28% from 21%. The corporate tax rate had been cut under President Donald Trump to 21% from 35% as part of a 2017 tax law.

Bezos support for a tax increase is notable given that Amazon has previously faced scrutiny over its tax record, including from Biden. Last May, Biden, then a presidential candidate, told CNBC that Amazon “should start paying their taxes.”

Biden singled out Amazon again last week during an address in Pittsburgh, slamming the company for using “various loopholes so they’d pay not a single solitary penny in federal income tax.”

In response, Amazon’s top spokesperson Jay Carney said in a tweet: ” If the R&D Tax Credit is a ‘loophole,’ it’s certainly one Congress strongly intended. The R&D Tax credit has existed since 1981, was extended 15 times with bi-partisan support and was made permanent in 2015 in a law signed by President Obama.”

— CNBC’s Jacob Pramuk contributed to this report.