GameStop Extends Slump on CEO Search Reports, Analyst Warning

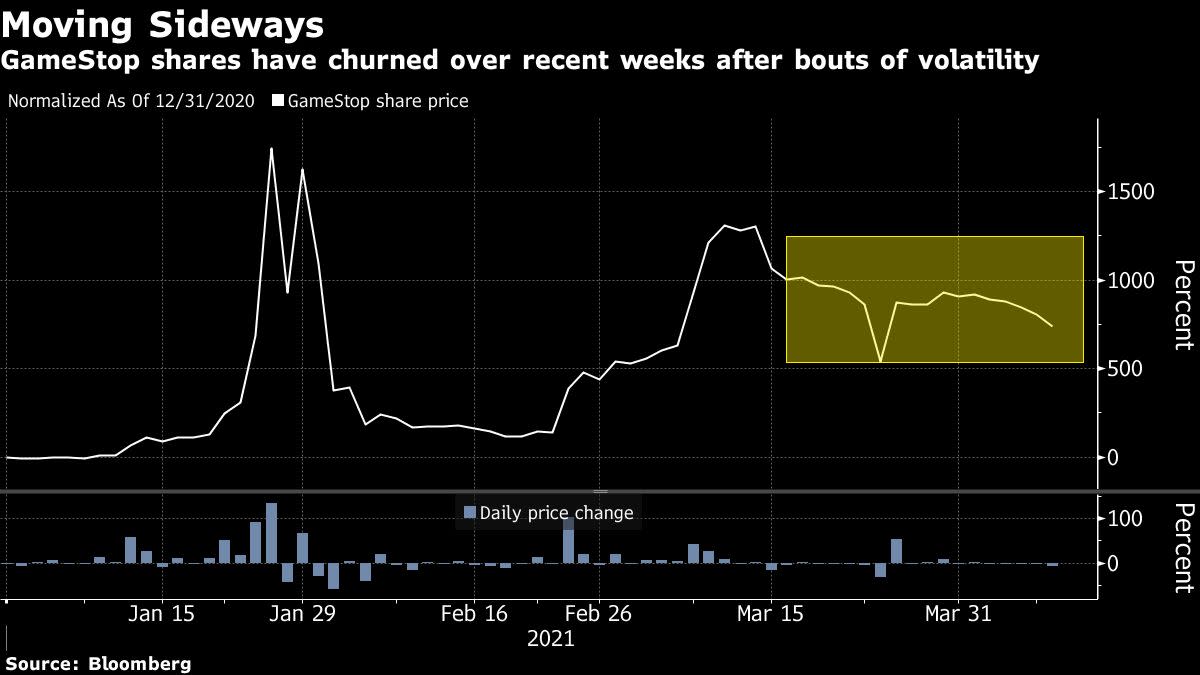

(Bloomberg) — GameStop Corp.’s shares fell on Monday, heading toward the longest losing streak in year, after another analyst questioned the video-game retailer’s long-term potential despite activist Ryan Cohen’s latest efforts to revitalize the company.

Its shares extended their slump to fall as much as 15% after Reuters reported the company is seeking a replacement for the current Chief Executive Officer George Sherman, citing unidentified people familiar with the situation. Its the latest in a series of high level departures after Jim Bell was ousted from his role as chief financial officer after a disagreement over strategy.

The report follows a warning by Ascendiant Capital Markets analyst Edward Woo who downgraded the retailer to sell from hold, saying increasing digital sales for video-game publishers is a looming risk given GameStop’s minimal market share. He warned clients in a note about the long-term prospects for the company as the market for new gaming systems matures after new launches from Microsoft Corp. and Sony Group Corp.

GameStop’s Reddit-trading surge is “likely to fade” as digital downloads of games increase at a faster pace, Woo wrote in the note.

The video-game retailer’s 741% surge this year through Friday’s close pushed its market value to $11 billion, however, Woo expects shares will tumble in the long run “to match its current weak results and outlook.” He trimmed his price target to $10 from $12, implying as much as a 94% drop from Friday’s close at $158.36.

Cohen has brought on a number of new executives and board members over the past few months as part of his overhaul. GameStop hired new senior executives to oversee growth and technology while nominating new board members including Larry Cheng, managing partner of Volition Capital, where Cohen made his name, and Yang Xu, senior vice president of global finance and treasury at Kraft Heinz Co.

GameStop’s slide coincided with selloffs in other meme stocks including animal health company Zomedica Corp., cannabis firm Sundial Growers Inc., and apparel company Naked Brand Group Ltd. The three stocks were among the 20 most actively traded companies in Monday’s session.

GameStop didn’t immediately respond to a request for comment on the Reuters report.

Ascendiant called out the rise in popularity of GameStop on Reddit chat boards and with Robinhood investors for making shares trade on “retail investors sentiment, hope, momentum, and the powers of crowds” in place of fundamental metrics. Woo did acknowledge the mania can drive shares much higher in the near-term, making short-term price forecasts “nearly impossible.”

The stock now has five sell-equivalent ratings, compared to two hold ratings and zero buys, data compiled by Bloomberg show. An average price target of $46.50 implies shares will lose two-thirds of their value in the coming year.

(Updates to add Reuters report of CEO search in first two paragraphs, updates share movement and adds request for comment in eighth paragraph.)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.